How to Best Understand the Control of SAP on IT Media

Executive Summary

- SAP controls the IT media system with a combination of advertising and paid placements.

- IT media entities do not declare their income source from SAP.

Introduction

I recently wrote an article that is a critique of our IT media system in the article The IT Media and the Fake News Debate.

Increasingly what I notice is the major media entities control a system that has no independent thought, a system not based upon what is true, and a system there what we think is true. The major media entities, all in some way that takes money from SAP, declare what the right thing to do is, that thing is done, and the significant media entities then reinforced what was done. As in self-reported benefits to say ABC Orange Juice Co was a 25% increase in sales order processing time from implementing SAP XYZ, so you should also think about SAP XYZ.

As in self-reported benefits to say ABC Orange Juice Co was a 25% increase in sales order processing time from implementing SAP XYZ, so you should also think about SAP XYZ.

I read the books SAP Nation 1 and SAP Nation 2 and follow any analyst who writes the truth about SAP, which is easy because it’s so few. But what I have recently begun to realize is Brightwork Research & Analysis is the only source taking the particular approach or thinking pattern to the material. It seems every other writer or media entity, even from that small set, is somehow respectful to some powerful entity, be it Gartner or SAP or even generally accepted, but often false principles.

Our References for This Article

If you want to see our references for this article and related Brightwork articles, see this link.

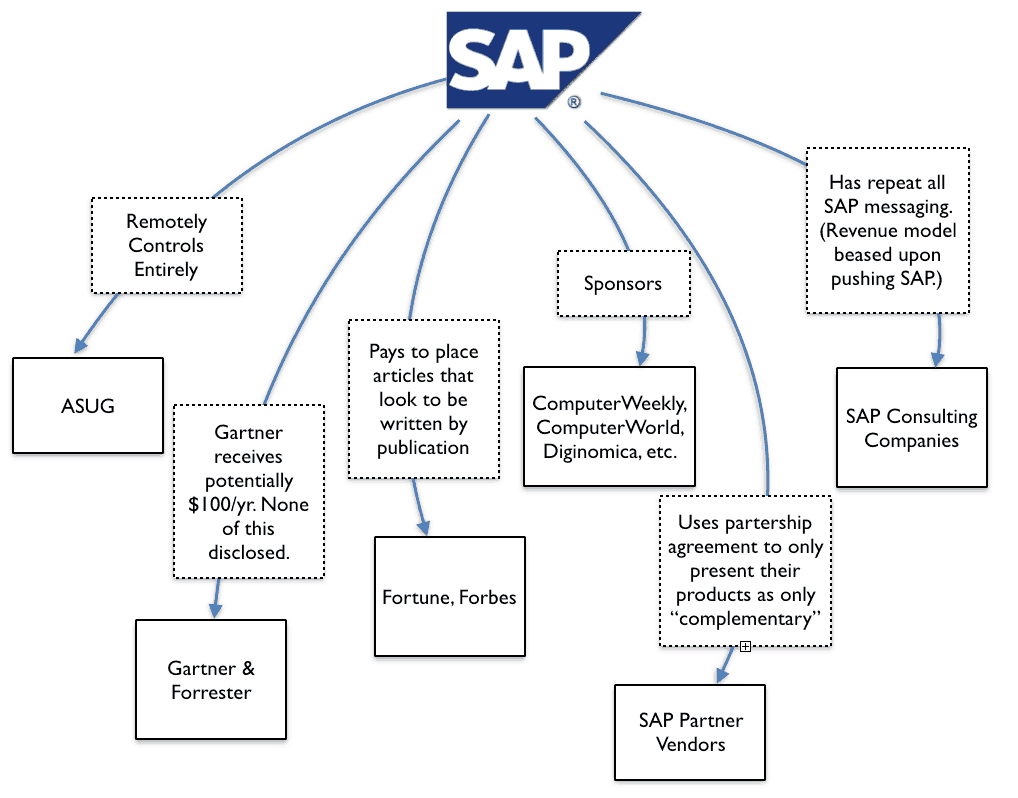

The SAP Media Model

After years of analyzing how SAP released information to the market and how other entities write about SAP, a model developed explains how the system works. The concept is to build an echo chamber, so that SAP says seems likely to be true. The SAP media model, or more generally, the IT media model applies to other large software vendors, Microsoft and Oracle being good examples, but no software vendor uses the IT media system as effectively as SAP. And an important reason for this is that while SAP is only the 4rth largest worldwide software vendor (after Microsoft, Oracle, and IBM). SAP’s overall economic activity is more substantial. This is because SAP outsources almost all of its consulting (where most of the money on SAP is spent) so that it has hundreds of thousands of SAP consultants that work for other companies. Like Deloitte, Accenture and IBM, these consulting companies serve as message repeaters for SAP, among a host of others. These entities repeat SAP’s messaging not because it is true (none of those entities has historically cared what was true) but because it is the profit-maximizing for them to do so.

