What To Do With The Ceaselessly Corrupt Financial Industry?

Executive Summary

- How Long Would a Fact-Based Analyst Last in Wall Street?

- Illusory Complexity

- Ending High Finance as we Know It

- The Necessary Functions of a Financial System

- What About Other Types of Finance?

Introduction

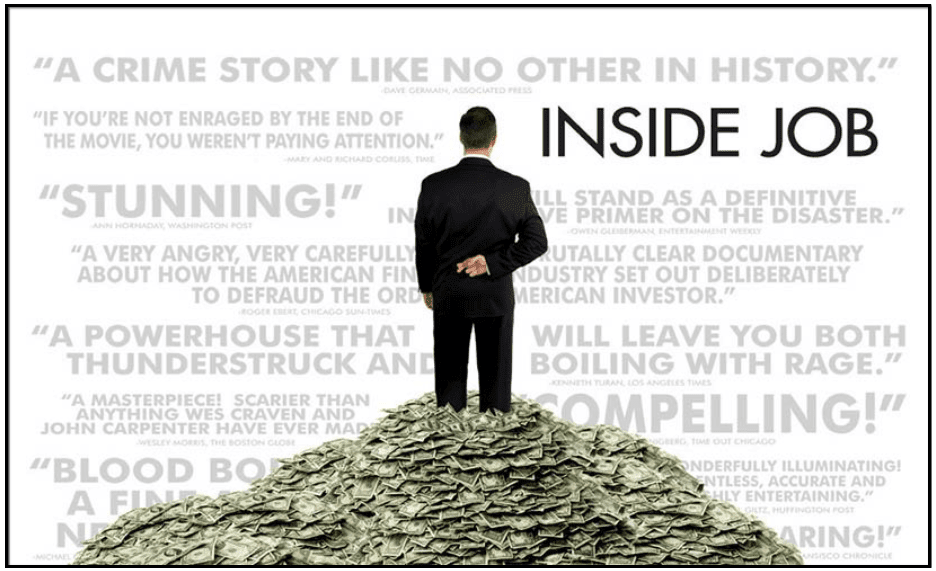

I am 1/2 way through Inside Job, which is a movie on the financial crisis. It is simply increasingly clear to me that not very much mental heavy lifting is done in finance. They essentially decide what they want to do (if they want to sell CDOs at a certain price) and then they work backward from what they want, and then jerry-rig everything and call it analysis. I guess some math skills are used to create the during the jerry-rigging, but it’s all fantasy based. The idea that they seem to be missing about math is that it is supposed to be based on something real. If math just becomes a mechanism for lying, then it’s not really “math” anymore, you might as well just draw a picture in crayon at that point. The fact that we have educated so many people in advanced math, who would be better off drawing cartoons, is a huge concern. If physics and math departments are training people so they can go and work on Wall Street, they need to cut their class size because clearly, we are over-investing in mathematics education in this country.

Contrary the industries constant proposals, I have a hard time seeing actual intelligence being applied in this industry. Here an analogy is useful. There is a movie series called Saw where some sick mastermind comes up with “ingenious” ways to butcher people or have them butcher themselves. But this type of thing is not lauded, although some of the things he did were innovative.

Probably a lot of skill went into developing this death mask. It required knowledge of mechanical engineering, metallurgy as well as some mathematics. Furthermore, in the movie, the homicidal main character has to capture his victims and put them in death contraptions. This all takes a lot of skill and motivation, which is above average in ever regard. However, would it be considered normal or proper to laud the creator for their multi-domain knowledge and ability to follow through on their plans? No? Then why do we laud financial types for creating financial products that do to the economy what the Saw character’s contraptions do to people?

How Long Would a Fact-Based Analyst Last in Wall Street?

If I had gone to work in finance, I probably would have lasted two minutes because it’s all just high paid prostitution. Acting as a sycophant you simply determine what the boss wants to hear, and then put together a report that is totally manipulated. Then you get paid. As time has passed, I have been approached by several companies to “write for cash,” that is to put your name to opinions and ideas that are not your own. This is where the real money is in both writing and mathematics.

Do you know what else is almost as complex as a derivative? A Rubix cube. Both are of equal usefulness, but derivatives have more negative externalities.

Illusory Complexity

While Inside Job is a good movie, I did not learn a lot new about the crisis. The fact is that no fancy math or great intellect is necessary to understand what happened. The major hurdle to understanding high finance and the crisis was placed there by major media outlets to built high finance into something significant with myths. The most import tool to understanding the fraud of high finance is the ability to see through the propaganda. As soon as someone spends more than a few minutes talking about a derivative, it’s clear that its a crock. There is a point in Inside Job where a financial consultant describes the fact that a derivative allows multiple people to insure something they don’t own. The example given is that 50 people could insure the same house. So two things immediately come to mind:

How can 50 people insure the same thing for the same value? Why do we legally allow someone to insure something they don’t own? The answer to the first question is they can’t, and the answer to the second question is we shouldn’t. At this point in discussion with a super highly paid and Wall Street type who I am sure would see someone like me. A person who wears clothes from Lands End and has a Honda Accord as a hopeless loser, would say that I don’t get it and I am narrow-minded, and possibly even “deliberately obtuse.” However, the finance type has a real problem, because nothing they say makes any sense to anyone who has any sense. Let me just say that some things are genuinely tough to understand, and where suspension of disbelief is important to understand what is happening. Microbiology is like this. The number of things happening at a microscopic level just inside of our bodies is mind-boggling and cannot be understood with normal logic. Gravity is similarly deep and complex and requires a movement outside of the everyday realm to understand. Finance types would like this to be the case as it would help justify their expensive degrees and help them hypnotize people better so they can be separate from their money. However, the problem is that it just isn’t. Finance is a business activity where money flows between individuals and institutions to support individual needs for consumption and investment, businesses for investment, and the government for spending and investment.

