How to Understand the Enterprise Software Market

Executive Summary

- The enterprise software market is far less efficient than generally assumed.

- We cover the basics of market efficiency and how they do not apply to enterprise software.

Introduction to the Software Market

Any selection of enterprise software happens within the context of the enterprise software market. Most people who write about the enterprise software market also either depend upon it for their livelihood or write upon the topic, which involves major advertisers and thus do not have an incentive in describing how it works.[1]

On the other hand, the academic department that might be well suited to analyzing the enterprise software market would be economics. Still, economists have little interest in studying how the enterprise software market works. I have performed the research on this, and there are extremely few articles or papers written about the enterprise software market by economists, which is both strange and quite unfortunate because some substantial portion of the improvement in productivity (something that economists are quite interested in) is due to enterprise software. It also means that anti-competitive behavior, which reduces the enterprise software market’s efficiency, is not called out. This is because those most qualified to write on the topic and compare and contrast the enterprise software market with other economic sectors are not part of the conversation.[2]

In writing these articles, although I am not an economist, I have applied principles of economics, such as tests for market efficiency, anti-competitive techniques applied by particular vendors, and the industry’s interaction with consulting firms and other actors. I used some of these articles in writing this book, as the nature of the enterprise software market essentially determines what is available to choose from during a software selection and is also critical to understand before making a software selection.

Background on the Enterprise Software Market

Before we go too far down this road of the details of the enterprise software market’s efficiency, in particular, let’s cover some of the requirements of an efficient market generally. I believe this is important because one must know what an efficient market looks like before evaluating the efficiency of a currently existing market like enterprise software.

Requirements for an Efficient Market

- Prices are Published Easily Compared: To have an efficient market, buyers must perform price comparisons. If one looks on Amazon for laptops, it is easy to perform price comparisons, allowing buyers to drive more volume to lower-cost providers – making the providers search for more efficient ways. Producers have a natural inclination to hide prices – meaning that the buyer must spend more time determining pricing information, making it more likely that the buyer will overpay.

- The Product is Easily Compared or Rated by Unbiased Third Parties: If buyers do not know what they are buying and cannot differentiate between products, it is challenging for an efficient market to exist. For instance, agricultural commodities tend to have efficient markets because an ounce of gold or soybeans is considered the same thing regardless of who is selling. Of course, few items can match the comparability of agricultural commodities. Consumer Reports greatly assists in rating products and services for the consumer market and uses objective criteria to provide ratings. However, not all consumers use Consumer Reports to make decisions. Many instead follow marketing messages and salesmanship or allow retailers – who are not objective sources of information (they have a bias) to steer them into purchases. Amazon.com also provides consumers with the ability to compare products through reviewers (although there are a suspicious number of books with 4.5-star average reviews). However, these tools are far less commonly available information in the business-to-business market – which is a significant reason IT consultancies have so much power.

- Producers Must be Regulated: Efficient markets typically require regulation. This is because producers will often purchase their competitors to eliminate a competitor in the marketplace to obtain an unfair advantage. With a competitor eliminated, the producer can raise their prices and reduce the investment into their product. This is the strategy of all the serial acquirers in enterprise software. These are two of the most common outcomes of software acquisitions. If the producers are not regulated, it is very similar to a competitive sports game without referees; there is simply no incentive not to cheat. Regulating markets protects the market, but not the producers in the market. The regulation concept is to make the markets work for the most Those that oppose regulation often oppose it because the regulation restricts freedom, but this is incorrect typically because unregulated markets are not at all “free.” The result of unregulated markets is tyranny by what eventually becomes monopolistic producers, which hurts consumers and other producers who are marginalized or eliminated from the market by the large monopolistic producers. This is not merely conjecture but can be quite easily demonstrated by evaluating any industrial sector with insufficient regulation.

- Sellers Must Have Low Monopoly Power: A monopoly is technically a single seller with multiple buyers. However, this is a relatively rare scenario, and economists have broadened the term to mean “tending towards” monopoly, as described earlier in this book. Some types of production are so efficient when produced on a large scale – such as power generation – that they tend towards having only one seller. These are referred to as natural monopolies and are usually highly regulated.[3] Wherever monopolies exist unless regulated, customer service/satisfaction/innovation declines, and prices increase. This is one reason why the large software vendors are so poor at innovation. Sellers generally only innovate if they need to compete, and many companies that say they are innovative are not innovative in the least. Declarations of innovation are constant and predictable and are often used to justify high profits due not to innovation but a monopolistic position in the market. This is explained with regards to software vendors in the following article, Why The Largest Software Companies Have now Reason to Innovate. Now that we have set the requirements for an efficient market, let us see how the enterprise software market compares.

