How to Best Understand Gartner’s Business Model

Executive Summary

- Gartner is extremely powerful and has a corrupt business model where Gartner never declares its conflicts of interest.

- Find out about the reality of Gartner’s business model.

Video Introduction: The Reality of Gartner

Text Introduction (Skip if You Watched the Video)

At Brightwork Research & Analysis, we refer to Gartner as a “Rubix Cube of Corruption.” This is because when we discuss one aspect of Gartner’s corruption, there are another six or seven categories of corruption that we are not discussing (hence other sides of the cube).

It is challenging to keep the different aspects of Gartner’s corruption in our heads, and it is that much more difficult for Gartner customers who are not researching Gartner.

This is why we have documented many aspects of Gartner’s corruption on this website. You will learn the unvarnished truth regarding Gartner’s business model and the fact that no software vendor will tell you, as they fear damaging their relationship with Gartner.

You will find the information provided in our articles very different than other articles on Gartner. This is because there is a strong fear of Gartner in the IT marketplace.

Notice of Lack of Financial Bias: You are reading one of the only independent sources on Gartner. If you look at the information software vendors or consulting firms provide about Gartner, it is exclusively about using Gartner to help them sell software or consulting services. None of these sources care that Gartner is a faux research entity that makes up its findings and has massive financial conflicts. The IT industry is generally petrified of Gartner and only publishes complementary information about them. The article below is very different.

- First, it is published by a research entity, not an unreliable software vendor or consulting firm that has no idea what research is.

- Second, no one paid for this article to be written, and it is not pretending to inform you while being rigged to sell you software or consulting services as a vendor or consulting firm that shares their ranking in some Gartner report. Unlike nearly every other article you will find from Google on this topic, it has had no input from any company's marketing or sales department.

The Gartner Business Model

In their 2012 annual report, Gartner makes the following statement about how they earn revenue.

- Research: “Gartner delivers independent, objective IT research and insight primarily through a subscription-based, digital media service. Gartner Research is the fundamental building block for all Gartner services and covers all technology-related markets, industries, and supply chain topics. Our proprietary research content, presented in the form of reports, briefings, updates, and related tools, is delivered directly to the client’s desktop via our website and/or product-specific portals. Clients normally sign subscription contracts that provide access to our research content for individual users over a defined period, which is typically one year.”

- Consulting: “Gartner Consulting deepens relationships with our Research clients by extending the reach of our research through custom consulting engagements. Gartner Consulting brings together our unique research insight, benchmarking data, problem-solving methodologies, and hands-on experience to improve the return on a client’s IT investment.” According to their annual report, Gartner receives about twenty percent of its overall revenue from consulting.

- Events: “Gartner Symposium/IT expo events and Gartner Summit events are gatherings of technology’s most senior IT professionals, business strategists, and practitioners. Gartner Events offers current, relevant, and actionable technology sessions led by Gartner analysts to clients and non-clients.”

Gartner’s Network Effect

With Gartner’s size, the number of areas covered, and the number of analysts it can bring to these different topic areas, it is easy to see why Gartner is the largest organization dedicated to the analysis of software. This type of scale provides significant advantages, including a large customer base that allows for a high number of return surveys, even if the percentage of participation is not very high on any one survey. This is important: a significant portion of Gartner’s competitive position is based on its interaction with an extensive network of software vendors and buyers. The system results in a comprehensive database of individuals to which Gartner analysts can reach out when researching topics. This database—as well as the relationships developed through constant interaction with the people that make up this database—is a significant percentage of Gartner’s value as a company. Referred to as a “network economy of scale” or “network effect,” an example is explained in the Wikipedia quote below:

“Many websites also feature a network effect. One example is web marketplaces and exchanges, in that the value of the marketplace to a new user is proportional to the number of other users in the market. For example, eBay would not be a particularly useful site if auctions were not competitive. However, as the number of users grows on eBay, auctions grow more competitive, pushing up the prices of bids on items.”

The Increased Value of the Network

The more people and companies Gartner is in contact with, the more valuable it is to Gartner. If Gartner analysts did nothing more than stay in touch with this database of individuals to discuss various topics, they would know quite a bit. Analysts do not spend their time testing software but tend to gain their information by reading, having phone conversations with buyers and vendors, and sometimes visiting sites. Gartner is also a frequent presenter at various conferences and puts on its events, allowing them to rub shoulders with a wide range of senior IT professionals and bring together groups of buyers and vendors in customized sessions.

