Is Oracle in Trouble (Longer Term) With Its Oracle Cloud vs AWS?

Executive Summary

- Oracle is a dominant database vendor, but Oracle is set to lose out in database growth and IaaS growth in the future.

Video Introduction: Oracle Being in Trouble for Oracle Cloud vs. AWS in the Longer Term

Text Introduction (Skip if You Watched the Video)

Oracle has been trailing the major cloud service provides since cloud services began to rise. Oracle states this is about to change every year, but it never does, and Oracle Cloud is barely mentioned when discussions of cloud service providers occur. Oracle competes by locking in customers, which is why it has performed so many acquisitions to force-feed their customers acquired through their database business to these acquired applications. Oracle wants to force-feed their customers Oracle Cloud, but they have not been very successful even with the home-field advantage. This article will point to something quite interesting about their popularity in databases and what it might mean for Oracle’s future.

Our References for This Article

If you want to see our references for this article and other related Brightwork articles, see this link.

Lack of Financial Bias Notice: The vast majority of content available on the Internet about Oracle is marketing fiddle-faddle published by Oracle, Oracle partners, or media entities paid by Oracle to run their marketing on the media website. Each one of these entities tries to hide its financial bias from readers. The article below is very different.

- This is published by a research entity, not some dishonest entity that is part of the Oracle ecosystem.

- Second, no one paid for this article to be written, and it is not pretending to inform you while being rigged to sell you software or consulting services. Unlike nearly every other article you will find from Google on this topic, it has had no input from any company's marketing or sales department. As you are reading this article, consider how rare this is. The vast majority of information on the Internet on Oracle is provided by Oracle, which is filled with false claims and sleazy consulting companies and SAP consultants who will tell any lie for personal benefit. Furthermore, Oracle pays off all IT analysts -- who have the same concern for accuracy as Oracle. Not one of these entities will disclose their pro-Oracle financial bias to their readers.

Understanding the DB-Engines Ranking for Oracle Cloud vs. AWS

DB-Engines Ranking is a site that uses a method that combines a series of factors to result in a rank of how widely a particular database is used. So what factors do they use? Well, I have listed their description of their method below:

“Number of mentions of the system on websites, measured as number of results in search engines queries. At the moment, we use Google, Bing and Yandex for this measurement. In order to count only relevant results, we are searching for <system name> together with the term database, e.g. “Oracle” and “database”.

General interest in the system. For this measurement, we use the frequency of searches in Google Trends.

Frequency of technical discussions about the system. We use the number of related questions and the number of interested users on the well-known IT-related Q&A sites Stack Overflow and DBA Stack Exchange.

Number of job offers, in which the system is mentioned. We use the number of offers on the leading job search engines Indeed and Simply Hired.

Number of profiles in professional networks, in which the system is mentioned. We use the internationally most popular professional networks LinkedIn and Upwork.

Relevance in social networks. We count the number of Twitter tweets, in which the system is mentioned.” – DB-Engines

This seems like a reasonable way to perform a ranking.