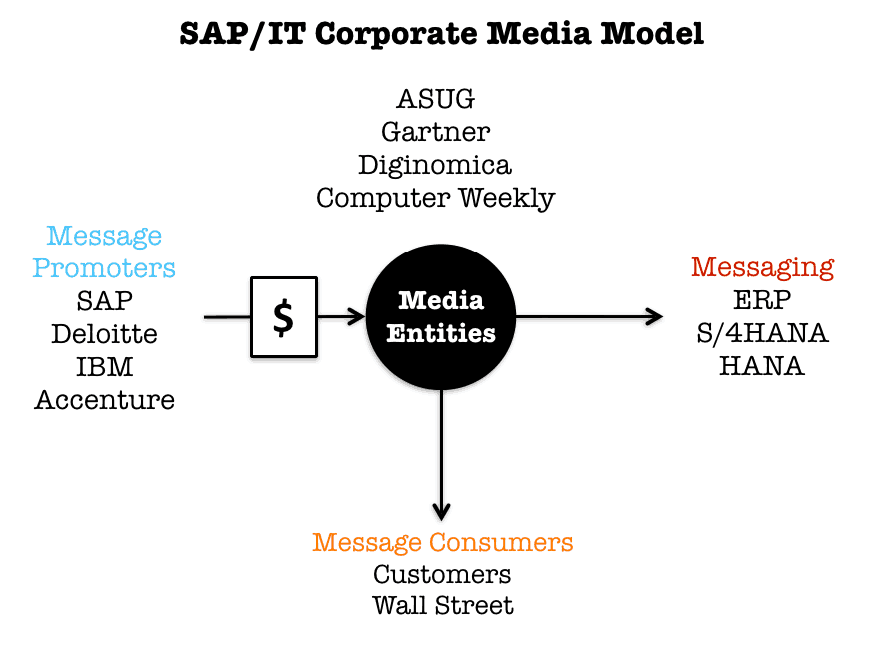

The SAP/IT media model is all about influencing action. It has four main components:

- The Message Promoters

- The Media Entities

- The Messaging

- The Message Consumers

Once you trace the money through the entities that release information about SAP to the market, SAP’s control over the media system can be viewed as very close to complete.