Gartner can be viewed as a social network but private rather than public (like a country club or a prestigious university where membership is expensive). People that read this might say, “Wait, Gartner is nothing like Facebook.” However, when I say a social network, I am not referring to a social networking site’s technology. Instead, I am referring to social networking theory, which goes back to the 1930s and possibly earlier.

Gartner’s Value As a Social Network

Gartner is a social network, while Facebook is both a social networking website and a social network. Facebook is so successful because it has managed to tap into people’s dominant desire to associate in a social network. However, social networks exist both online and offline. While Gartner distributes its research online, its social network is a decidedly offline affair. The information contained in Gartner’s published findings is just the tip of the Gartner iceberg. Gartner has often interpreted it as a research and consulting entity, but this misses a powerful part of its value-add. (In fact, as we will see, Gartner is the strangest type of research entity.)

While clearly understood by some, this value-add has not been explained in published form; interestingly, I was unable to find any published material on the topic of Gartner, or IT analysts, or industry analysts themselves as social networks. It seems that this observation has been missed by most.

Books like this one explain how to study social networks. Social networks were a field of study in academics long before they burst onto the scene with the creation of social networking sites.

How Benefits the Most from a Social Network?

To understand Gartner’s aspect, it makes sense to review the social network function and who benefits the most from a social network. Wikipedia’s entry on social networks is a synopsis of the academic work in this area.

“In the context of networks, social capital exists where people have an advantage because of their location in a network. Contacts in a network provide information, opportunities and perspectives that can be beneficial to the central player in the network.

Networks rich in structural holes are a form of social capital in that they offer information benefits. The main player in a network that bridges structural holes is able to access information from diverse sources and clusters.”

How Gartner Benefits from Being at the Network Center

Gartner gains great power and authority from being at the center of the enterprise software social network. Gartner’s research has authority not necessarily because it is right or because there is any evidence that Gartner can select vendors that are the best fit for their subscribers (this would be hard to prove) but because it is popular.[2]

Very few of Gartner’s target market of customers are researchers or understand what research is. Gartner customers generally don’t go back and read through old Gartner research reports testing for accuracy. Still, they know that Gartner is understood and respected by their peers and their superiors. The major characteristic of a social network is that its members value their peers’ opinions in the social network; their fellow members are heavy influences on any decisions they make. Therefore, if Gartner’s social network members read and respect Gartner’s reports, that means a lot to the members of this social network.