Oracle’s Growth Rate

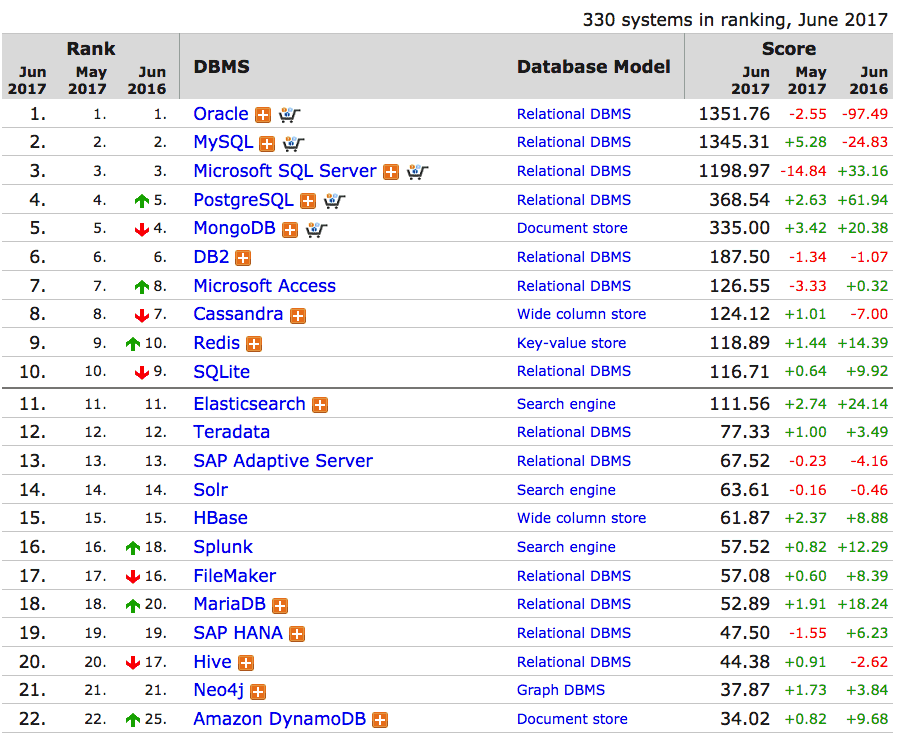

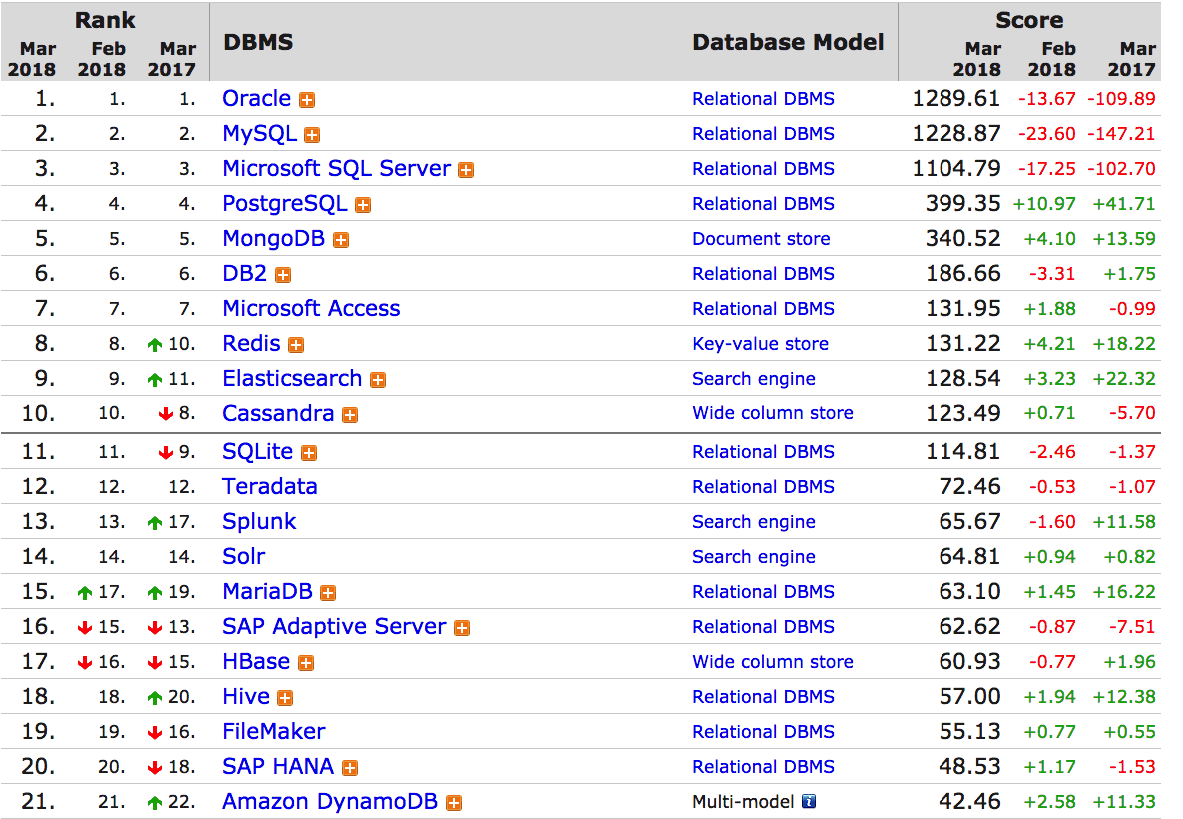

To begin, let us review the usage/popularity list from DB-Engines.

DB-Engine rankings can go up and down over time, so we took a second data point when we refreshed this article.

Oracle’s decline has continued, but interestingly, MySQL and SQL Server have turned significantly negative. This does not track what we will discuss: Oracle databases that are switched from being on-premises to being hosted with AWS or Azure or other — reducing Oracle’s support revenue.

Oracle’s DB-Engines Ranking for Oracle Cloud vs. AWS

Oracle has two of the fastest declining databases in terms of popularity on the entire list of databases. MySQL is less of a concern as Oracle makes little money on MySQL as it is open source. However, Oracle’s proprietary databases are steeply declining in popularity. Now the overall database market is not growing very fast. The top 2 databases have an average growth rate of 4.2%. Although it should be mentioned, DB-Engines is not measuring revenues but rather popularity.

