How to Make Sense of The Natural Confusion with Alpha Beta Gamma

Executive Summary

- The jargon-heavy core statistical forecasting parameters known as “Alpha, Beta, and Gamma” could just as easily be called by the more descriptive names of “Base Factor, Trend Factor, and Seasonality Factor.”

Introduction

The jargon-heavy core statistical forecasting parameters known as “Alpha, Beta, and Gamma” could just as easily be called by the more descriptive names of “Base Factor, Trend Factor, and Seasonality Factor”. It is interesting how common terms in forecasting can have precise definitions for them available online. The terms Alpha Beta Gamma are good examples of this. What does not help is that these values were never named logically from the beginning. You will learn both about naming these parameters and how to use these parameters for forecasting.

Our References for This Article

If you want to see our references for this article and other Brightwork related articles, see this link.

What Are Forecast Parameters?

Every statistical forecasting application ships with a series of standard forecasting models.

Forecasting Models

Every statistical forecasting application ships with a series of standard forecasting methods. As an example, here is the list of methods that ship with SAP DP.

- First Order Exponential Smoothing

- Constant Model with Auto Alpha Adaptation

- Moving Average

- Weighed Moving Average

- Forecast with Trend Model

- Holt’s Method

- Second-Order Exponential Smoothing

- Trend Model with Automatic Alpha

- Forecast with Seasonal Model

- Seasonal Model Based on Winter’s Model

- Seasonal Linear Regression

- Median Method

- Forecast with Seasonal and Trend Model

- Holt and Winters’ Exponential Smoothing

- Forecast with Automatic Model Selection

- Test for Trend

- Test for Season

- Test for Trend and Season

- Seasonal Model and Test for Trend

- Trend Model and Test for Seasonal Pattern

- Model Selection Procedure 2

- Historical Data Adopted

- Manual Forecast

- Croston’s Model

- Linear Regression

- No Forecast

- External Forecast

The forecast methods can be considered the starting point for creating a statistical forecast.

Forecast Methods Require Parameters

These forecast methods require parameters to provide the desired forecasting output. A parameter is defined as follows: A numerical or other measurable factor forming one of a set that defines a system or sets its operation conditions.

There are different categories of forecast parameters. Some are common to every forecasting tool, and others are less commonly used or are only used in specific types of forecasts. To organize the discussion, I have broken the possible parameters into three categories that will be explained in this chapter.

These categories are:

- Core Forecast Parameters: Alfa Beta Gamma

- Secondary (to the Core) Forecast Parameters: Alfa 2, Alfa End, Alfa Increment, Sigma, Trend Dampening

- Time-Based Forecast Parameters: Seasonal Periods, Period Indicator, Forecast Horizon, Historical Periods

For this article, we will only focus on the core forecast parameters.

The Core Forecast Parameters

We are fortunate that, in the information age, the most common statistical parameters have been well-defined online. This includes Alfa Beta Gamma. Despite this, many people who have worked in statistical forecasting can list these parameters. However, a much smaller subset can tell you what they mean. It doesn’t help that these parameters were named nonsensically with jargon labels. In our view, this was done for academic reasons rather than being given a more descriptive appellation.

If we take the gamma example, it isn’t easy to see why it was chosen to represent the seasonal factor. This is because Gamma’s definitions are historically in nuclear science or stellar cartography. Adding to the confusion, dictionaries generally do not bring up the forecasting definitions of any of these terms, as they are niche.

What the Outcome of the Misnaming Has Caused

All of this leads to widespread confusion that would be resolved if they had been called something meaningful like “Base Factor,” “Trend Factor,” and “Seasonality Factor.”

Alas, we’re stuck with the first names given, and forecasting tools continue to use them with two notable exceptions. JDA Demand Management, which is JDA’s forecasting application, uses the latter and more straightforward terminology of Base, Trend, and Seasonality instead of Alfa Beta Gamma. DemandWorks Smoothie also dispenses with the common terms and replaces them with something more descriptive.

Now that we have described the Alpha, beta, and gamma history, let us define each.

These forecast models require parameters to provide the desired forecasting output. A parameter is as follows: A numerical or other measurable factor forming one of a set that defines a system or sets the conditions of its operation. The transmission will not let you downshift unless your speed is within the lower gear’s parameters.