How Enterprise Software Stacks Up

Are Prices are published and Easily Compared?

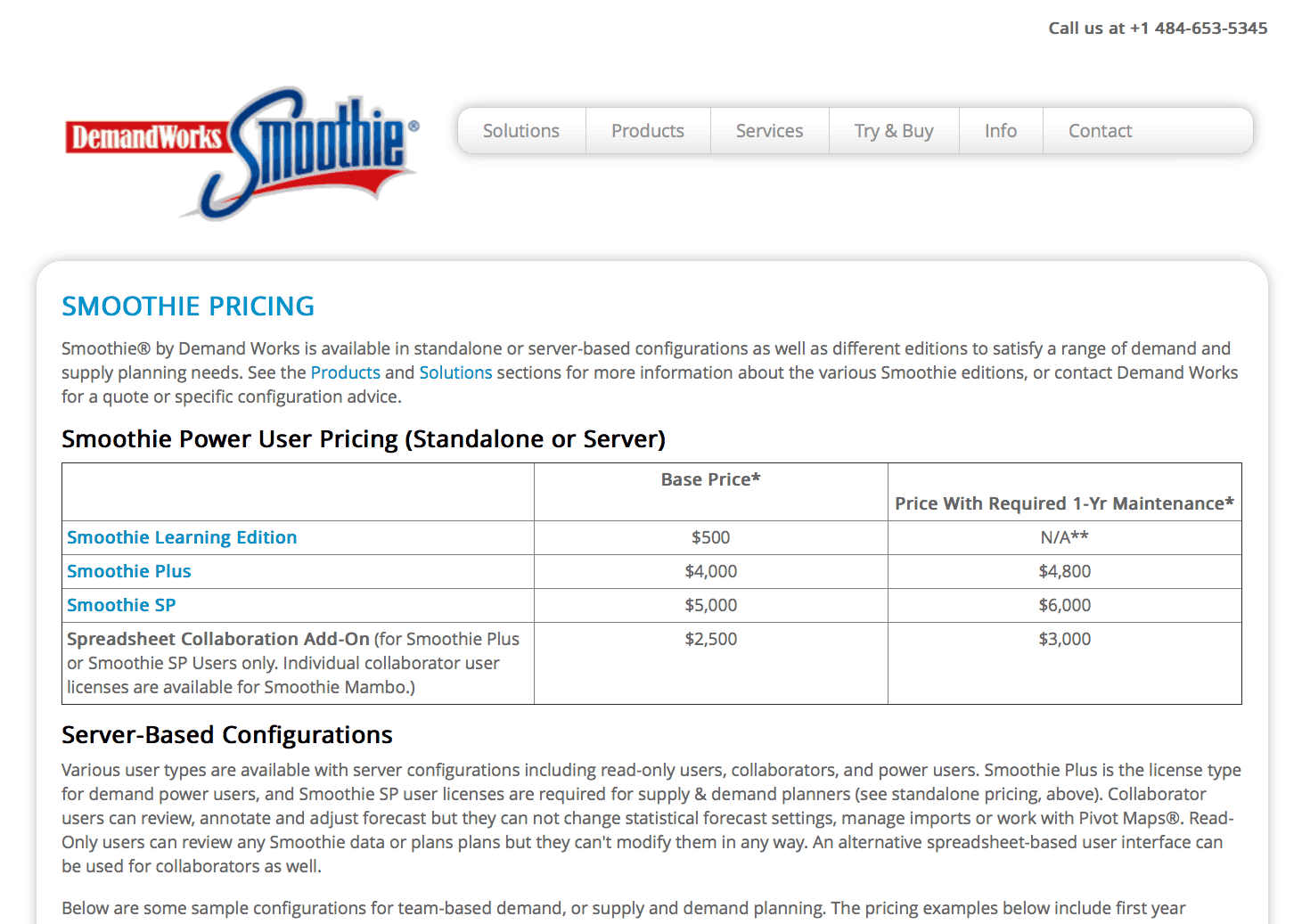

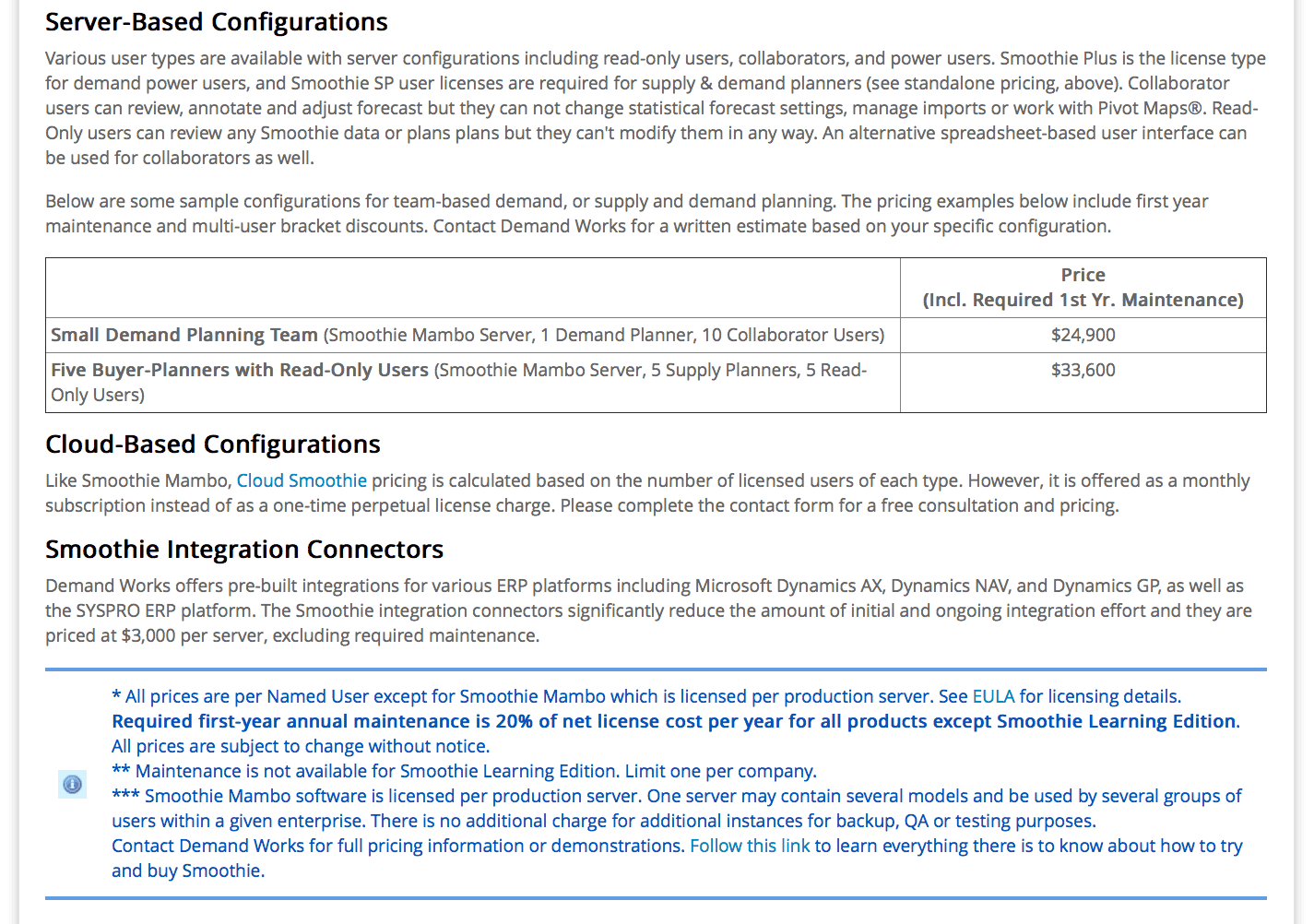

While there is no single answer to this question as it varies depending on the software vendor, prices are mostly not published in enterprise software. The software vendors that publish their prices tend to be low-cost producers. For instance, the two software vendors, Demand Works and Arena Solutions – being the low or lower-cost producers in their respective software categories, publish their prices right on their website. Salesforce.com does the same but is not the low-cost producer, but this is a distinctive feature of the CRM software category, particularly transparent. CRM is an interesting case study as a software category as the software costs are remarkably close to one another. For instance, SAP, which follows a high-cost strategy for most of its other applications, does not follow this CRM market strategy. SAP CRM is about the same price as many different applications in the CRM category. CRM also has the most SaaS offerings, which appears to be an impetus to more price transparency.