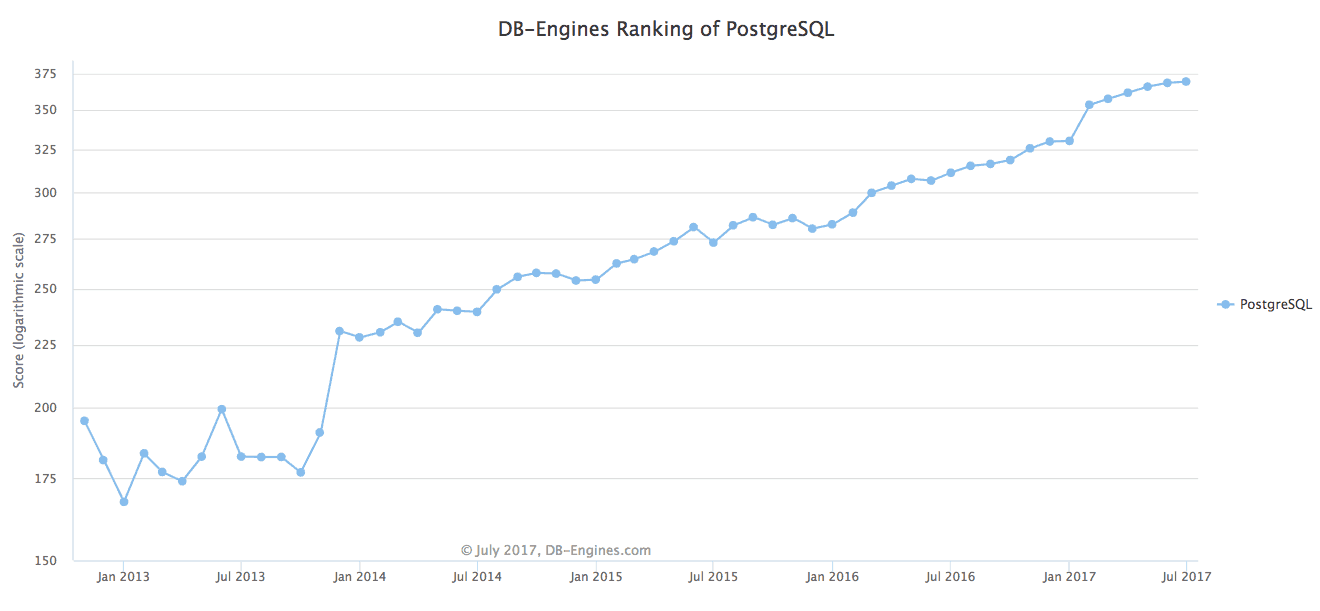

- Databases proliferating, such as PostgreSQL and MariaDB, are merely taking the market share that Oracle is losing. PostgreSQL has probably the best overlap with Oracle in terms of higher-level functions of all the open-source databases. However, it is also true that many companies that use Oracle don’t take advantage of Oracle’s higher-level functions. That is, they purchased Oracle based on brand recognition and defensibility if something were to go wrong (i.e., the IBM argument “no one ever got fired for buying IBM”)

- This means lower-cost databases erode the market share of a high-cost database, with high maintenance costs (but with more ability to be tuned).

Oracle’s Long-Term Growth

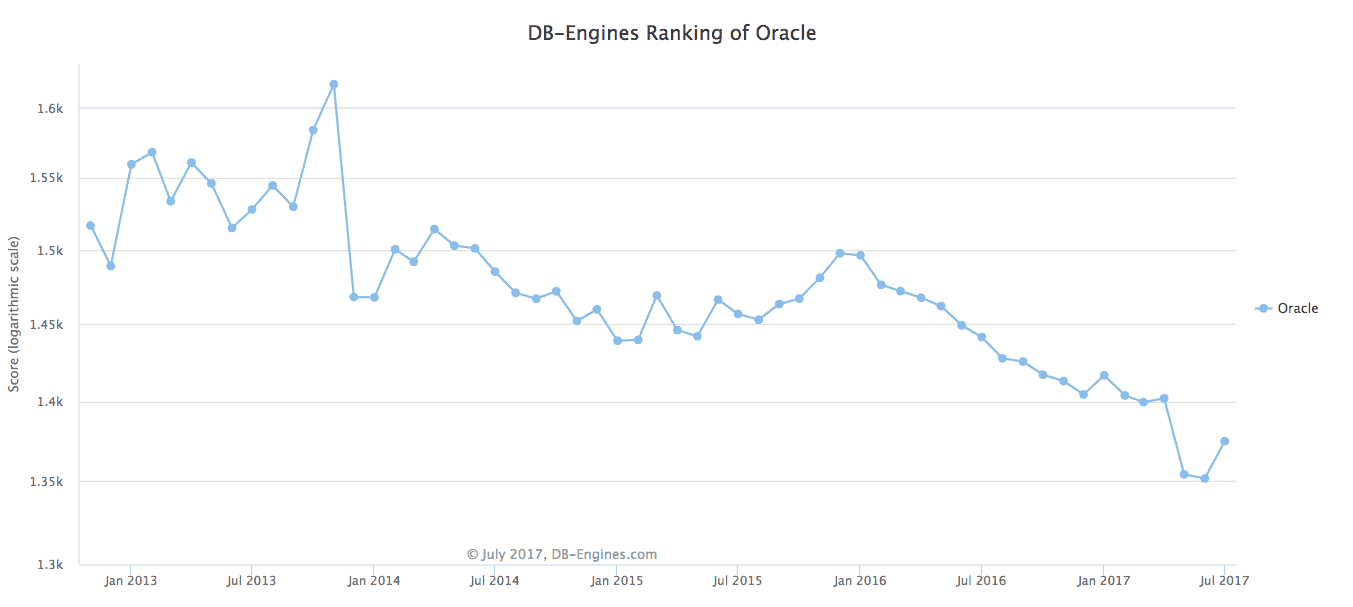

DB Engines also shows the long-term trend of Oracle.