“Usage: Until recently, use of the word parameter was confined to mathematics and related technical fields. Since around the mid 20th century, however, it has been used in nontechnical fields as a technical-sounding word for ‘a limit or boundary,’ as in they set the parameters of the debate. This use, probably influenced by the word perimeter, has been criticized for being a weakening of the technical sense. Careful writers will leave parameter to specialists in mathematics, computer science, and other technical disciplines. As a loose synonym for limit, boundary, guideline, framework, it is a vogue word that blurs more than it clarifies. Perimeter is a different word, meaning ‘border, outer boundary, or the length of such a boundary.” – Apple Dictionary

The Different Categories of Forecast Parameters

There are different categories of forecast parameters. Some are common to every forecasting tool, and others are less commonly used or are only used in specific types of forecasts. To organize the discussion, I have broken the possible parameters into three categories that will be explained. These categories are:

- Core Forecast Parameters: Alpha, Beta & Gamma

- Secondary (to the Core) Forecast Parameters:

- Alpha

- Alpha End

- Alpha Increment

- Sigma

- Trend Dampening

- Time-Based Forecast Parameters: Seasonal Periods, Period Indicator, Forecast Horizon, Historical Periods

Primary Ways Models are Adjusted

In statistical forecasting, parameters are the primary way models are adjusted. Understanding and manipulating forecast parameters is the measure of a capable statistical forecaster. No person can manually adjust statistical forecasting models without understanding forecast parameters. Unfortunately, investing in the training necessary to gain model manipulation proficiency often costs significant money. Thus, many companies find themselves short of real expertise. The best way to learn and demonstrate knowledge of forecast parameters is to learn by adjusting forecast parameters in real-time. Most methods use a mixture of statistical and subjective techniques, requiring the human operator to be familiar with the tools. You can read this and other books, but there is no replacement for putting the time into adjusting forecast models yourself. Those who read this article will be able to do this (with some practice, of course) and understand broader concepts and issues related to forecasting parameter setting and maintenance.

Major Parameters to be Discussed

There are different categories of forecast parameters. We have categorized all common forecast parameters into the core, secondary, and time-based classes, and we’ll look at each group separately. The core statistical forecasting parameters (the ones most commonly discussed in the literature) are:

- Alpha

- Beta

- Gamma

Lesser-Known Parameters

Other lesser-known parameters are the following:

- Alpha

- Alpha 2

- Alpha End

- Trend Dampening

- Sigma

- Seasonal Periods

- Period Indicator

Timing Settings

Timing settings fields that are also very important in controlling a forecast are the following:

- Forecast Horizon

- History Horizon

- Forecast Horizon – From Date

- Forecast Horizon – To Date

- Forecast Horizon – Number of Periods

Further in the article, we will show how the parameters and the other settings are saved in a list that makes up something called a Forecast Profile.

The Core Forecast Parameters

In the information age, we are fortunate that the most common statistical parameters, including Alpha, Beta, and Gamma, have been well-defined online. Despite this, many people who have worked in statistical forecasting can list these parameters, but a smaller subset can tell you what they mean. It doesn’t help that these parameters were named nonsensically with jargon labels rather than a more descriptive appellation.

Where did the terms “Alpha, Beta, and Gamma” Come From?

Researchers selected these names because they sound more technical than “Base, Trend, and Seasonality,” and the individuals who first published on statistical forecasting wanted jargon-heavy terms to increase their specialized status in their work. My hypothesis for this is that “Alpha Beta Gamma” sounds more technical than “Base, Trend, and Seasonality.” These second options would have been better choices.

Alpha has a range of definitions, from the decay of particles to the dominant human or animal. Beta’s definitions range from being the second brightest star in a constellation to the second in a series of items to the state of a test. Gamma’s definitions are primarily in nuclear science or stellar cartography. Adding to the confusion, dictionaries generally do not bring up the forecasting definitions of any of these terms, as they are rather a niche. All of this leads to widespread confusion that would be resolved if they had been called something meaningful like “Base Factor,” “Trend Factor,” and “Seasonality Factor.”