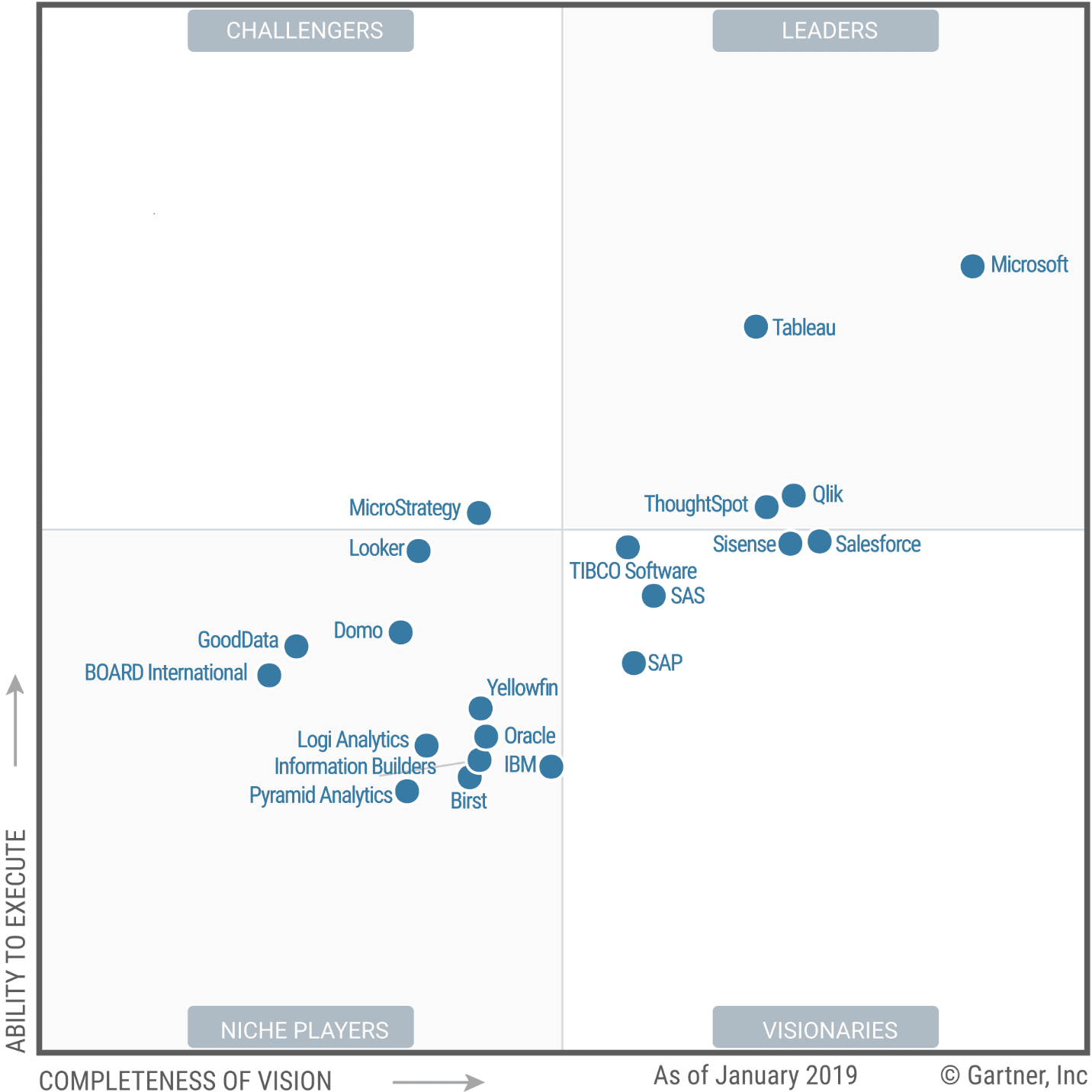

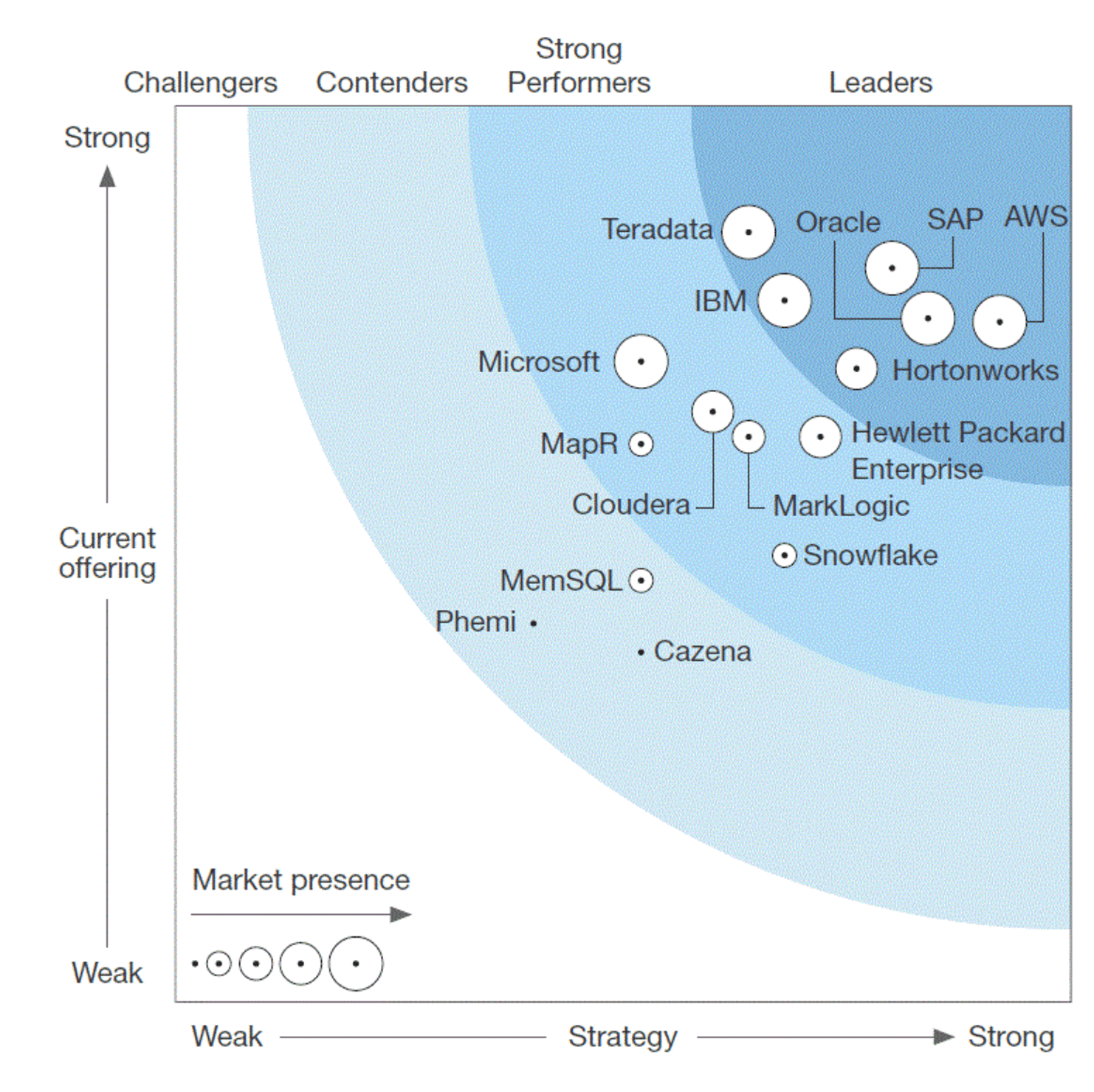

*We have estimated that Gartner receives roughly $150 million per year from SAP, 1/8 of Gartner’s total revenue from vendors. This payment is obvious when reading Gartner output. Other significant vendors that end up with elevated positions in MQs they don’t deserve are Microsoft and Oracle.

This is the MQ for analytics. SAP is nowhere close to SAS in analytics but is placed very close to them. Microsoft is way out in the leader position, but its PowerBI analytics applications are nowhere close to where they should be. We cover vendors’ positioning in the MQs in the article A Machine Learning Study of Gartner’s Magic Quadrant Bias.

The Focus of the Model

The SAP/IT media model is unconcerned with what is true. What is true does not factor in any part of the media model. If the objective were to communicate what is true, there would be no reason to have the media model in the first place. The media model is primarily opposed to truthful information and in favor of inaccurate information that can be used to meet the message promoters’ objectives. The foundational element to the SAP/IT Corporate Media Model is that message consumers don’t have any right to accurate information on SAP. In this way, it is identical to advertising. There is never a point where an advertiser asks whether their advertisement is providing accurate information. But while SAP advertises also, the point of SAP’s media model is to produce messaging and have that messaging repeated that is advertising “accurate” in nature but is not interpreted as advertising by the message consumer.