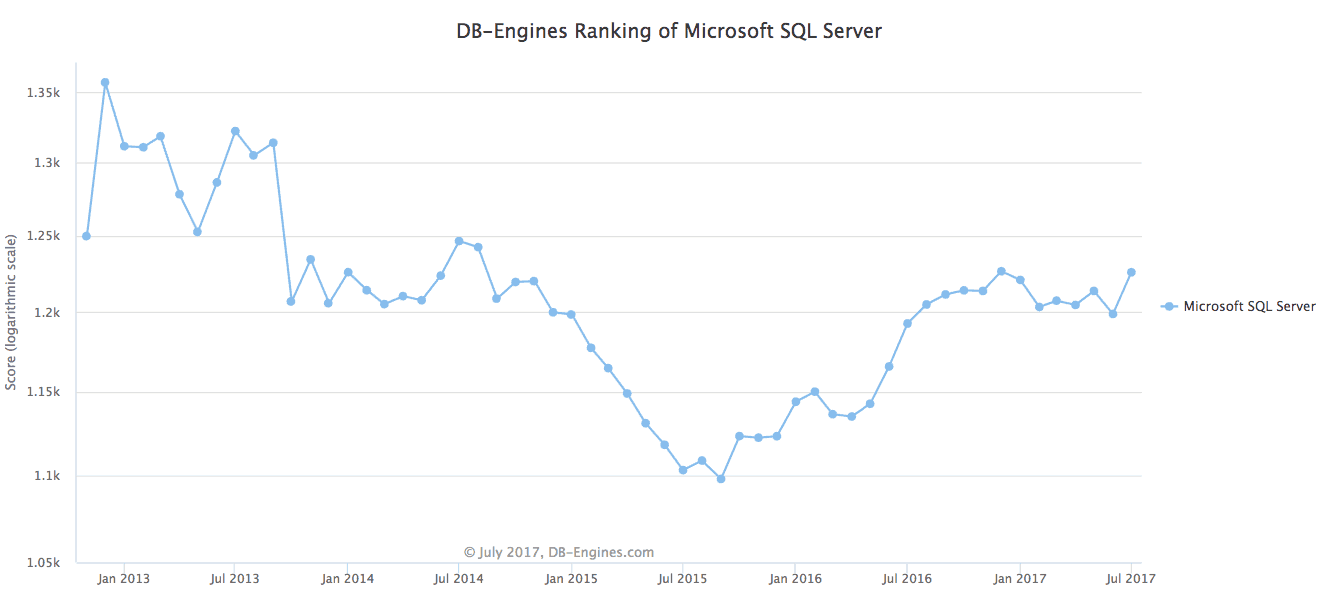

This is a rather shocking and severe decline. What is curious is how little this is commented upon. Oracle’s databases have not declined, but open-source alternatives are eating away at Oracle’s market share, as well as lower-priced databases like Microsoft’s SQL Server. Let us look at SQL Server’s growth.

This graphic is misleading, however. It makes Oracle’s decline look much more severe than it actually is. This is because the base is set to 1.3 instead of zero. If we look at the actual percentage decline from Jan 2013 to July 2017, it is 1.5k – 1.35k or .15. .15/1.5 = 10%.

However, if we look at the graph, it looks like a decline of over 50%. This is the problem with graphs that do not have the x-axis set to zero.

This does not seem to match the 97% decline year over year presented in the table. July 2016 shows Oracle with a popularity of roughly 14.2. A decline from 14.2 to 13.7 is .5/14.2 = 3.5%. So how does that comport with DB-Engine’s estimate of 97% decline year over year?

After a significant period of decline in 2014, 2015, SQL Server is regaining its popularity. But is not indicative of long-term growth.

PostgreSQL is a highly technically competent open source database. After 2014, PostgreSQL has grown consistently. This is precisely the type of database taking market share from Oracle and looks ready to do so in the future.

Oracle and the Cloud (Oracle Cloud vs. AWS)

Oracle is like SAP, a vendor that flourishes and is completely designed for the on-premises model. Oracle has two significant problems with the cloud.

- SaaS vendors tend not to choose Oracle. And prominent SaaS vendors like Salesforce that do use Oracle are trying to move away from them.

- Oracle’s applications are not substantially used in the cloud. Oracle sells cloud licenses (because this is how Oracle compensates salespeople), but Oracle sells both the on-premises license and the cloud license bundled. However, the cloud license is far less frequently used, and it becomes shelfware — all of this is an attempt to cloud wash Oracle’s earnings for Wall Street.

Ahmed Azmi brings up the following point.

Oracle is obsessed with AWS. Over the past couple of years, Oracle’s marketing machine has been completely fixated on Amazon’s cloud business. I knew something was up when Larry used most of his hour-long keynote at Open World ’16 in San Francisco to trash AWS’ slow first-generation cloud infrastructure.

By October 2017, AWS migrated over 40,000 databases to their cloud. The majority of which are Oracle instances. Why’s this a threat? Because these are AWS fully managed instances. This means AWS takes care of the full range of database administration work including upgrading, patching, and security.

How AWS Explains This Topic

This is explained in the AWS page on the benefits of managed databases like AWS RDS.

Many customers prefer to use Amazon RDS for Oracle because it frees them to focus on application development. Amazon RDS automates time-consuming database

administration tasks, including provisioning, backups, software patching, monitoring, and hardware scaling. Amazon RDS simplifies the task of running a database by eliminating the need to plan and provision the infrastructure as well as install, configure, and maintain the database software. – Strategies for Migrating Oracle Databases to AWS

As we are currently doing application development for our application, the Brightwork Explorer, this resonates with us. We want the database to work and don’t want to worry about all the database maintenance, which is why we are going with AWS ourselves.

Ahmed continues….

“The AWS threat is so serious, Oracle resorted to the most desperate anti-competitive measure the industry has seen in decades. In January 2017, Oracle quietly doubled its database license for instances hosted on AWS cloud!”

How AWS is Changing How Customers Staff Database Management

This next quote from Ahmed explains how AWS is changing how customers staff database management, essentially outsourcing it to AWS.

This is irresistible to many customers because they no longer need to keep as many DBA’s on their payroll. The savings are really quite significant. The operational agility is even better. This model is a no-brainer not only for small businesses, but also for large companies trying to do more with less.