Alas, we’re stuck with the first names given, and forecasting tools continue to use them with two notable exceptions. JDA Demand Management, which is JDA’s forecasting application, uses the latter and more straightforward terminology of Base, Trend, and Seasonality in lieu of Alpha, Beta, and Gamma. DemandWorks Smoothie also dispenses with the common terms and replaces them with something more descriptive.

Alpha, Beta, and Gamma Definitions and Examples

- Alpha: This is also known as the base value. This value determines the weighting of past data values in setting the baseline (magnitude) for the forecast, with higher Alpha values leading to the increased weight being given to the most recent observations, while lower values of Alpha imply a more uniform weighting. Therefore, a higher alpha value was used if a time series were 90, 100, 110, 150, 250, 300, 375. The forecast generated would be higher because the more recent data points would be emphasized, and the more recent data points are higher than the less recent data points.

- Beta: This is also known as the trend value. It determines the degree to which recent data trends should be valued compared to older trends when making the forecast. Going back to the previous time series of 90, 100, 110, 150, 250, 300, and 375, if a higher beta were applied, the forecast would be higher than if a lower beta were applied because the trend is increasing more rapidly in the more recent data points.

- Gamma: This is the seasonal component of the forecast, and the higher the parameter, the more the recent seasonal component is weighed. The seasonal component is the repeating pattern of the forecast. A seasonal pattern is often thought of as a seasonal pattern per year. If the year is broken into four periods, then a standard seasonal pattern would break down along spring, summer, autumn, and winter. However, a seasonal pattern can also apply within a month or a week. For instance, when shipment patterns are analyzed, there is often a seasonal pattern within a week, or a month, as shipments are created only once per week or multiple times per month. The duration over which the seasonal component repeats is not what defines the seasonal component, only that there is a pattern of repetition. If a higher gamma value is used, the more recent seasonal pattern is emphasized over, the less recent. The first time series cannot illustrate the effect of using a higher or lower gamma value as the time series does not have a seasonal component. However, if we were instead to use the following time series of 100, 105, 120, 100, 100, 115, 125, 100, and if we were to use a higher gamma value, then the forecast would be higher because the seasonal increase of the second four data points is higher than the seasonal increase in the first four data points.

Note that each of these values varies how recent components of the time series are weighted versus the less recent components. This is one of the most misunderstood features of these forecast parameters. Many people think that the emphasis of these parameters is on the absolute weight of each parameter.

System Default Values for Alpha, Beta, and Gamma

Many systems use default values for the core forecast parameters alpha, beta, and gamma. For instance, SAP uses 0.2 for Alpha, 0.1 for Beta, and 0.3 for Gamma and Delta; therefore, even if no values are populated, such as in the screenshot below, “some” parameter value is used.

Forecast Ranges for the Core Forecast Parameters

Forecast parameters have a range of values that can be used. In most cases, this range is from 0.1 to 1.0. One of the requests for this article was to include the ranges for each parameter. This isn’t easy to provide because the effective range of a parameter depends on the forecasted item.