The Undeclared Financial Relationships to SAP

In journalism and research, one is supposed to declare if they receive money from the entities they cover. However, companies like Forrester and Gartner never declare their financial relationships.

-

- When Gartner releases its Magic Quadrant, the most influential software selection tool used for enterprise software, they never declare who they received money from that they have included in the quadrant. However, SAP is a significant contributor to Gartner. Forrester is the same.

- ComputerWeekly essentially republishes SAP press releases.

- ASUG, the SAP user group, publishes whatever SAP wants to be published. ASUG pretends to represent users, but its media output is undifferentiated from that of SAP’s.

The following media output from Forrester is a good example of this. This is Forrester’s Wave for the Big Data software category.

Reviewing Pro SAP Media Output

So let us look at the ranking. SAP is rated as close to AWS, Hortonworks, and Oracle. AWS is well known for its open-source Big Data hosting, offering the standard open-source DBs, tools, etc. Hortonworks is a well-known Hadoop vendor. It had $185 million in revenue, and Big Data is all that it does.SAP has HANA to offer in the Big Data space, but HANA can’t possibly be a good use for Big Data because it is not for unstructured data and it is quite expensive, and it is priced per GB or TB. SAP recently acquired Altiscale, but Altiscale was more of a Big Data software startup, and SAP would not have had time to incorporate them in time for this Forrester Wave.