The Function of Gartner

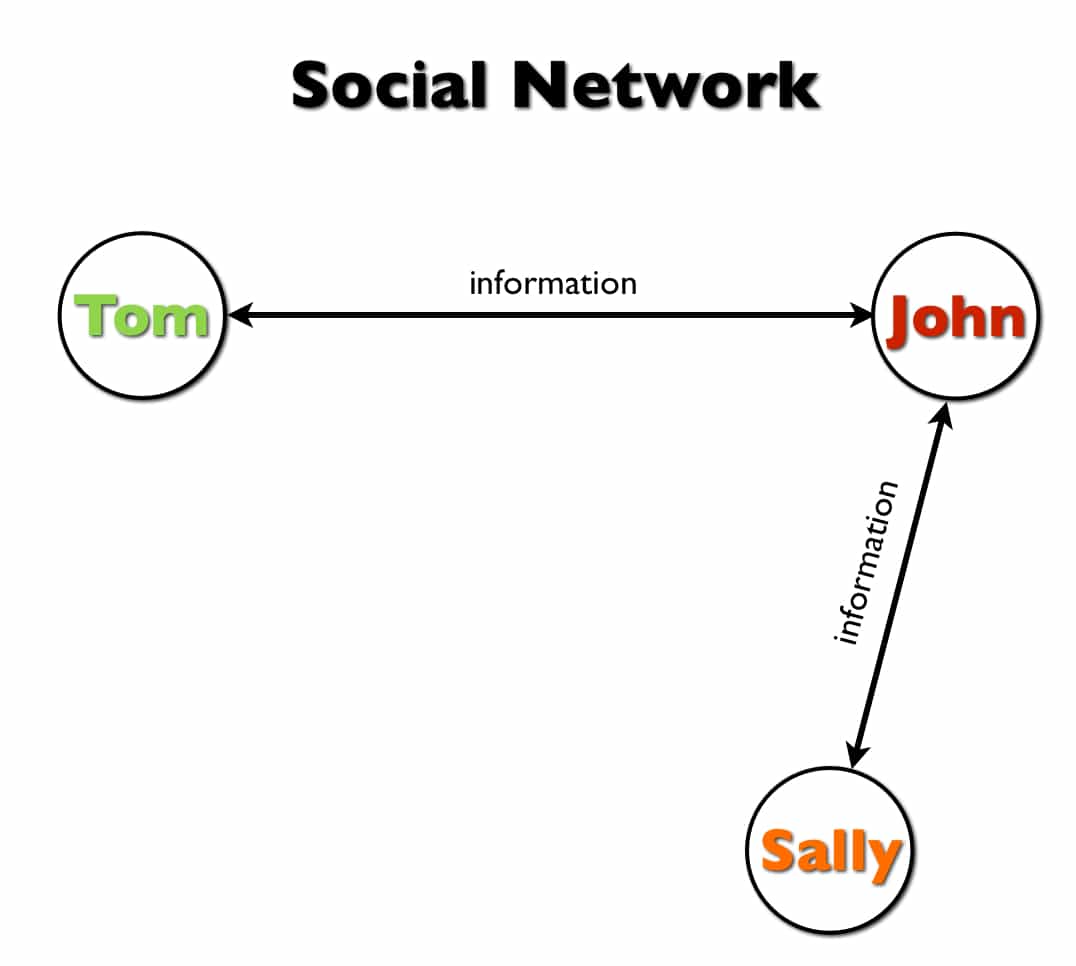

The function that Gartner—or any information broker for that matter—can add through its central position in a social network is explained with the following graphics.

This simplified example represents the social network of three people concerning IT information. (A person can be part of multiple social networks. For instance, each person has a social network of family, friends, etc. However, we are filtering each person’s social network for IT information exclusively). Tom, John, and Sally work with and are interested in the same software category. Tom and John work in different companies and share information about their experiences. The same is true of John and Sally. John has two people in his IT social network, while Tom and Sally only have one person in their social network. Sally and Tom do not communicate with one another. Sally and Tom get some information that is passed to John, but not all the information.

All three people do subscribe to Gartner, and Gartner fills in the gaps between Tom and Sally. Gartner also interacts with many thousands of other people in vendors, buyers, consulting companies, etc. Therefore, Gartner is capable of filling “structural holes” between individuals.

All three people do subscribe to Gartner, and Gartner fills in the gaps between Tom and Sally. Gartner also interacts with many thousands of other people in vendors, buyers, consulting companies, etc. Therefore, Gartner is capable of filling “structural holes” between individuals.

How is Gartner Different From a Social Networking Site?

Social networking sites are the standard frame of reference for most readers, so seeing how Gartner is distinct from Facebook is interesting.

- Gartner creates research products, a form of broadcasting, and has one-on-one interactions—a “narrowcasting.”

- On Facebook, individuals are allowed to freely associate as long as they are part of one another’s social network. Gartner, on the other hand, behaves more as a central hub, controlling the interaction. Except for events, where it in part charges for the right to connect up sub-segments of the Gartner social network for freeform communication, the primary information flow is narrowcasting between Gartner and clients and then broadcasting more limited and obscured information through research reports.

- Facebook monetizes its social network by advertising and selling personal information about its social network members to various interested parties. In contrast, Gartner monetizes its social network with subscriptions, consulting services, and events. Facebook does not interview or interact with its members.

- Facebook creates a collaborative environment and allows the social network to self-organize and automate guidance routines, which encourages members to enlarge their social network and become more involved with Facebook.

- Facebook is a simple social networking site, while Gartner is a mixture of a social networking company combined with a research company, consulting company, and information broker.

Gartner is Identified as a Research Entity

Generally, Gartner is identified as exclusively a research and consulting company, but it is much more than a research company. Its method of absorbing and providing information makes Gartner the “center of attention.” Gartner researchers/analysts do not merely read vendor marketing literature, test software, analyze historical databases, and then release reports that Gartner customers can purchase online. Instead, their job is intensely social, and much of their work and others at Gartner are about maintaining and nurturing that social network. One cannot understand Gartner by only looking at its media product because that is only a part of what makes Gartner the force that it is today. I made this mistake when I read my first Gartner reports over a decade ago.

I could not see why they were so influential by simply reading the content. I should point out that social networking is a feature of all industry analyst firms; however, Gartner is particularly connected and particularly good at leveraging the social network it has created. They have, in essence, take it to the next level. There is no other IT analyst firm with anything close to Gartner’s social network.