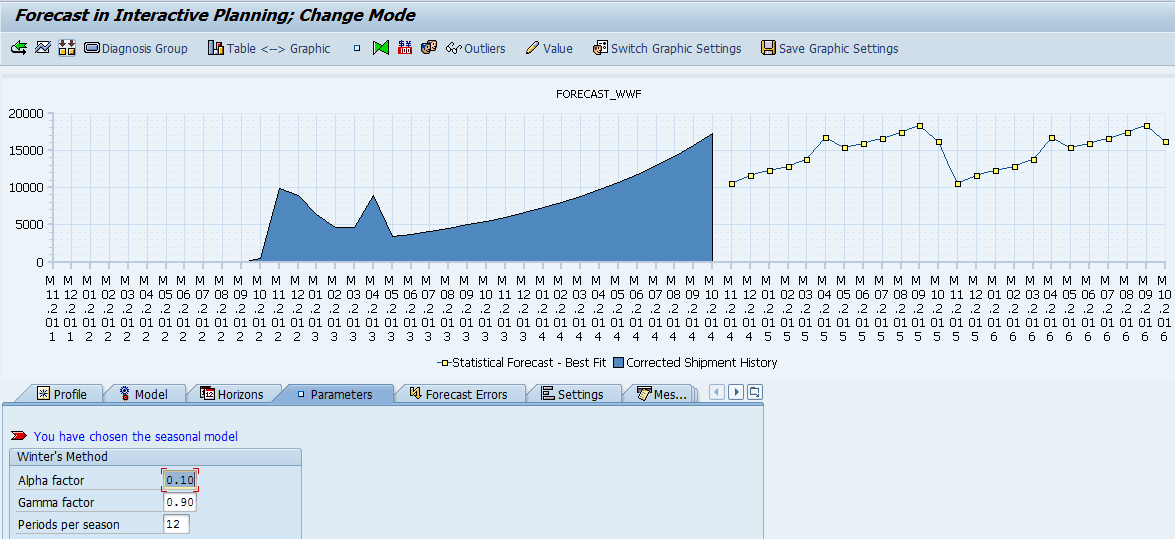

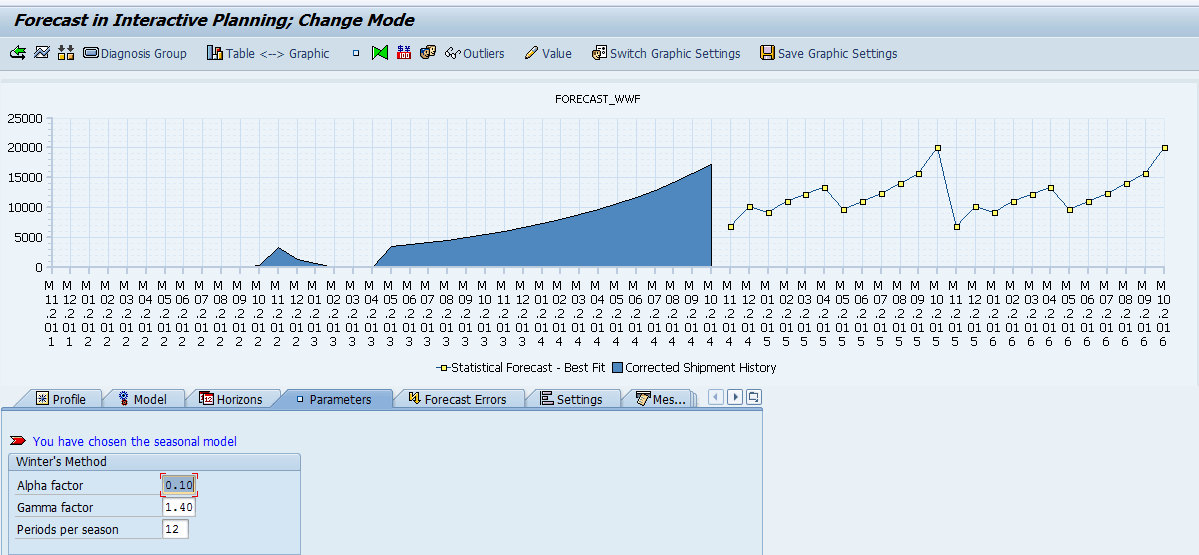

Here is an example in the application of SAP DP.

With this Univariate Forecast Profile, we have a very high Gamma, emphasizing the more recent seasonal pattern. We will now make a change to the Gamma value to see what happens to the generated forecast.

By reducing the Gamma to its lower end, notice how the trend is de-emphasized, and the seasonality becomes more apparent. By the way, I should note that this change to the Gamma parameter just greatly increased the forecast error. However, we are less concerned with getting a low forecast error as we are testing the outcomes of changes to the ranges of the forecast parameters. What is apparent is that changing the Gamma to the extremes of the range has a dramatic effect on the forecast output.