Complicated Pricing

Typically in the enterprise software market, pricing is complicated. Pricing is based partially upon how many users will be on the system; a user is called a “seat.” However, a host of other factors also come into play, including extra add-ons. For instance, beyond different usage levels, there are add-on modules or integration modules that have a separate price. Also, how strategic the account is to the software company – if they think they can gain a big bump in credibility from selling to one particular client, the price may come down. Instead, estimates are given only after considerable interaction between the vendor and the company. SAP and Oracle being the high-cost producers, rarely publish their prices. For instance, SAP publishes Crystal Reports’ price – advertising is in effect. Still, Crystal Reports is their lowest-cost application (although it is no a low-cost application in terms of its TCO). Most of the SAP product lines, which are typically the most expensive in any category, do not publish pricing information. Publishing prices only where you are competitive is not pricing transparency; it is misleading. In general, most software vendors similarly do not publish their prices.

Furthermore, many vendors treat requests for pricing information as opportunities to gain knowledge to make a sale. Often the salespeople at software vendors will continually ask for more interactions and more information to “meet your special needs.” They have a series of rationales that interfere with any entity determining pricing based on ostensible dedication to quality with statements such as “we don’t like to just throughout pricing numbers without knowing the situation.”

Of course, the software vendors could make their pricing much more straightforward, so determining price would not require extensive information. At Brightwork Research & Analysis, our Product Planning Package and our TCO Calculator estimate software costs based upon variable user input – therefore, if the software companies wanted to, they could put similar calculators on their websites. However, most choose not to do this. Software vendors often seem to go out of their way to make their software difficult to compare with alternatives – as a result. It takes a great deal of effort to determine pricing, at least with many, if not most, vendors.

It does not get much more transparent in terms of pricing than Demand Works.

However, even still, several different factors must be added up before arriving at the correct price. The pricing listed here is ordinarily to prompt the customer to call for more explanation.

Salesforce was one of the first to provide a great deal of transparency to prospects right on their website. Salesforce provides options for getting details about their application directly on the first page. Salesforce will allow anyone to get into their demo system immediately.

Salesforce has its pricing options declared very clearly.

Something, which helps clients, is inexpensive or even free trials. Salesforce offers very reasonable lower-level CRM functionality, allowing the buyer to test drive the application before committing much of anything.

