A Critical Analysis of the Gartner’s Analytics and Business Intelligence Platforms Magic Quadrant

Executive Summary

- Gartner produces an Analytics and Business Intelligence Platforms MQ.

- We evaluate this MQ to see if it holds up to scrutiny.

Introduction

Gartner produces a large number of Magic Quadrants highly. Curiously, while these Magic Quadrants are prevalent topics of discussion and determine many purchase decisions, each one that we have evaluated has significant problems that make us question the validity of this highly popular product.

Analytics and Business Intelligence Platforms Magic Quadrant

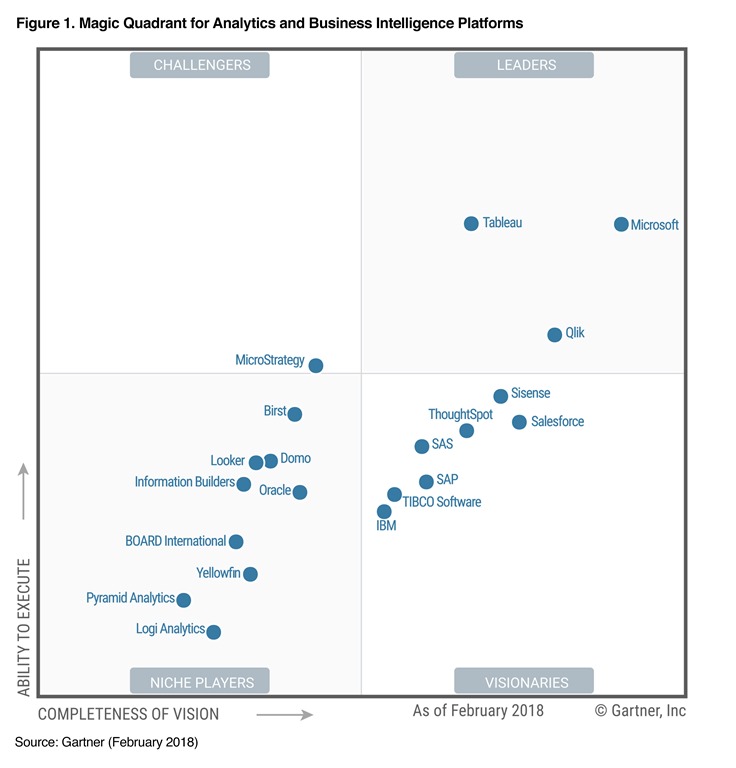

The following is the 2021 version of Gartner’s Analytics and Business Intelligence Platforms Magic Quadrant.

A few things immediately pop out to us when reading this MQ.

Observation #1: A Difficult to Produce MQ

This category contains so many different offering that are so different, it does not seem like a worthwhile endeavor to produce a single MQ to try to capture the distinctions. There are also so many vendors and offerings left out, that this MQ, as with other MQs, unnecessarily narrows the field for a software selection. One of our favorite analytics products is Amazon QuickSight. It is extremely low in price, and does not require interacting with any vendor salespeople to begin using.

Furthermore the pricing differences between these offerings is extreme. In the Leader Quadrant, Microsoft and Tableau are listed. However, Microsoft and Tableau compete on opposite sides of the price spectrum. This would be like including an economy car and a luxury car in the came category.

Observation #2: SAP Close to SAS?

There is no way to see SAP as close to SAS. SAS’s primary focus is on statistical analysis and analytics. SAP dabbles in analytics, but most of its revenues do not come from analytics. However, Gartner shows them as more of less equivalent to one another. This equivalence is false. SAS has a completely different type of analytics buyer from SAP. SAP customers buy SAP analytics as part of a bundle. SAS customers buy SAS in order to access SAS’s deep capabilities, and they have a statistical component that is not part of what SAP does.

Observation #3: Taking the Case of IBM

Let us say that one wanted to use this MQ and saw that IBM was in the Visionaries Quadrant. A company can’t just reach out to IBM and just purchase a point solution. First, IBM Cognos is an overwhelming complex application (we cover Cognos), and had greatly declined in relevance since its acquisition by IBM. IBM also acquired the statistical application SPSS, and increased the price by 5x, and caused many people to move away from SPSS and find alternatives. Contacting IBM to buy these dated applications and deal with IBM sales makes no sense unless one already is using other IBM products. Everything IBM would offer would be extremely uncompetitive both in the application as well as the highly inefficient and overpriced consulting. How can such a thing even be compared to a solution like AWS QuickSight or other offerings that are available with just a credit card?

Conclusion

This is not a useful MQ. The jumble of vendors that have been added based on their ability to pay does not make sense. I can’t think of a single way that this MQ would be useful for a software selection. This MQ takes a small segment of the available application providers in the space and attempts to categorize offerings along lines that don’t really apply for the category.

Companies use Gartner Magic Quadrants without understanding how Gartner arrives at their results. Gartner profit maximizes — rather than provides honest research. This means that Gartner works backward from how it can get paid the most (including fees from vendors and buyers), and they determine their views and the Magic Quadrants based upon this. This is why this MQ has the results that it does. The vendors in this MQ can afford to pay Gartner the most. It does not matter to Gartner whether these vendors are challenging to work with or are more expensive because the MQ is not designed around the needs of the buyers but is designed around the needs of Gartner. From the vendor’s perspective, they are also willing to pay Gartner to help “narrow the field.” That is, in a monopolistic fashion, the largest vendors are eager to pay not only to be included but to have a price of admission that is sufficiently high that it keeps smaller and better value vendors out of the Magic Quadrant. This drives buyers to the most expensive solutions and causes vendors that are easier to deal with and lower cost to be sidestepped as not enterprise-ready. Curiously, the scheme behind the Magic Quadrant has not been more widely exposed.