Executive Summary

- This article is part of our honest vendor series, which is one of the only ratings of vendors rather than applications.

- The vendor quality is critical to the decision making process as software purchases have a high long term involvement by the software vendor.

Introduction

Oracle is generally considered the most disliked vendor in enterprise software by its customer base. Customers that negotiate with Oracle often describe an experience similar to dealing with the Mafia. Its internal culture is one of domination – and it uses account control to extract the maximum revenues from its clients – a strategy it perfected with its leading database. However, unlike its database, Oracle’s functionality in ERP has never been considered leading-edge, and almost all of its software outside of databases is the result of acquisitions. Oracle ERP was built through the acquisition of such firms as Peoplesoft and JD Edwards.

In 2012 Oracle performed 11 acquisitions. In 2011 they completed nine acquisitions, and if you read the list, the acquisitions go on and on. Oracle has grown so much through acquisition that it is a software conglomerate, and these are all very different applications in the Oracle stable with diverse heritages. This is not as great of a disadvantage as one would typically think. Over the years, Oracle has developed adapters between their applications. However, they vary a great deal in quality. And Oracle often misinforms buyers as to how much the software they are purchasing has much to do with Oracle (or whether it was entirely developed someplace else, and has not been “Oracled” since its acquisition). However, the problematic part of this strategy is that the primary logic for application purchases seems to have been buying customers and to invest minimally in the application’s constant development. This means that the application essentially dates itself at the point of acquisition. This constant churn of acquisitions and the number of lagging applications in Oracle’s portfolio is clear evidence that Oracle is incapable of innovation outside of its database business.

Quality of Information Provided

Oracle is routinely accused of product misrepresentation by customers either through conversations or in lawsuits and has been operating in roughly the same manner for decades. Oracle is a software vendor that tightly controls information. Many software vendors provide screenshots or videos of the application on the website. Some companies offer pricing on their website, or even informative white papers (with varying quality). Oracle provides extremely little information, and much of the information they do provide is pure sales copy – the intent of the website is not to inform, it’s purely to get the prospect to contact Oracle. Oracle also continually misrepresents it’s the status of its applications. This quotation was taken from their website.

“Oracle Value Chain Planning is a best-in-class, and complete planning solution built on a common foundation that leverages pre-built integration with both Oracle (E-Business Suite, and JD Edwards EnterpriseOne) and non-Oracle systems and can be deployed in a modular approach to save time and cost—enabling companies to solve their most important problems first.”

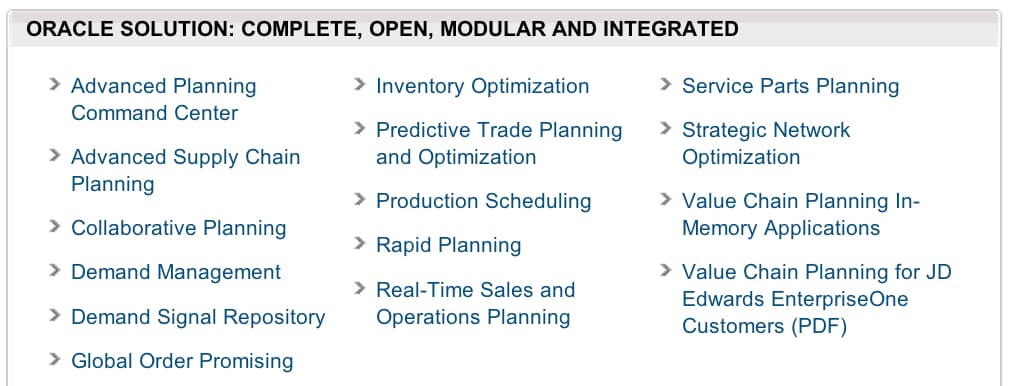

Very little of this paragraph is true. Oracle is not best in class in planning, their solution may be broad, but it is also weak across the board. We have reviewed numerous Oracle planning applications, and they are unimpressive. The integration is partially built and requires modification and heavy maintenance once installed, etc.. Oracle then lists the following applications.