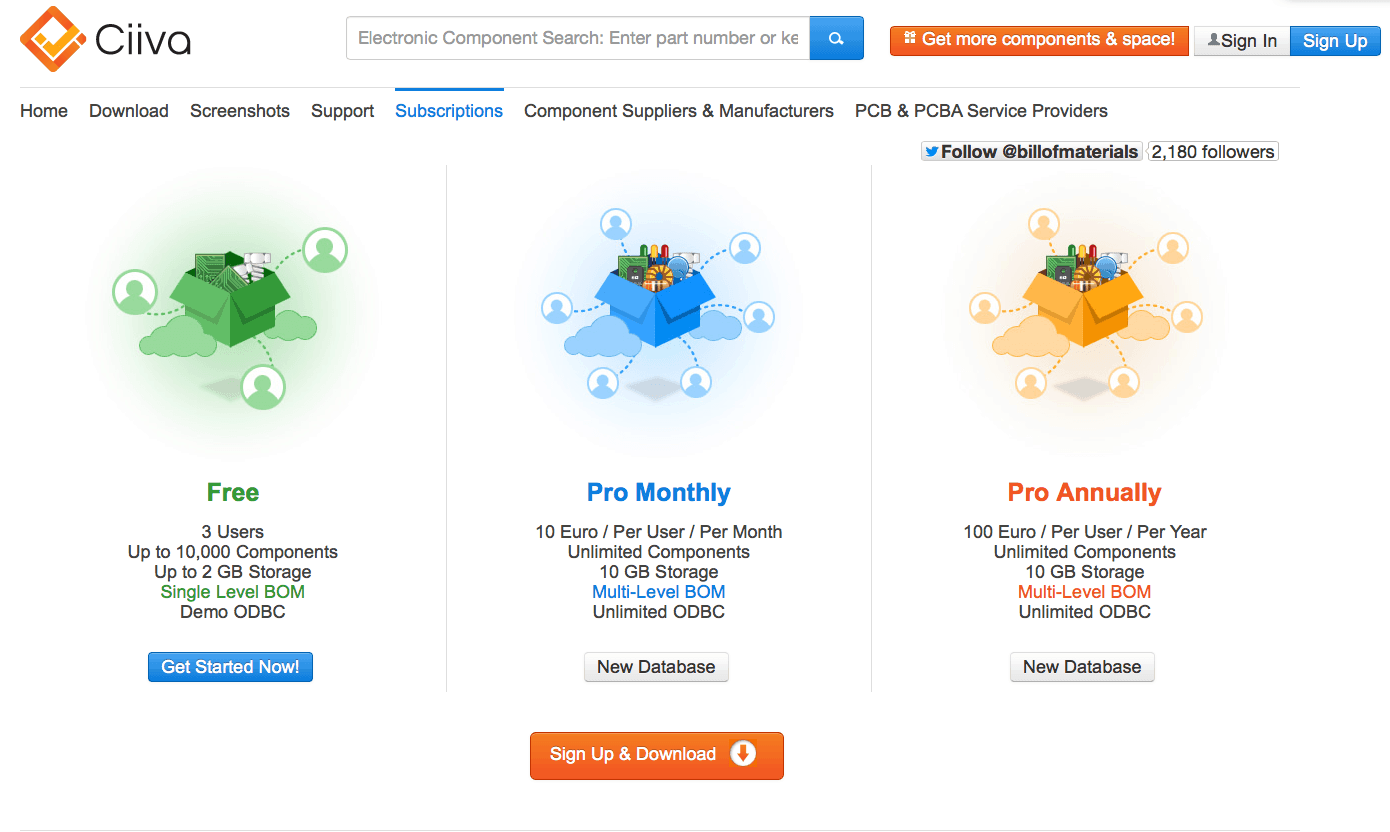

Rare software vendors like Ciiva provide free versions of their applications that prospects can use for as long as they like. For more fully functional versions of the software, the opportunity is migrated to paid versions. As applications become more SaaS-based, something, which is inevitable, we see this model becoming more common.

However, the more monopolistic the vendor, the less pricing information they make available. Oracle’s prices are nothing to brag about, and therefore you mostly can’t find published pricing information on the Oracle website. You can’t find Oracle demos or videos on their site either (although you can find them on YouTube). The Oracle website is all about getting prospects to contact Oracle directly.

The Elusiveness of Total Costs

So software costs are often not published, and when they are, there still is considerable interpretation required to come to the final software costs. However, these are not the total costs that the company will pay to use the application. For the applications we have priced at Brightwork Research & Analysis, the software cost averages a little less than 10% of the application’s total cost of ownership (TCO). The proportion of the overall costs varies.[4] The highest cost is by far maintenance costs.

Even the rare buyer or software vendor that performs a TCO analysis will often leave out many costs. This is why I refer to almost every TCO study that I reviewed for the book Enterprise Software TCO: Calculating and Using Total Cost of Ownership for Decision Making as a partial cost of ownership study or a “PCO.” The TCO analysis at Brightwork Research & Analysis estimates costs of internal implementation (that is, the cost of internal resources assigned to the project) as well as internal support costs on the business side.)

Most buyers make purchase decisions based on this initial cost – the software license cost – rather than the TCO. Estimation of TCO, particularly in any substantial way, in general, is exceedingly rare. I find this strange because there are so many white papers on the importance of selecting applications with a low TCO. However, talking about low TCO and producing low TCO are two completely different things. The typical presentation of many entities in the enterprise software space regarding the topic of TCO is that it is “important, but unknowable.”

With multiple factors complicating the calculation of costs, costs are frequently unknown in the enterprise software market. This makes decisions making it more difficult for enterprise software buyers and works against market efficiency.