Overall, there is simply no possible way that SAP would have been listed in this comparison without the money that it gave Forrester. And this is the type of thing that software vendors that compete with SAP must always contend with. SAP can appear that it is a leader in various media output because of its enormous financial resources. Forrester has a long history of taking money from SAP and writing unsupportable studies. One we cover is in the article How Accurate Was The Forrester HANA TCO Study?

And this is only one example of how SAP controls the conversation.

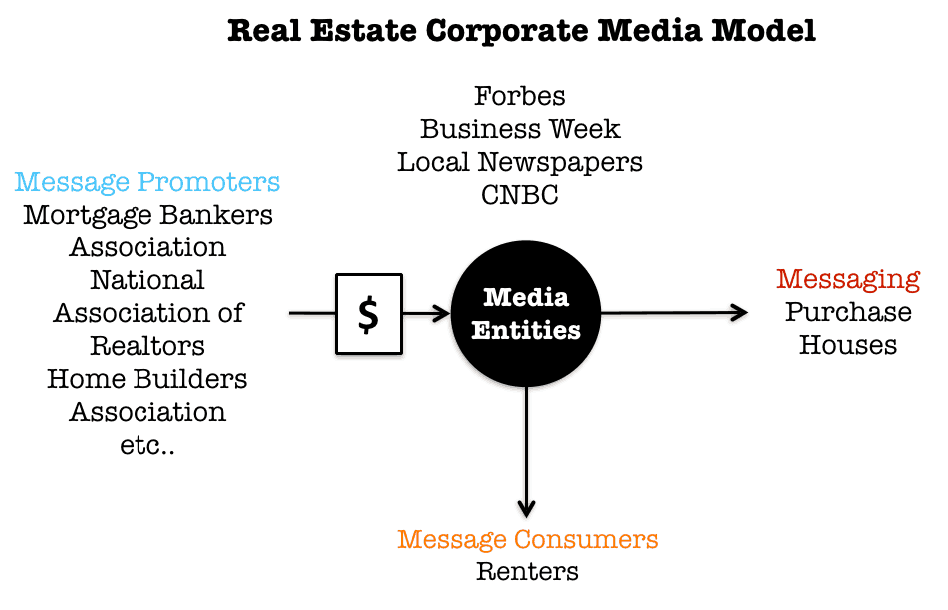

The Real Estate Media Model

This media model is applied to powerful entities outside of SAP and outside of IT. For example, the same media model exists in real estate to promote home purchases.

Here the intent is to promote house buying by underestimating the costs of owning a house and overestimate the benefits. Therefore, house appreciation and mortgage deductions of interest are emphasized, but the long-term cost of maintaining a home is undiscussed. Realtor fees, housing taxes, homeowner association fees, loss of geographic flexibility are not discussed.

The promoters of buying homes are promoted by the message promoters that make money from house purchases. For these entities, home purchases are universally positive as they drive fees and purchases. If the message promoters can influence renters to become purchasers of houses, then their revenues increase. Therefore it is in their financial interests to promote a one-sided view of the benefits of homeownership.