But that’s just an appetizer. Here’s the main course: A fully managed database is a trouble-free database. In other words, customers can easily drop the annual 22% maintenance and support fee they pay Oracle and save really BIG. That’s the existential threat because nearly 50% of Oracle’s annual revenue is generated from install base M&S. The cash cow is moving to greener pastures.

But familiarity becomes less of a concern if someone else manages it — providing the DBA, etc… And to Ahmed’s point, AWS has a history of proving managed DBs; Oracle never had this background. (They are an on-premises vendor in their heritage — and as Ahmed points out in their actual revenues).

The customer buys the database and hires their own DBA. That has been their model.

How AWS Threatens Oracle Account Control

Oracle (overall) is vulnerable to database maintenance loss because everything Oracle does is based upon its account control, based upon its monopolistic control over the database.

If AWS threatens that, it threatens everything else that Oracle does — including their account control.

Ahmed’s quote regarding the commoditization of the database layer is as follows.

Cloud computing commoditized hardware. Now, it’s commoditizing software starting with database. The database, a back-end process by definition, is the perfect candidate for automation.

What happens when a database is commoditized? Just like compute and storage, customers only care about the SLA not the manufacturer. They no longer care HOW you deliver 99% availability because that’s no longer their concern. In this case, why keep paying millions for M&S? You no longer maintain the database and you loathe tech support.

How Oracle Cloud vs. AWS Differs in How the Companies Go To Market

And this shows a difference in how Oracle and AWS go to market.

AWS and Google are developer-focused. They sell to developers. When your buyer is a developer, you really need credentials. You get credentials from building not buying and reselling.

You may be surprised to learn that AWS hired so many seasoned Oracle salespeople. They hire them because they own the account relationships at many organizations and know how to open doors. Long years of experience also gives you a deep understanding of the local market.

AWS goes to market primarily by gaining grass root mindshare for their developer centric tools. You can call it B2D2B where developers use the services to build solutions then they (the developers) do the selling internally on behalf of AWS. They showcase their work to management as social proof. Much of the process, as you said, is self-service. You don’t need nearly as many sales people. The products do much of the “talking”.

This gets into the topic of the prominence of the database as it becomes a service.

The database trajectory is a micro-service. Apps and developers only need to know the API/SQL. If the service provider switched overnight to another SLA-compatible micro-service that happens to run say RedShift, who cares?

Migrating Oracle to AWS (Lo0king Easier and Easier)

As pointed out by Ahmed, AWS has hired ex-Oracle sales to get Oracle accounts transfer to AWS hosting. A significant part of Oracle keeping its customers is inertia. AWS’s hiring to sales reps (many who were let go by Oracle to go younger and cut its sales costs, explained by Ahmed in the following quotation).

The idea is to replace as many highly experienced (expensive) account reps with much cheaper fresh grads to lower operating cost enough to report a net profit for product lines where sales growth has stalled.

The justification is that in such accounts, experienced reps add no value since the customer is already locked into long-term contracts and account control is already established via lock-in and the prohibitively high switching cost.

The problem, as Mark Dalton noted, is that those high-profile reps joined competitors like AWS, Google, Salesforce, and Workday. They took with them the account relationships, deep industry insights customers want more than anything else, and some pretty persuasive, time-tested, competitive tactics.

It’s dangerous to think that the credentials of an enterprise sales rep is a replaceable commodity.

This is clear evidence that AWS is becoming more aggressive in going after Oracle’s maintenance business. AWS did not have to do this. They could have sat back and continued to receive inbound business and continued to grow very well. However, we guess that AWS saw the opportunity to cut into Oracle’s maintenance business severely. By selectively hiring ex-Oracle sales reps, we decided to alter their usual sales strategy. How can we put this? AWS essentially said to Oracle, “For you, we will make an exception.”

But AWS also has online educational material that explains how to migrate Oracle DBs to AWS and Oracle DB to AWS’s DBs like Aurora.

They also offer a migration service.

We have always found that AWS has some of the best technical documentation, and all of it available on the web.

The Multiple of the Initial License Paid Per Database Version Since Purchased

| Database Version | Overpayment Multiples of Initial Net License Charge | % of Oracle DB Customers |