Is The Product is Easily Compared or Rated by Unbiased Third Parties?

The subsection deals with how buyers interpret the products in the market and how easy or difficult it is to understand the product’s features and value.

Ease of Product Comparison

Enterprise software is not an easily compared product. Enterprise software is a complex product for which the interpretation changes depending upon one’s perspective and who is presenting the information regarding the product and the pre-existing software that the buyer has already purchased. Enterprise software buyers will very frequently not understand much of what they are buying. This is simply the nature of enterprise software, one of the most sophisticated products that any company will purchase. It is, in fact, far more complicated than computer hardware. Increasingly, understanding computer hardware at a detailed level means understanding physics, mainly how various mechanisms control electrons. However, it is unnecessary to get to that level of detail to make purchase decisions, as specifications can be compared. However, the software cannot be compared as quickly on gross specifications. To appreciate the distinctions between various applications, it can take years working in the application. For example, I was familiar with PlanetTogether’s Galaxy APS for at least three years before I realized it contained multi-plant planning functionality, and I did not know this until I met the business requirement on a client. Except in rare software categories, like CRM, it merely impossible to know everything about what an enterprise software application can do and how it can be used.

The primary way in which buyers become familiar with enterprise software applications in detail is through software demonstrations. Most demonstrations or demos are performed either through site visits or increasingly through screen-sharing web conference sessions. Some software vendors provide online access to demonstration systems for potential customers, but most software vendors do not offer this option. Many software vendors argue that their applications are too complex to provide an online demonstration system to prospects, and there is some merit to this argument. However, a few hours spent with a person who is an expert in an application is nowhere near enough time to understand an enterprise software application.

Third-Party Ratings

Consumer Reports is an excellent example of a financially independent entity that provides ratings of products and vendors and is a great boon to consumer products’ efficiency. Yelp is another example of a rating entity that, while they cannot police every fake review written, is not known to have a financial bias towards those rated. That is, a local dentist cannot pay Yelp to change its reviews. Yelp has been extremely important in improving the market’s efficiency for local services, channeling more customers to higher-rated businesses, enhancing market efficiency.

Few financially unbiased media entities exist that provide objective information on enterprise software. Some of the best-known names, notably Gartner, have the most substantial financial bias. This will be covered in specific detail later in this book. In interviewing buyers and performing troubleshooting and diagnostic projects for problematic implementations, it is clear that buyers cannot consistently determine application capabilities, the level of vendor innovation, or even the fit between enterprise software and their business requirements. The evidence I present for this is that the applications that score the best in our multiple dimensions. But specifically along the lines of maintainability, usability, functionality, and implement-ability (what we call MUFI for short) are only very rarely the best selling applications in their respective software categories.

The Santa Clause Syndrome

Unlike the consumer software market, the executives who make the purchasing decisions are never the same as those people who use the software. At Brightwork Research & Analysis, we refer to this as the Santa Clause Syndrome, and just as with Christmas, when the buyer is buying for someone else, the purchasing decision tends not to be as good.

That is, the purchase decision made for others, even when the buyer places the recipient’s interests above that of the seller; the purchasing outcomes are almost always inferior to when the individual who is to use and live with the selection makes the selection themselves.[5]

Usually, neither the executives nor anyone else at the company will use the solution before the purchase. Typically the potential customer will see several software demonstrations or review some screenshots. Much of what is published about the software in marketing literature— or what vendor salespeople state— is of limited accuracy or does not apply to actual implementation. Not understanding the distinctions between applications themselves, corporate decision-makers rely upon sales representatives, consulting companies, and IT analyst firms for this information. And each of these entities has its financial incentives that are not only not aligned but aligned against their client’s interests.

The Importance of Lying in Enterprise Software

The article describes how so few SAP customers or analysts have picked up that SAP provides so much false information in the marketplace. This puts all the onus on people like me to explain nonsense SAP marketing constructs to the decision-makers. Many people assume that SAP must be providing accurate information because they are a big successful company.

However, SAP lies all the time and exceptionally brazenly. This extends from anywhere from telling clients about functionality that does not work to providing false references about how their software has been deployed. I work with and interact with many vendors. I estimate that SAP, IBM Oracle, is the least honest vendor in the enterprise software space, not coincidentally, the three most significant vendors.

This indicates that lying is a significant advantage in the enterprise software space.