Testing and the Gamma Value

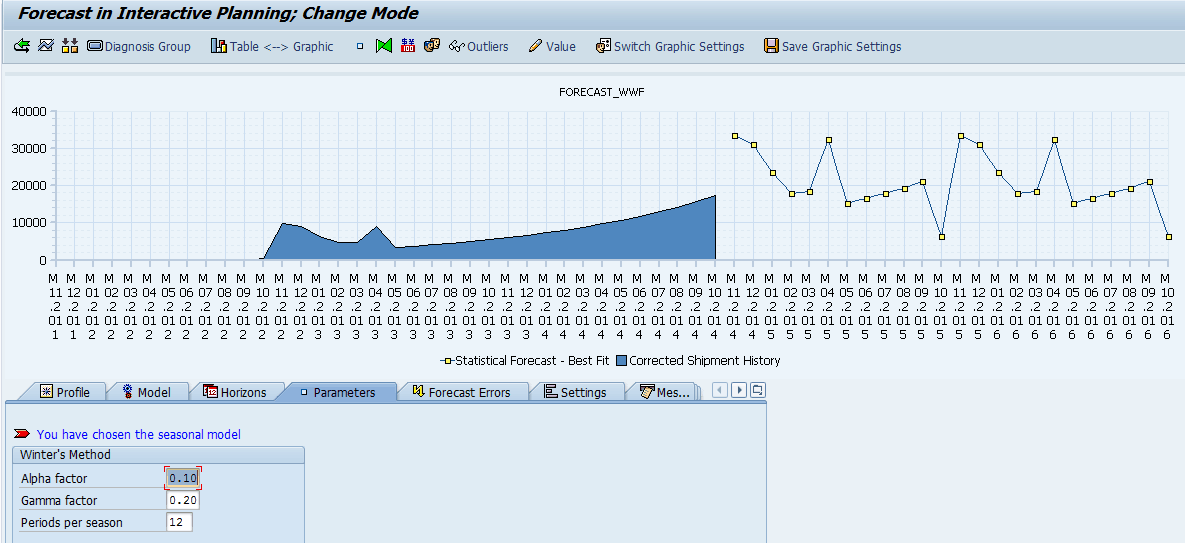

Something that came out in testing is that while the Gamma parameter is supposed to have a range of between 0.1 and 1.0 when a larger Gamma was used, this still changed the forecast. Here is the forecast generated with a 0.9 Gamma.

And here is the forecast output with a Gamma of 1.4. Notice that the forecast has less definable seasonality peaks than in the previous forecast variant.