|---|---|---|

| Oracle 8i | 13% | |

| Oracle9i | 21% | |

| Oracle 10g | 29% | |

| Oracle 11g | 31% | |

| Oracle 12c |

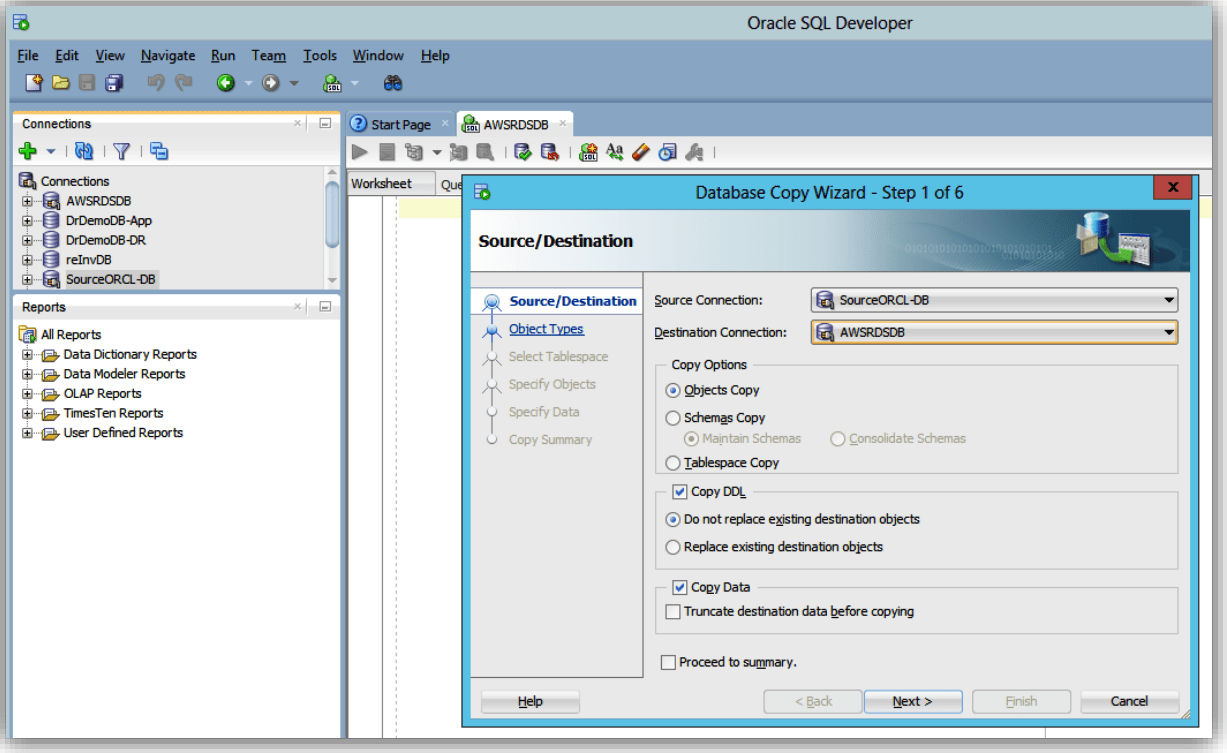

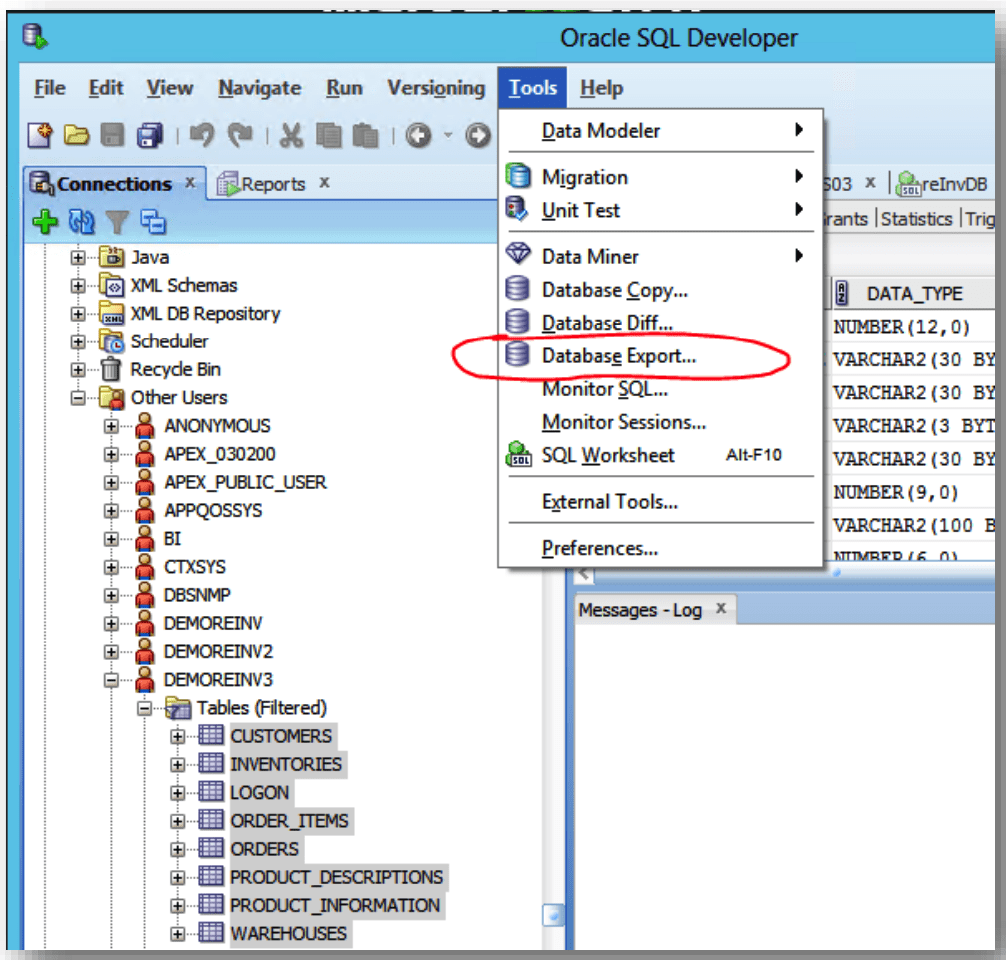

In AWS’s documentation, it shows different approaches for exporting databases from Oracle.

This is the SQL Database Copy (for smaller databases).

...which changes depending upon the size of the database. SQL Loader for databases smaller than 10 GB.