The Lying Advantage

A company that lies, and gets away with it, has an advantage in the marketplace. Under the on-premises software model, companies implement their software, and they are stuck with it because they have sunk so much money into the implementation. This is why lying is a crucial component of some and often the most successful enterprise software vendors. It is similarly essential for consulting companies, as misleading clients about what software products are the best for their needs (that is, recommending software with a high billing rate and for which they have resources training in the application) profit-maximizing.

A Continually Strong Market for Lying

If you can’t lie to clients, you have very little use to SAP or any of the major consulting companies, for that matter. Recruiters sometimes approach me to work as a sub-contractor to a major consulting firm. I reject these options because I know full well that it will mean lying to clients about functionality. I recently received a call about working for Accenture on SAP SPP for Boeing. SPP has several problems, and I instantly knew that Accenture was looking for someone with experience in the application who will tell Boeing that it is a good product. Accenture could not care less as to whether the product can be implemented. They want to start billing SAP resources as quickly as possible. Therefore Boeing will be plied with lies, and enormous consulting puffery in the RFP regarding how committed Accenture is to the product and how uniquely qualified they are, and how their resources have such deep subject matter expertise. (read the article below on standard puffery in RFPs, and how legally unenforceable they are)

Interestingly, I told the recruiter that Accenture would pressure me into lying (to get the business), and he asked if maybe I could take the project for two weeks during orals. That is could I lie for two weeks to help Accenture get the business. Having a conversation about elementary morality with a recruiter is a bit like discussing the same topic with an alligator. It’s a bit over their head.

Are Producers Regulated?

Enterprise software is not orally consumed. It can’t hurt anyone physically, so the main form of regulation that would protect buyers and make for an efficient market would be regulating the messages sent out by software vendors. This was to ensure that they are true and then whether the statements related to functionality, such as user manuals and release notes, are true.

Regulation of Statements by Software Vendors

As anyone who has worked for a reasonable amount of time in enterprise software can tell you, there is no restriction on what software companies can say. Any software company can make any announcement it likes regardless of how false, and no government agency will come knocking on their door asking for a retraction. And it gets worse than merely placing incorrect information and puffery into marketing documentation. Some of the information in release notes describes functionality that does not work or does not work as intended. There is no regulation of what software vendors say or what they place in their documentation. However, the government seems to have problems regulating food labels, and regulating software for the accuracy of the “contents” would be far more complicated than regulating food labels as it is both more complicated and more subjective.

Regulation of the Concentration of Market Power

In the US, where most enterprise software companies originate and are based, it is scarce for software acquisitions to be disallowed by the Federal Trade Commission (FTC). This is true even in cases where it quite clearly increased monopoly power – such as in the all too obvious Oracle acquisition of PeopleSoft. I have witnessed repeated purchases, which are performed to eliminate a competitor. While I continually hear about all the benefits of acquiring the acquiring company, in just about every case I can think of, the software acquired goes into a steep decline—the costs of the software rise. Within a few years, the purchased application is no longer relevant. Oracle’s acquisition of Agile and SAP’s acquisition of Business Objects, Servigistics’ acquisition of MCA Solutions are notable examples of this common outcome, but the cases go on and on. It is challenging to find examples where the acquired application improves post-acquisition.

The effect of software acquisitions is restricting choice, increasing prices, and allowing large and inefficient software vendors that are poor at innovation to replenish their application base with new applications continually. It also substantially increases the risk for buyers. A smaller, high-value, innovative vendor can be acquired at any time, and a buyer can find himself or herself sitting across from major software vendors – i.e., “sharks,” and the value proposition can turn upside down very quickly. The customers of Business Objects found out that SAP radically reduced the service support for Business Objects after the acquisition. The support was so poor that it became the subject of articles in the mainstream IT press.

If software acquisitions were not allowed, the more significant vendors would eventually give way to the smaller and more innovative vendors. For instance, a primary reason that SAP purchased Business Objects and why Oracle acquired PeopleSoft is that these software vendors were beating the SAP and Oracle in competitions. And this was just “too much competition” for these two entities – and they most likely would have continued to lose market share to these vendors. The standard applied by the FTC for acquisition approval is where the combined entity would increase market concentration on what is referred to as the Herfindahl Index – which I won’t go into. But is essentially a way to justify any acquisition or merger based upon esoteric criteria that have little to do with mergers’ practical outcomes. The entire exercise is academic because most of the FTC employees who have decision-making ability are out of the industry and are angling for better-paying jobs once they leave the FTC. And the entity has been fully captured, and only in very extraordinary instances does it lookout for anyone’s interests aside from the major enterprise software producers.