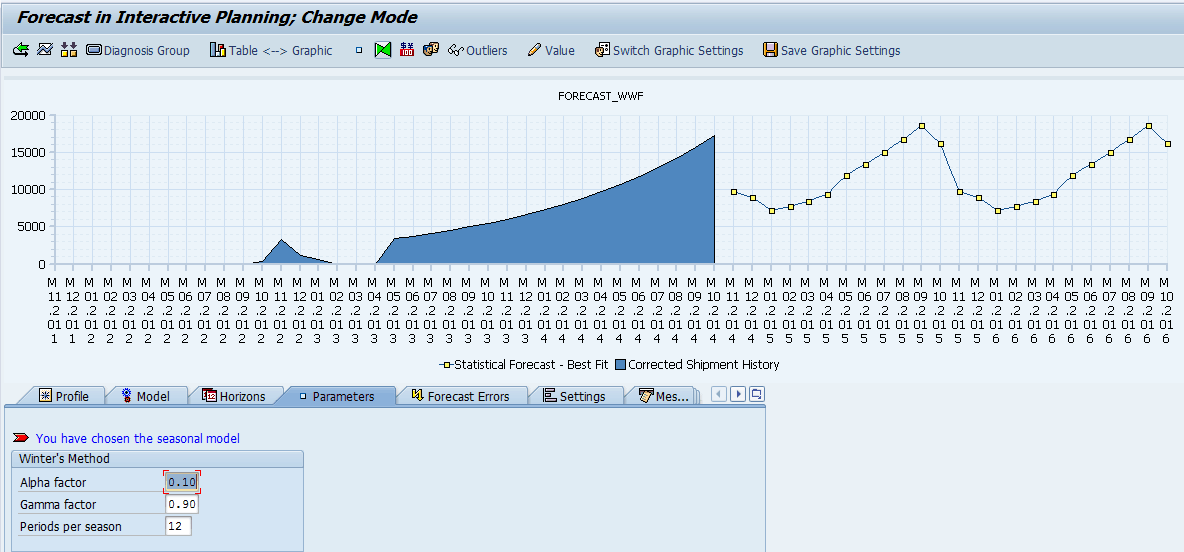

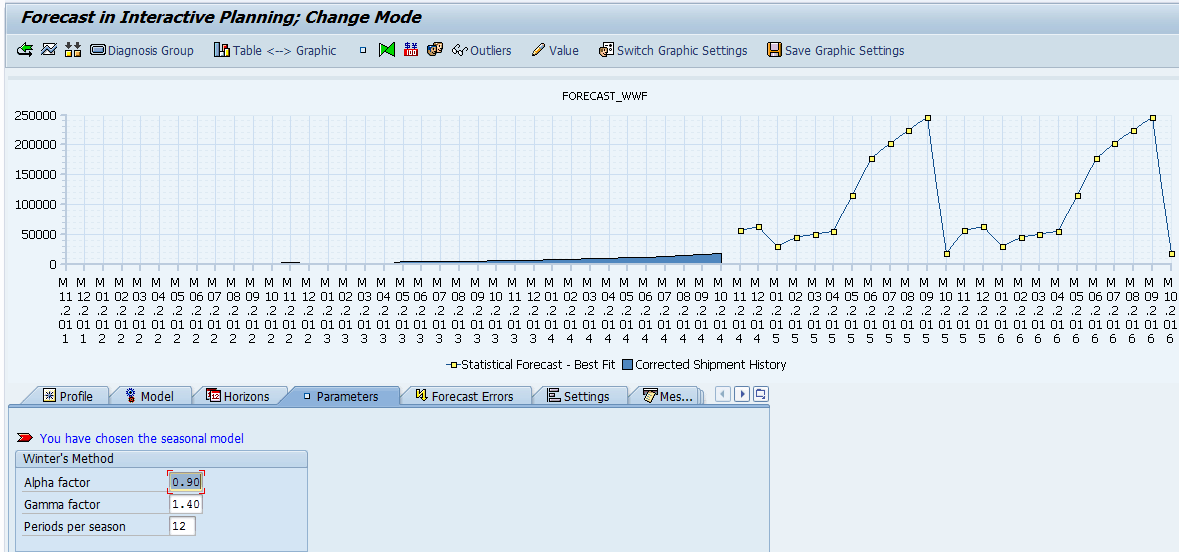

Now we will push the Alpha factor higher and notice the dramatic change that occurs.

Now we will push the Alpha factor higher and notice the dramatic change that occurs.

Pushing the Alpha Value to Far

The forecast is now enormous compared to the shipment history because the Univariate Forecast Profile extrapolates the increase in volume out into the future in a much-exaggerated way. This abysmal forecast illustrates how critical it can be to set sensible values for your core parameters.

The forecast is now enormous compared to the shipment history because the Univariate Forecast Profile extrapolates the increase in volume out into the future in a much-exaggerated way. This abysmal forecast illustrates how critical it can be to set sensible values for your core parameters.

Why Learn to Set Forecast Parameters Manually

To precondition a forecast model, you can either set parameters by hand or let the computer set them based on the data or some first approximations common to a given application. The former approach is very labor-intensive and prone to mistakes if the user is not trained in understanding parameters and how they affect the forecast. The latter method is, thus, the most common way forecasting is done in the real world. This might lead you to conclude that there is no need for the human operator to understand the parameters themselves fully, but you would be wrong. Although auto-setting forecast parameters work quite well in some fields, it is not always available. Many systems automatically adjust parameters based on initial estimates of the human operator and the results.

Alas, over-reliance on computer-generated parameters leads to models that are less effective than they could be. It also leads to the mistaken conclusion by many administrators that forecast modeling is not useful for many metrics within their organizations when, in fact, it would be under better initial conditions.

Should Users Adjust Alpha, Beta, and Gamma?

Well, it depends.

Some systems don’t allow parameters to users as they optimize the parameters.

One approach for applications that do not optimize forecast parameters is to have demand planners manipulate the simulation mode parameters. Once a better forecast model variant is created, the demand planner can save the variant. Some applications allow you to save the variant, while other applications do not. The next step is having the forecasting lead create a new model. This model for the demand planners. It is then added to the library of forecast models that can

I recommend creating a forecast model list (a sample I will demonstrate in a few paragraphs). This is an external spreadsheet. It is with the demand planning department. It provides the ability to perform sortation. This list provides visibility into the forecast models and the assignment between the forecast model and the product location.

Is The Importance of Understanding Them Coming to an End?

