The 2021 US Bitcoin Bubble

Executive Summary

- In June of 2021, there are multiple financial bubbles that require analysis in the US.

Introduction

This article covers 2021 bitcoin bubble and will propose an investment strategy based upon this analysis.

Bubble #3: Bitcoin Bubble

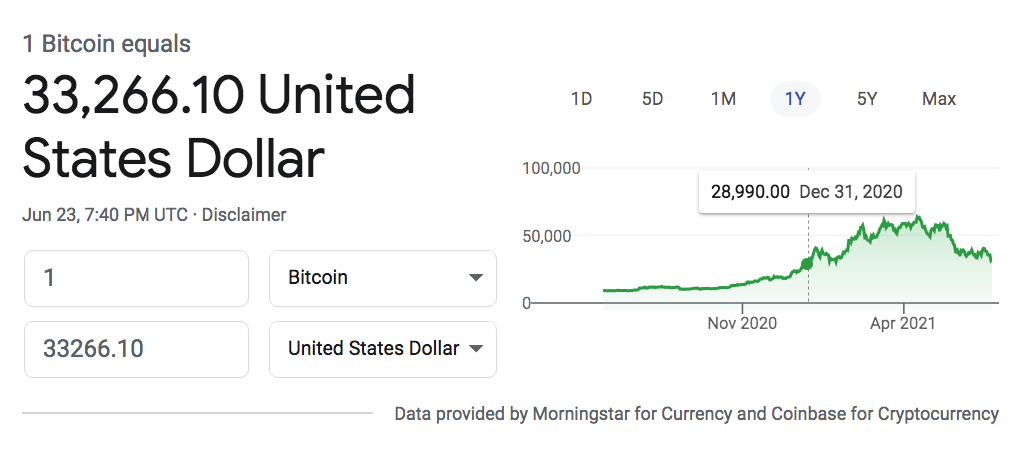

And the June price of Bitcoin.

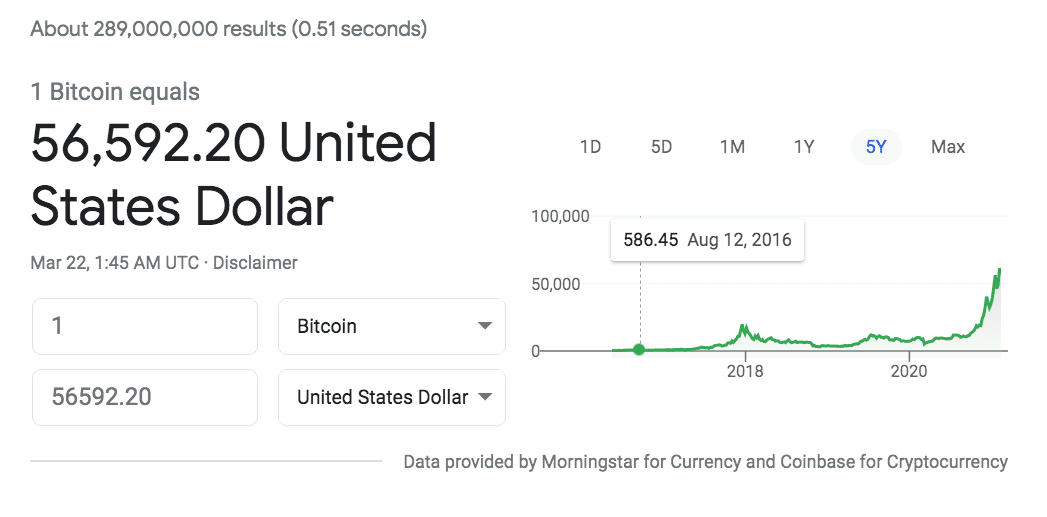

Cryptocurrencies are faux assets that just have not had enough time for people to realize there is nothing there. Much of the population does not understand the social credit/state credit/seignorage theory of money, making them susceptible to claims by bitcoin enthusiasts. Like everything else in 2021, they are being driven by large amounts of speculative liquidity. There is nothing to stop an unlimited number of cryptocurrencies from being created.

The focus on speculation driven by easy money is explained in this video.

Dalio explains that interest-only loans are being created, pushing up the bubble.

Uses of Bitcoin

It has been observed that there are no real uses for bitcoin. It is not used as money to make purchases. It is a purely speculative asset. Of course, this is not much different than stocks, although stocks have a dividend yield. However, most of the value of stocks is based upon reselling them for a higher price than the one paid.

Dean Baker on the Ups and Downs of Bitcoin

Perhaps Bitcoin’s price will double or triple again. After all, who knows how badly people need digital currencies that are not really currencies? But more likely the market will run out of people who are willing to trade real money for nothing. At that point Bitcoin’s price will plunge and may approach its underlying value of zero.

In the meantime the price surge shows us that markets are capable of enormous amounts of irrationality. This is helpful for people who can’t remember the stock bubble at the end of the 1990s.

*https://cepr.net/tesla-amazon-and-bitcoin/

Strategy: Short bitcoin

BITI is designed to provide daily investment results, before fees, expenses, distributions, brokerage commissions and other transaction costs that endeavour to correspond to up to one-times (100%) the inverse (opposite) of the daily performance of an index that replicates the returns generated over time through long notional investments in Bitcoin Futures. The current Underlying Index of BITI is the Horizons Bitcoin Front Month Rolling Futures Index (Excess Return). BITI does not seek to achieve its stated investment objective over a period of time greater than one day. – Horizons