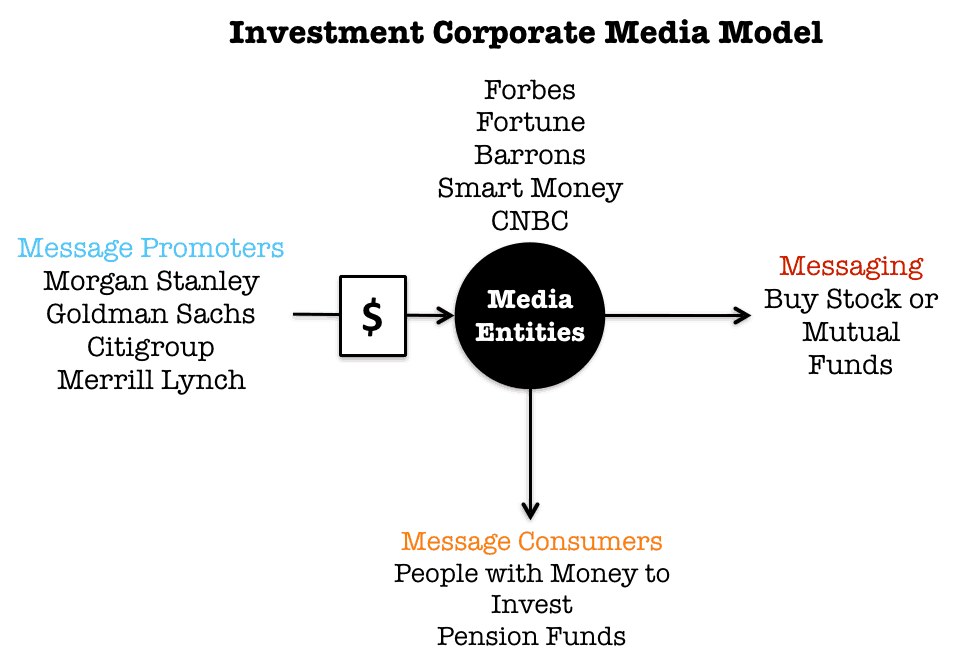

The Investment Media Model

The investment industry applies the same model. Here, entities that make fees for promoting people to invest in various instruments influence the media apparatus to accept their assumptions uncritically.

Media entities are significant factors in promoting bubbles. Important issues regarding the investment instruments are left out. For example, the gains that are mentioned are pre-tax gains. Secondly, in the stock market, while insider trading allows those with the most assets to take returns from lower asset investors, the average return is quoted as if that return is available to everyone. Because of yield disparity, where the insiders make most of the gains, this is inaccurate.

Previous Research into Media Control

In effect, this can be seen as merely an extension of the research performed by Noam Chomsky and Edward Herman and encapsulated in the book Manufacturing Consent.

These videos discuss manufacturing consent in pseudo-democracies (that is, counties where the population thinks they are democratic, but in fact, they are anything but. This video is very good at explaining how advertising works to control media coverage.

When media outlets offer you content, the question should arise, how is this coverage being paid for? Even if you buy a magazine off of the newsstand, it still only covers a fraction of the revenue obtained by that media outlet. Even in that case, at least 1/2 of the media outlet’s funding comes from advertisers.

In the case of many online publications, the reader contributes no money to the media outlet. Advertisers entirely fund the media outlet. Some of the articles are themselves advertisements (without being declared as such).

What type of media output can one expect when 100% of the revenues come from the vendors? And what kind of disclosure requirements do media outlets face who rent out the website for vendors to get their message out?

The answer to that question, in the US at least, is straightforward. There are no disclosure requirements. This is an entirely unregulated part of the economy.