Doing Research or Using Gartner

Considering the stakes involved, software buyers do surprisingly little research when deciding which software to purchase. Most companies that buy software have no research capability and an IT department faking its knowledge level to the rest of the company. IT departments are easily tricked, and they are routinely tricked by consulting companies like Accenture, WiPro, etc.., and tricked by IT analysts like Gartner. Due to the lack of internal resources to perform this research, most information about products to purchase comes from third-party entities. As my book Enterprise Software Selection describes, obtaining objective advice on enterprise software is virtually impossible because nearly all entities providing information on this topic have financial conflicts of interest.

How IT Analyst Firms Work

Information technology analyst firms primarily sell their knowledge of software, hardware, and services to those companies that purchase any of these items. They secondarily sell information related to vendors as well as information about clients to vendors. Information technology analyst firms—Gartner chiefly among them—are significant influencers. This is true not only on the demand side (that is, with companies that make enterprise software purchasing decisions) but also on the supply side (the software vendors themselves), as meeting the criteria of analysts can influence everything from the strategy that software vendors follow to their ability to raise money. However, while many opinions about analysts are available on the Internet, there are few authoritative sources about how analyst firms work and how to get the most out of them. This is true from the demand side, supply side, or investors. When researching the Gartner articles, I checked the types of questions companies asked about Gartner.

What the Gartner Subscriptions Cost

It seems that companies ask many questions about even the most elementary topics, such as Gartner subscription costs. Some IT analyst firms have a more straightforward offering – selling research reports for a specific published price, and in most cases, they also offer to consult. However, understanding how to best use Gartner’s offerings can be a challenge because of the breadth of Gartner’s offerings and how to control the information about them and what they cost.

Other Major IT Analyst Firms

Gartner is one of the top mega IT analyst firms in the world. The IT analyst firm IDC (International Data Corporation) is close in terms of influence but generally lower, although still influential in different areas than Gartner. Forrester Research is the third mega IT analyst firm but is roughly twenty percent the size of Gartner. While often compared directly with one another, these three firms do not entirely overlap in their offerings. For instance, IDC is more of a media conglomerate. Like Gartner, IDC sells research, but it is also a publisher of technology magazines. Forrester has the Forrester Wave, but as they have fallen back from Gartner, they now mostly just write rigged marketing collateral for vendors. You can see an example of this in our analysis of their work at Forrester’s Fake S/4HANA TCO Study. At one time, Forrester was close to Gartner in terms of their influence, but Gartner has now pulled ahead and is far more frequently quoted than Forrester –(which, of course, is expected as they are over five times as large as Forrester).

What Gartner is so Important

Gartner was not always as influential as it is currently; its increased influence is partly due to its effectiveness in managing its business and US anti-trust law not being enforced. Gartner has been allowed to grow into a monopoly because it has gobbled up many of the other competing options. It has acquired over thirty firms, and it seems likely that Gartner will continue to acquire new firms in the future. New IT analyst companies are certainly free to try to fill the gaps left by these acquisitions, but it’s not as easy as it sounds.

The Impact of Gartner’s Reports

Gartner’s issuance of a report means something significant to corporate buyers and has real financial consequences for those vendors mentioned in the report, both good and bad. Many companies in the catbird seat desire Gartner to charge for information that many vendors pay to give them. Gartner is paid while it both gathers information and provides advice. Gartner is so influential that they control (in part) the fates of software vendors and set specific standards to which software vendors must adhere. Gartner has a series of preferences to which vendors either subscribe or pay the penalty in the marketplace.

Not only is Gartner a significant influencer in software purchases and vendor strategy, but less frequently discussed but also quite substantial in its influence on the stock prices of the public software vendors and the ability of software vendors to raise capital.

Many banks and investment banks maintain subscriptions to Gartner and rely heavily upon Gartner’s analysis to make their investment decisions. Investors don’t even have the luxury of implementing software; so much of their software information comes from sources like Gartner. The extent to which Gartner caters to the investor market is greatly underestimated by those who work in the software industry. This is covered in detail in Chapter 5: “The Magic Quadrant.” Vendors also hire Gartner to raise capital from investors.

“Buyer facing” means that the company primarily provides research for buyers. Gartner is both buyer and seller facing, but more of its income comes from buyers.

Conclusion

Gartner’s business model is to mislead software buyers about its financial conflicts with software vendors and to provide fake research that takes the products of those that pay them the most and promotes that item. Gartner is very successful, but a primary reason for its success is that they are based upon adjusting information for the highest bidder. Anyone can get Gartner to write a complimentary report about their product by simply paying Gartner.

This means those who read Gartner’s output must be very careful. Gartner’s analysts don’t actually work with the software. They are basing their conclusions on what software vendor paid them the most and discussions with executives in software buyers, who also don’t know much about software.