The more customers have customized the Oracle database, the more they have followed Oracle’s advice and placed stored procedures in the database. The more difficult it will be for them to migrate their data to AWS and other non-Oracle databases.

A big part of AWS’s strategy for grabbing Oracle’s support business is by having customers help themselves as much as possible.

How Oracle Sees the Cloud (Oracle Cloud vs. AWS)

Oracle appears to have a weak commitment to the cloud as anything more than a mechanism to extract more income from companies and get a higher multiple from Wall Street. The following quotation is the problem that companies run into when they both try to message to customers and Wall Street, and you end up with inconsistencies.

And healthy margins are what Oracle’s cloud strategy is all about. “When a customer who is on-prem paying us support moved to the cloud, they pay us more money,” Hurd explained on the most recent earnings call. “They don’t pay us one to one, they don’t pay us two to one, they pay us more like three to one. In some cases more than three to one. – Forbes

How is a customer supposed to interpret this statement from Mark Hurd?

Mark Dalton, CEO of AutoDeploy, offer more reality regarding Oracle’s true commitment to the cloud.

Oracle has cloud marketing, AWS has the real deal. The capabilities that AWS has so far outpaces anything Oracle talks about, it is astonishing. I would urge everyone to watch Werner Vogels and Andy Jassey’s talks at Reinvent, last year. Vogels is particularly good.

On Oracle sales front, I used to think the biggest threat to Oracle was not having a fully baked cloud roadmap. I’ve come around to think that it’s the massive sales force that Oracle has alienated, and now have huge upside to go work with Google, Amazon, SFDC etc….Oracle is losing the institutional knowledge of their sales teams. They just push cloud cloud cloud regardless of customer needs. It’s a problem.

What is the Value of Oracle Support?

Oracle support is as little in value-add as SAP’s, and Rimini Street was essentially originated as an idea to go after this 90%+ margin business that Oracle has in its support. As with SAP support, it is one of the great waste areas in IT budgets for companies that use SAP or Oracle.

As a recent Rimini Street survey showed, as much as 74 percent of Oracle customers are running unsupported, with half of Oracle’s customers not sure what they’re paying for. These customers are likely paying full-fat maintenance fees for no-fat support (meaning they get no updates, fixes, or security alerts for that money). – NZ Reseller

This article brings up the question of whether you should be hosting with Oracle. That is, is IaaS and managed DBs a core thing for Oracle? Oracle has immense resources and can cut the price on its IaaS BDs, but the price is not the only factor, but other probably more notable features are selected and options for one. So what if a customer wants to migrate some of my current Oracle DBs to Redshift or try out other DBs? Is Oracle a good choice for my IaaS provider? No. Oracle will, of course, lock them into Oracle.

How about proven managed DB capability. Is this an Oracle core “thing?” No. Oracle is doing this defensively.

Again Oracle seems to be transitioning to managed DBs rather than it being something they usually have done.

How AWS Differs Dramatically from Oracle in Using Products Themselves

Have you noticed how little AWS talks or makes announcements or talks about how much they are investing in A or B? Amazon is huge but very quiet. They don’t have to make big pronouncements; they don’t need expensive sales reps — they quietly grow market share by being more efficient and offering more choice.

If you don’t use your stuff, you are much more likely to create trendy stuff that sounds cool. SAP does this. They sell software based on things that sound cool, and they don’t care if any of the cool things end up being true.

Oracle has made announcements that they are investing mightily in data centers, as the following quotation attests.

The future of IT is autonomous. With our expanded, modern data centers, Oracle is uniquely suited to deliver the most autonomous technologies in the world,” said Oracle CEO Mark Hurd. “As we invest, our margins will continue to expand. And with our global datacenter expansion, we are able to help customers lower IT costs, mitigate risks and compete like they never have before.

First, Oracle has very little to show for the “autonomous database,” which responds to AWS’s managed service. The vast majority of Oracle instances globally are managed the old fashioned way, inefficiently, on-premises, and with little in the way of automation.

Second, Oracle seems to think the only thing that separates them from AWS that will make the difference between Oracle Cloud vs. AWS is more servers and more sysadmins. But if customers are looking to have someone manage their databases, why would they want to be locked into one database vendor?

- If possible (which it is), it is preferable to choose an entity that is database agnostic.

- An entity that can offer scale economies in Oracle’s database that even Oracle can’t seem to offer?

- And if the database becomes managed, then the preference for Oracle DB will decline, as much of Oracle’s market share in DBs currently is due to familiarity with IT departments.

A Prediction of What Will Happen Versus AWS (Oracle Cloud vs. AWS)

It sounds like Oracle is going to lose a lot of maintenance to AWS in the coming years.

This whole thing with Oracle being able to charge so much for their database for such long periods so long is odd.

Frequently customers say Oracle is their least liked vendor, yet they have this leverage over their customers for so long while there are so many good options available. The old argument was MySQL was not heavy duty enough, but now PostgresSQL brings scale and performance. MariaDB has built-in cloud features that 12c does not have.

AWS sees a significant fat margin in Oracle maintenance, and they are going after it.

Oracle’s Attempt to Respond to AWS with Pricing

Oracle has claimed that customers that switch from AWS to Oracle for managed DBs will see their costs decrease.

Ahmed Azmi has the following observation on this.

Larry doubles Oracle DB license on AWS then claims he can halve the cost on Oracle cloud. When Larry’s gone, I’m going to miss his funny antics. Ethics aside.