Interestingly, there is not a single application on this list provided by Oracle that is even close to the best in its category, and most are, in fact, the worst applications in the class.

Companies that deal with Oracle must be extremely skilled at software vendor management and be ready to negotiate well to protect the company’s interests. The Oracle Sales Model is exceptionally well established and known in the software industry. The ability to extract accurate information about Oracle’s products from Oracle sales personnel is deficient. Also, buyers should not only expect highly unreliable information from Oracle salespeople but should expect to be pitched to frequently, and to be contacted by multiple representatives from Oracle.

Consulting and Support

Oracle’s consultants have a good talent and motivation level, although they are often pressured to not tell the client the truth by account management. Our estimates for the SAP and Oracle consulting capabilities – which are generally good. Although both companies have a hard time managing projects because they usually only provide technical consulting resources. However, this rating does not apply if significant consulting companies staff the project. Companies looking for a risk estimate when the software is implemented with a consulting company as the prime contractor would need to contact us, and this is a paid service.

Oracle support is a weakness and is getting increasingly incapable of supporting the many applications that makeup Oracle’s business. Support at Oracle often means waiting and being dissatisfied with the result. As with any software conglomerate, the acquisition strategy means support tends to be reduced along with software development. Most of Oracle support is outsourced to low-cost support centres, just as with SAP – even though both these software vendors charge at the top of the market. It is estimated that Oracle makes close to 90% margin on its support business at least for ERP – and very little of the money paid by companies to Oracle for support reaches the person providing the support.

Internal Efficiency

Oracle’s internal efficiency is inferior. It is not yet showing in Oracle’s revenues – because they keep making acquisitions, but the company’s growth is tapped out. Buyers report often being contacted by different Oracle salespeople as if Oracle has no CRM system which performs account control. This is amusing as Oracle has CRM software, and touts to the public that it uses all of its software to make its internal operations better.

Innovation

With this constant pace of acquisitions, one wonders if Oracle is reinstating the conglomerate stock strategy. This is where a large company, who’s stock sells at a high price to earnings ratio purchases companies for their earnings – which are then brought into the fold and the stock market then bids up these earnings now that they are incorporated within a larger company. Conglomerates usually are companies that purchase other companies that have nothing to do with each other. All of Oracle’s acquisitions are in software. However, many of them have little to do with one another. This strategy eventually runs its course, as pointed by Investopedia.

“History has shown that conglomerates can become so diversified and complicated that they are too difficult to manage efficiently. Since the height of their popularity between the 1960s and 1980s, many conglomerates have reduced the number of businesses under their management to a few choice subsidiaries through divesture and spinoffs.”

Vendor Scores

Honest Vendor Ratings

- VC = Vendor Consulting

- VS = Vendor Support

- QIP = Quality of Information Provided

- IE = Internal Efficiency

- I = Innovation

- C = Category

- ACS = Average Category Score

| Vendor | VC | VS | QIP | IE | I | C | ACG |

|---|---|---|---|---|---|---|---|

| Average Score for the BI Heavy Software Category | 6.4 | 5.3 | 5.1 | 4.5 | 4.4 | BI Heavy | Category Average |

| Average Score for the BI Light Software Category | 7.7 | 6.7 | 5 | 6.3 | 6.8 | BI Light | Category Average |

| Average Score for the CRM Software Category | 5.2 | 4.4 | 4.3 | 3.4 | 3.4 | CRM | Category Average |

| Average Score for the PLM Software Category | 7.3 | 7.5 | 6.3 | 6.2 | 6.3 | PLM | Category Average |

| Average Score for the Production Planning Software Category | 7.3 | 6.7 | 6 | 5.2 | 5.7 | Production Planning | Category Average |