Some forecasting software eliminates these terms from forecasting. This is because the software optimizes these values for the user. Older applications can’t optimize these values. Thus, people have to spend their time worrying about these terms. One’s interpretation of this value depends on whether the forecasting system can optimize these parameters better than a manual change. However, if the application optimizes the parameters, then you can’t create custom models.

There is a second problem: every time a change to a forecast parameter is made, it creates a new variant. That variant must be accounted for and then saved to be re-applied. It becomes easy to lose track of the forecast model variant applied to which forecasted item without doing this.

Suppose you are a director or VP of supply chain planning. In that case, selecting software that best uses the demand planner’s time and receives the highest possible forecast accuracy is important. That means matching the forecasting system to the capabilities of the demand planners. Also, does your demand planning group tend to hold onto planners or tend to turn them over? The more turnover, the less complicated the system can be.

Competing Approaches for Model/Parameter Selection

To select the right forecasting model and parameters, it is necessary to measure the forecasts efficiently against history. This can partially be done by observing the trend line versus the fitted forecast. Secondly, when a best-fit procedure is run, the procedure will auto-optimize forecast parameters. However, over time we have begun to reduce our reliance on very highly automated methods like this. Another competing approach is testing a forecast with the same parameters against a segment or grouping of the product location database that tends to work for a specific model/parameter setup.

Conclusion

Alpha, Beta, and Gamma are basic parameters, but they are named. This makes them seem more complex than they are.

This had to do with the motives of academics that developed Alpha, beta, and Gamma. They wanted to make something simple sound complicated for funding reasons. They succeeded in this, but we now have the legacy of a confusing naming convention.

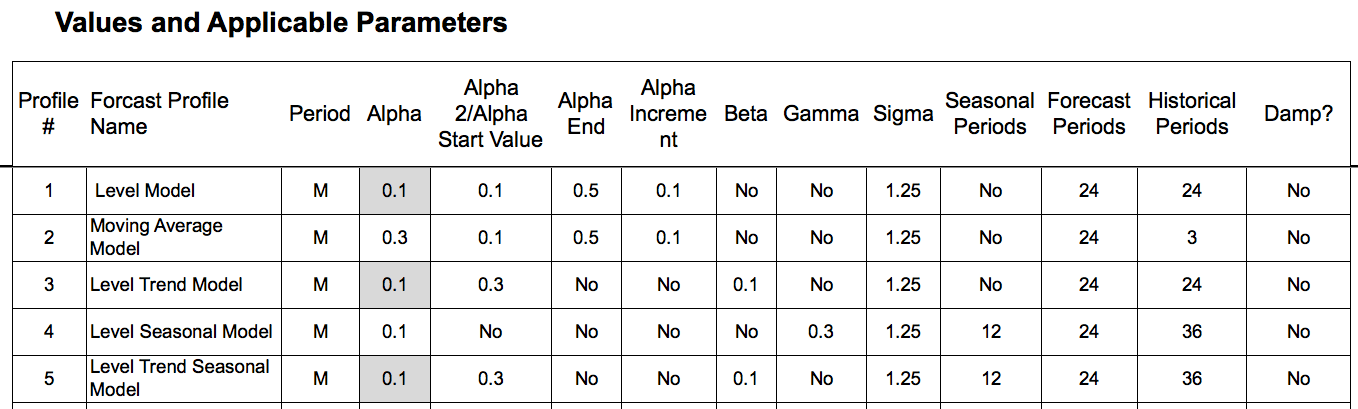

Comparing Parameter Combinations

This is an abbreviated example from my book Setting Forecast Parameters in Software. This is a listing of forecast parameters and other settings that make up a Forecast Profile.

When I perform a forecasting improvement project, I create several customer profiles. Notice the names in the far left column. Each profile contains both parameters along with several other settings. Once I have the Forecast Profile listing, I know I have a profile covering each grouping of product locations in the overall database.

To perform the Forecast Profile assignment correctly, the forecast error must be tested for each Forecast Profile when run or applied against the demand history of tested product location combinations.

The core statistical forecast parameters control how much the more recent demand history should be weighed versus the demand history further back in time. These core forecast parameters are applied for the Alpha (the base), the Beta (the trend), and the Gamma (the seasonality) components of the demand history.

Sharing This Article

Share this article with someone you know by copying this article link and pasting it into your email so they can read the same information.