Nobody can compete with Amazon or AWS on price leadership. Google’s the only exception because of their monstrous scale and pervasive automation. Everyone else, in comparison, has enormous cost inefficiencies. If you have any lingering doubts, ask Verizon, HP, Cisco, Rackspace, and VMware.

Oracle as a Highly Expensive Offering with High TCO

Oracle has always been a costly offering — literally, customers continuously complain about Oracle’s pricing. I have heard these stories for decades now. But all of a sudden, Oracle is going to cut the cost in half. It isn’t easy to believe because it is antithetical to what Oracle has been about. That history does not get wiped away because Hurd or Ellison make some pricing statement at a presentation.

The standard argument offered by Oracle has been their database is better than all other databases. That is a different topic. But it has not been the price argument.

Here is another story that makes the Oracle price declaration seem unrealistic.

According to that story, Oracle, which would not comment, is calling lawyers in faster to invoke “breach notices.” These contractual notices mandate that non-compliant customers stop using the relevant software within 30 days. If the software in question happens to be the company’s lifeblood database, that is a potentially lethal threat. But guess how the customer can avoid all that unpleasantness? By buying cloud! Cha-ching for Oracle. – Fortune

And in this quote.

The secret: tricking customers into using features they haven’t licensed. “Oracle’s licensing policies are notoriously vague and confusing,” said Robert Sheldon, technical consultant writing for TechTarget’s SearchOracle. “One misstep and you can end up owing thousands of dollars in audit fees. Yet Oracle software, with its dazzling array of management packs and pre-installed options, is easy to misuse.

This is the same technique used by SAP, but for indirect access. Both SAP and Oracle use confusion to charge more from customers than would ordinarily be possible. This can be viewed as the attorney’s approach to extraction.

The challenge with Oracle software, in particular, is that product options and management packs are installed with the main products and enabled by default.” Once a customer has fallen into this trap, Oracle sends it a breach notice, and then sends in a team to conduct a software license audit. Bringing a customer into compliance, however, isn’t Oracle’s primary goal – selling them services they may not want or need is. “These days, to make the breach notice go away — or to reduce an outrageously high out-of-compliance fine — an Oracle sales rep often wants the customer to add cloud ‘credits’ to the contract, Bort said.

Once again, it almost seems as if this is undifferentiated from SAP’s use of indirect access. Under indirect access, SAP brings what phony claims to push companies into buying more SAP are.

Customers are buying cloud services to make the Oracle issue go away, not because they have any intention of using cloud services,” according to Craig Guarente, CEO of Palisade Compliance.

Why Is Oracle Used?

Oracle has several different businesses. They have the hardware, applications, and databases. But their core advantage lies in their database. However, the options for both the database itself and the hosting now put Oracle’s database in a weak value proposition. A case can be made for Oracle 11 and 12’s differentiation in the market, but the distinction is for a narrow number of applications. If a reset button were hit, and companies could select any database they wanted, Oracle’s database dominance would change very quickly. This brings up the following quotation.

For many of its existing customers, however, sticking with Oracle in spite of its anti-customer policies is preferable to switching to another vendor – not because Oracle’s products are necessarily any better, but because Oracle has done such a good job putting up roadblocks for any company considering such a move. – Forbes

The Problem for Oracle for Oracle Cloud vs. AWS

The problem with this for Oracle is that databases are Oracle’s core strength.

Oracle used its database revenue to make many acquisitions in applications.

However, none of those acquisitions were as differentiated as the database. And with fantastic database options (although blocked out for many applications due to restrictive certifications), combined with the Oracle database’s bloat, as Oracle’s database decline continues, it reduces their power over their customers. And that leads to Oracle’s application sales also declining. Not immediately, of course. Applications in the enterprise space have a stickiness. For example, DB-Engines shows Oracle declining in popularity over the long term, but a rapid decline.

The original purpose of making such acquisitions in the first place was, at least in part, to concentrate the account management and sales effort. Therefore, an Oracle rep would not only offer databases but applications as well. Enterprise accounts tend to like to concentrate their purchases from as few vendors as possible. That is, rather than evaluate each offer on its own merits. IT pushes the business to make their lives as easy as possible and to manage fewer vendors.

Therefore, the thought goes that the more that any one rep can offer, the higher the ability to crossover sales for various products.

Historically, vendors that have made the most money have used a strong capability in one area to sell more products in another area. This is how vendors grow from stronger offerings to progressively weaker offerings.

Conclusion

The databases trend is clear — most of the growth is coming from open source databases versus proprietary databases. This will have a significant impact on Oracle Cloud vs. AWS. What this shows us is that the original promoters of open source are being proven correct.

- The Relational Market: Oracle still dominates this in both its proprietary databases and, in MySQL, is giving way to open source databases.

- The Rise of AWS: The usage of AWS’s open source databases continues to proliferate. This is bad for Oracle Cloud vs. AWS because AWS primarily offers open-source databases on its PaaS. It exposes more customers to non-Oracle databases. And the more they do, the more customers will realize they often have Oracle databases that could be migrated to open source options.

These activities in the popularity of databases bode poorly for Oracle, at least in the long term, and they will need to address some strategy.

As a side note, it is important to look over long periods for database increases or decreases in popularity. If we look at SQL Server’s example, it has grown quite a bit over the past few quarters. However, it has yet to recapture the popularity that it maintained back in 2013. This may indicate some change in policy, price change, etc..