| Average Score for the Small and Medium ERP Software Category | 7.3 | 6.7 | 6.3 | 6.7 | 5.9 | Small and Medium ERP | Category Average |

| Average Score for the Supply Planning Software Category | 7.5 | 6.7 | 6.1 | 5.5 | 5.6 | Supply Planning | Category Average |

| Average Score Score for the Demand Planning Software Category | 7.7 | 6.9 | 6.6 | 6.1 | 6.1 | Demand Planning | Category Average |

| Average Score for the Big ERP Software Category | 4.7 | 3.8 | 2.7 | 2.2 | 2.6 | Big ERP | Category Average |

| Actuate | 7 | 7 | 8 | 6 | 5 | BI Heavy | Application Specific |

| Arena Solutions | 9 | 10 | 10 | 8 | 10 | PLM | Application Specific |

| AspenTech | 4 | 3 | 4 | 3 | 7 | Production Planning | Application Specific |

| Base CRM | 8 | 8 | 9 | 9 | 7 | CRM | Application Specific |

| Birst | 8 | 8 | 8 | 8.5 | 9 | BI Heavy | Application Specific |

| Business Forecast Systems | 9 | 9 | 10 | 9 | 8 | Demand Planning | Application Specific |

| Delfoi | 8 | 8 | 8.5 | 4 | 8 | Production Planning | Application Specific |

| Demand Works | 9 | 9 | 10 | 10 | 10 | Supply Planning | Application Specific |

| ERPNext | 8 | 8 | 8.5 | 10 | 9 | Small and Medium ERP | Application Specific |

| FinancialForce | 10 | 10 | 9 | 10 | 9.5 | Financial | Application Specific |

| Hamilton Grant | 8 | 9.5 | 8 | 9.5 | 8 | PLM | Application Specific |

| Intacct | 10 | 10 | 9 | 9 | 9.5 | Financial | Application Specific |

| Intuit | 8 | 8 | 9 | 6 | 6.5 | Financial | Application Specific |

| JDA | 3.5 | 3 | 4 | 2 | 2 | Demand Planning | Application Specific |

| Microsoft | 4 | 5 | 2 | 1 | 1 | Small and Medium ERP | Application Specific |

| MicroStrategy | 8 | 7 | 7 | 7 | 7 | BI Heavy | Application Specific |

| NetSuite | 6 | 5 | 6 | 4 | 4 | CRM | Application Specific |

| OpenERP | 7 | 8 | 8.5 | 8 | 7 | Small and Medium ERP | Application Specific |

| Oracle | 5 | 2 | 1 | 1 | 1 | Many | Application Specific |

| PlanetTogether | 9 | 10 | 8 | 10 | 10 | Supply Planning | Application Specific |

| Preactor | 7 | 8 | 7.5 | 3 | 3 | Production Planning | Application Specific |

| ProcessPro | 10 | 8 | 9 | 10 | 9 | Small and Medium ERP | Application Specific |

| QlikTech | 8 | 7 | 5 | 8 | 9.5 | CRM | Application Specific |

| Salesforce | 7 | 3 | 8 | 6 | 6 | CRM | Application Specific |

| SAS | 9 | 7 | 10 | 7 | 7 | Demand Planning | Application Specific |

| SugarCRM | 4 | 4 | 5 | 5 | 3 | CRM | Application Specific |

| Tableau | 10 | 10 | 9 | 10 | 10 | BI Light | Application Specific |

| Teradata | 9 | 8.5 | 8.5 | 6 | 8 | BI Heavy | Application Specific |

| ToolsGroup | 10 | 10 | 9 | 9 | 9 | Demand Planning | Application Specific |

| SAP | 5 | 3 | 1 | 1 | 1 | Many | Application Specific |

Part of the Following Software Categories

Select the following link(s) if you have subscribed to the following analytical product(s).

Software Selection Package for Big ERP

Software Selection Package for Small to Medium ERP

Software Selection Package for BI Heavy