While a description of the gravitational effect can go on for hours, if a discussion on any financial transaction or setup goes on for more than a few minutes, then fraud is taking place. Finance types essentially want the best of both worlds. They want very high pay, and they want the prestige of being intelligent and in working in a very intelligent field with high status. However, the problem is that the two are not related. The best-paid doctors are not the most intellectual (who perform quality research), but those that perform the most unnecessary surgeries, and dispense the most pills. However, money does funny things to your ego. Because they are so overpaid, they think that they are incredibly intelligent.

In fact, they chose a profession because they are greedy, got through a fancy school by paying big money and studying hard. However, nothing high finance does is based upon truth or reality. And the inconsistency there is that to be considered “elite” it is necessary to investigate real things and to follow some method that is based on discovering some truth. High finance reveals nothing and covers truth, to maximize profit and short term gain, and therefore is a hollow field of study. Saying that finance is intellectual is much like saying marketing is intellectual. It’s impossible as the depth of study is limited by the field.

There is a scene in the movie Copland where DeNiro’s character who is a detective tells Stallone’s character, who is a small town Sheriff that

“You may be part of law enforcement, but you are not a cop.”

This same statement could be said of high finance with regards to the pretense of their amazing mental capabilities. They could have chosen something intelligent to do with their lives, but they took money over doing anything interesting or of value.

Ending High Finance as we Know It

While Inside Job did not cover new ground, it was very well done. The consistency of the story of what happened is simply damning evidence that this is an industry that is better off dead. Not reformed, dead. High finance is what economists would describe as a negative externality machine. People for high finance’s continued existence declare that it is necessary to have a vibrant economy. However, no evidence is ever provided of this. It is simply expected to be accepted because all the really intelligent people who have been right about so much (Larry Summers, Timothy Geithner, Alan Greenspan, Hank Greenberg, Robert Rubin — you know the smart folks) tell us that it is necessary.

The Necessary Functions of a Financial System

Not much more than a national banking system is required to support the financial needs of any country. Banking should simply be seen as a mechanism for efficiently and in a stable fashion distributing government fractional reserve based money. This national banking system, which would employ very few people would work like the Social Security Administration. The Social Security Administration has less than 1/2 a percentage point in administration costs. This very low administration cost is not unusual in government, although this story is muted because anytime the government beats private industry at something its kept relatively quiet because of the lack of profit incentive to point this out. For instance, similarly, Medicare administrative costs are 2% of claims, while private insurance has 30%. Large public financial programs like this are inexpensive and quite stable. Any situation involving benefits distribution the US government easily beats private industry, which brings up the question of why we have either a private banking system, private health care system, or private insurance system.

Can We Live Without Financial Innovation?

It’s important to point out there would be no innovation; just the same basic standards applied year after year. The interest rates would also be very low because the costs of running the system would also be low, and there would be no financial panics, no FDIC (the government is insuring itself already), no bank mergers, nothing exciting at all.

What About Other Types of Finance?

There is no need for any parallel financial system outside of a national banking system. Other areas which currently exist are described below:

Individual investors can invest their money privately but should be barred from selling products or making products that could in any way be sold to individuals or public trusts like pension funds. With no stock market, and no bond market and no mutual funds or hedge funds, these d-bags have no market and nothing to do. Then individual private investors who can invest their money in starting up a new business or combine with other individual wealthy private investors to form partnerships.

With no stocks or bonds, there would be no need for auditing companies as all companies would be private.

Bonds do not need to exist outside of US Treasuries because municipalities would simply tap into the public nationalized banking system for loans. States are part of the US monetary system. Why do they need to sell bonds in the first place?

Conclusion

Outside of a national banking system, I see absolutely no purpose in the finance industry. Secondly, it is more than clear at this point that the financial industry in its current incarnation is just too dangerous to be allowed to survive. They are the most powerful lobby in the country and will use their financial muscle to continue to fight any regulation and to fund supporters in the media system which will write articles that justify their existence.

At this point, the rest of the population is very much faced with the decision of what to do after you capture Hannibal Lecter. If you capture him, you have to decide if you can transport him in a way that is safe for you as well, then you have the luxury of providing him with due process. However, Hannibal is not an ordinary criminal, he is smart and resourceful, and if you make a mistake during transportation, he will eat you. That would be a tragedy because as a sociopath Hannibal’s life has little value compared to you, just as with those who work in high finance. If you can’t transport him, you kill him were captured and say he resisted arrest. This is the situation with high finance. Never before was Malcolm X’s quotation of “By any means necessary,” more applicable.