The 2021 Analysis of Investing in Commodities

Executive Summary

- In 2021, with the likelihood of inflation increasing, there is a question of whether this is a good time to invest in commodities.

- This article will attempt to estimate the probability of gain from this strategy.

Introduction

This article is designed to analyze whether commodities are a good investment in 2021.

Our References for This Article

If you want to see our references for this article and other related Non Status Quo articles, see this link.

The Current Situtation

The current rise in the probability of an increase in inflation and instability brings up commodities as a good investment opportunity.

As is explained in the article The 2021 Analysis of US Financial and Monetary Situation, commodities are shown by the Asset Allocation Model as one of the categories that is an investment opportunity.

This video covers why some investors are buying precious metals.

The Longer Term Pattern of Commodities

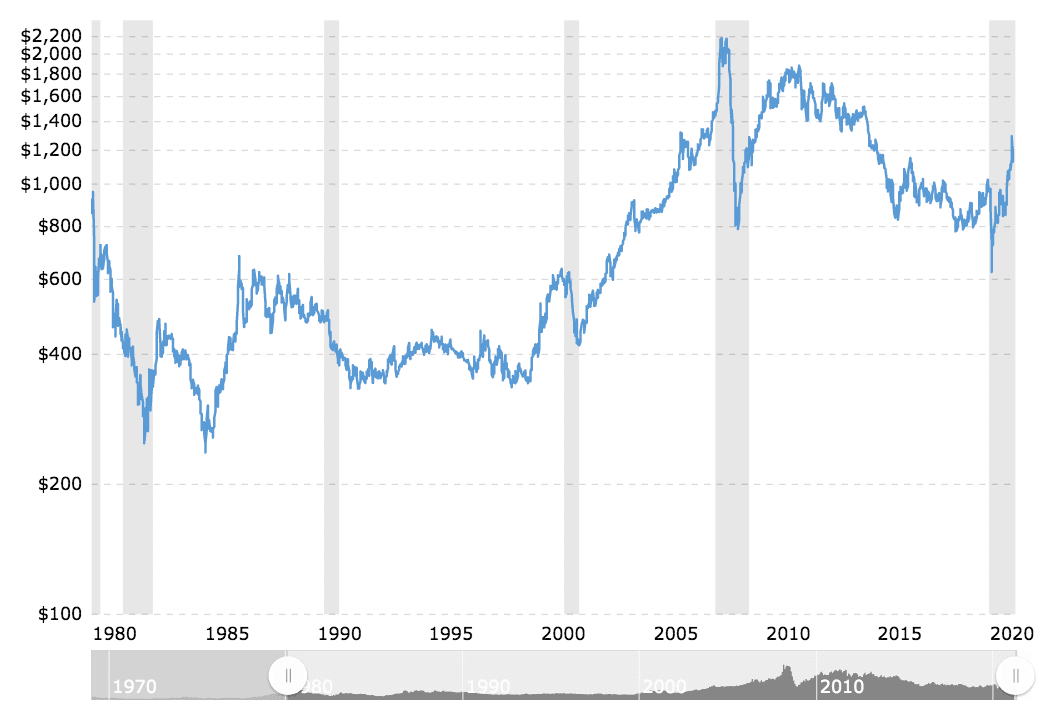

Metal commodities have increased substantially since the Coronavirus. However, they have leveled off and declined somewhat from mid-2020 highs.

The price of platinum has roughly doubled since its low of last year but is only around 20% more than its long-run trend line. Again, the chart above starts at 600 at the baseline.

Adjusted for inflation, platinum is had gone down since 1980.

Platinum is the best hedge against inflation of all of the metals or metal commodities.

Copper has not seen much of an increase in recent years. The increase in copper was primarily from 2003 to around 2007. Given inflation, it is about what it was priced at in 1980.

As is covered in the article, The 2021 Analysis of US Financial and Monetary Situation, none of the agricultural commodities have increased since Coronavirus hit. None of them have appreciated much since the 1980s. When adjusted for inflation, most have gone down in value. This could be a positive sign of appreciation, as the following quotation explains.

Many economists believe that the upswing phase in super cycles results from a lag between unexpected, persistent, and positive trends to support commodity demand with slow-moving supply, such as the building of a new mine or planting a new crop. Eventually, as adequate supply becomes available and demand growth slows, the cycle enters a downswing phase.

With more and more parts of the world experiencing growth simultaneously, demand for commodities is not isolated to a few nations. – Visual Capitalist

Different Options for Commodities

In addition to the major commodities, there are less known by very actively traded commodities like the following.

- Phosphorus

- Rhodium

- Molybdenum

- Manganese

- Vanadium

- Palladium

- Sulfuric Acid

- Recycled Paper

- Coal

- Uranium

- Nickle

- Iron

- Lead

- Zinc

- Neodynium

- Chlorine

Conclusion

Commodities, outside of metals, are presently low in price versus historical standards. They are also an excellent hedge against inflation. Given the rise in gold and silver, the relatively low price of platinum would put it into consideration as being the best value of the three metals and is even a better hedge against inflation. All of the agricultural commodities are an even better value, and also a very good inflation hedge.

*Oil is a heavily traded commodity, however, it was left of of this analysis due to how oil has been highly connected to the decline in driving and overall travel during the Coronavirus.

How to Go Long in Commodities

Rather than buying commodity futures, one can invest in commodities most easily by investing in commodity mutual funds. If the commodities in the funds rise, the fund rises. There are several funds to choose from, so the question is which fund or funds combination.

Given the low price of commodities and the likely coming inflation, commodities would be a heavily weighted investment. This provides considerably more upside than investing in foreign currencies, as we cover in the 2021 Analysis of Currencies Versus the US Dollar.