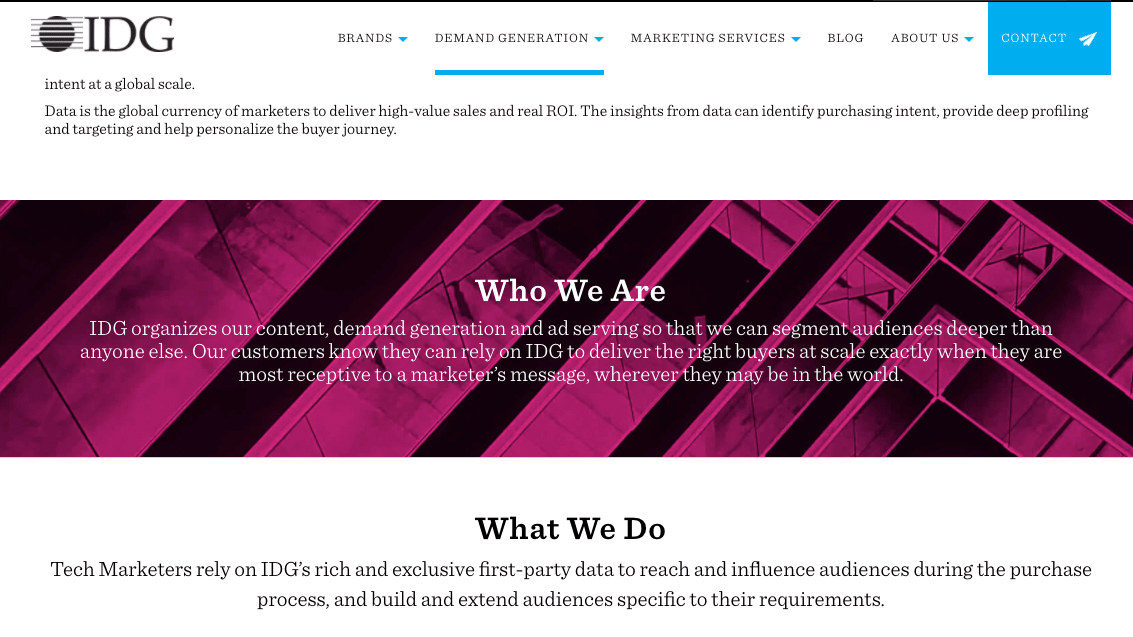

In IT, the agenda-setting media is not the New York Times or Washington Post (as they don’t cover IT for a large part). Instead, they can be replaced by Gartner, Forbes, ComputerWorld, IDG, etc..

On the IDG website, for example, they are evident that they can deliver buyers and that they inherently know how to manipulate buyers on behalf of advertisers. See this quotation.

“Our customers know they can rely on IDG to deliver the right buyers at scale exactly when they are most receptive to a marketer’s message….”

Notice that IDG has no concern here about accuracy. The orientation is to deliver an audience that is receptive to purchasing.

Let us ask a question. How do articles that cover IT realistically fit into “delivering buyers….when they are most receptive to a marketer’s message”?

Does this orientation, to maximize advertising revenues, impact IDG’s media output? Interestingly, in reviewing many IDG publications, including ComputerWorld, Brightwork has found that IDG publishes entirely inaccurate SAP articles. Furthermore that these articles are, in fact, paid placements from SAP.

This brings up the question of what is IDG. Is IDG an advertising platform, or is IDG interesting in publishing truthful inf0rmation?

Studies in Pharmaceutical Payment

Companies and individuals frequently make the case that while an entity pays them, it does not affect their recommendations. Once a corrupt business model has been unearthed, the only real position is to make this claim. However, every time this claim has been tested, it is turned out that payments directly influence the outcome.

A study by ProPublica into prescription writing patterns illustrates what most doctors deny, that payments from drug companies influence prescriptions written.

Doctors have long disputed that the payments they receive from pharmaceutical companies have any relationship to how they prescribe drugs.

There’s been little evidence to settle the matter — until now.

A ProPublica analysis has found for the first time that doctors who receive payments from the medical industry do indeed tend to prescribe drugs differently than their colleagues who don’t. And the more money they receive, on average, the more brand-name medications they prescribe.

We matched records on payments from pharmaceutical and medical device makers in 2014 with corresponding data on doctors’ medication choices in Medicare’s prescription drug program. (You can read our methodology here.)

Doctors who got money from drug and device makers—even just a meal– prescribed a higher percentage of brand-name drugs overall than doctors who didn’t, our analysis showed. Indeed, doctors who received industry payments were two to three times as likely to prescribe brand-name drugs at exceptionally high rates as others in their specialty.

Doctors who received more than $5,000 from companies in 2014 typically had the highest brand-name prescribing percentages. Among internists who received no payments, for example, the average brand-name prescribing rate was about 20 percent, compared to about 30 percent for those who received more than $5,000.

ProPublica’s analysis doesn’t prove industry payments sway doctors to prescribe particular drugs, or even a particular company’s drugs. Rather, it shows that payments are associated with an approach to prescribing that, writ large, benefits drug companies’ bottom line.

But overall, payments are widespread. Nationwide, nearly nine in 10 cardiologists who wrote at least 1,000 prescriptions for Medicare patients received payments from a drug or device company in 2014, while seven in 10 internists and family practitioners did.

As with drug prescribing, payments to media entities control their output. Like with IT media firms, the article in ProPublica is filled with ridiculous claims by the recipients of payments that the payments do not impact their prescription writing.

Conclusion

- SAP uses a media model that is used by other industries.

- The media model intends to control behavior and use selective information release and, in many cases, false information to influence behavior. There are very few independent sources of information on SAP or IT generally, and therefore it is a simple matter to influence media entities.

- In the SAP case, it has enormous multinationals called consulting companies that serve as reliable message repeaters.

The combination of SAP’s control over IT media, combined with the multinational consulting companies that are little more than consulting arms of SAP (for the percentage of their practices that focus on SAP), allows SAP can create an echo chamber at will.

This media control by SAP is more significant than that displayed by any other software vendor and is a primary foundation of their success.