Enterprise software mergers and acquisitions are a significant way that uncompetitive vendors can stay relevant and in control of the market and a major if not the dominant way to maintain their monopolistic power.

Case Studies of Two Vendors: How SAP and Oracle Cheat the Commercial Software Model

Many people like to pretend that SAP and Oracle operate under the generally accepted rules of the “free market” enterprise software segment, but this is far from the case. SAP and Oracle practice the most extreme commercial software tactics and behaviors, pushing up against the legal rules and far beyond what is generally considered ethical. With open-source software, anyone can use the software, and in most cases, it is free to use. Commercial software charges a license fee to use the software. However, SAP and Oracle aren’t regular commercial software vendors. This is because a typical commercial software vendor would sell its software for a license fee but allow its software to be used with any other software. This is the logical basis for allowing commercial software in the first place.

Why is Commerical Software Allowed?

Commercial software is allowed as it is intended to compensate the software development entity for their investment. Commercial software licenses were never intended to allow more extensive and vendors with more resources to “block out” other vendors from environments where they predominate. However, SAP and Oracle develop exclusionary products that reduce interoperability and use various legal and account control tactics, all designed to push the company’s purchases to SAP and Oracle.

Why Does SAP Make Integration so Difficult?

SAP has routinely made integrating other applications to SAP far more complicated than it needed to be and encouraged the large consulting companies to talk down non-SAP software in favor of SAP software. (An easy task as SAP consulting partners make so much money on SAP consulting.)

Oracle’s Monopolistic Acquisitions

Oracle has used aggressive acquisitions to control the purchases of its customers. SAP has used its ERP system’s centrality to limit choice on the part of customers, while Oracle has done the same thing but using its control over databases. SAP introduced S/4HANA, which was the successor to their most popular ERP application. For decades, it worked with various databases and made the new version exclusive to SAP’s HANA database. SAP has created several technical arguments as to why this was better for customers and why it was necessary (a subject we cover in-depth in the article How HANA is Used to Block out Other DB Vendors).

Sellers Must Not Have Monopoly Power

The most prominent software vendors have monopoly power in the enterprise software market, and this is not so much a contradicted point as an un-discussed point. While this concept existed at one time – as is evidenced by anti-trust legislation like the Sherman and the Clayton anti-trust acts, there is minimal residual idea remaining in the US culture that companies should have to follow any rules of competition. Or that the government has a role in keeping markets efficient.

Why the Enterprise Software Market is Inefficient

Monopoly power exists in the enterprise software market for the simple reason that there is little to no effort to keep the market for enterprise software competitive. Although many would like to propose it, there is no “natural” reason for this. Some would make the argument that this is “the way of the market.”

However, it isn’t. It is instead because of how the game is set up. Furthermore, the enterprise software market’s present inefficient state is quite good evidence (although no further proof is required on this point) that markets left to their devices/or the law of the jungle do not result in inefficient outcomes. It also means that the deck is stacked against buyers and that the likelihood of overpaying and ending up with underperforming systems is quite high. It happens quite frequently. It shows up in the success/failure statistics – but the underlying reasons for why this is the case are either not illuminated or poorly illuminated by IT media entities which must be careful not to alienate advertisers and other funding sources. It should not take much of a logical leap to understand that buyers in this market face a much higher risk than if they were regulated.

If consulting companies were not allowed to sell implementation services to the same clients they advise, the largest software companies’ market power would be severely compromised. If mergers were disallowed, within a decade, the enterprise software market structure would be significantly changed for the better.

The Implications of Inefficiency

The enterprise software market is highly inefficient. This means that companies that buy enterprise software pay much more than they should have to. The industry mostly serves the needs of two powerful interest groups, monopoly vendors and major consulting firms. SAP perfected the hijacking of the major consulting firms’ advisory function, and since then, Oracle has tried its best to copy them. All of these facts seem to escape the interest of economists. They seem to have far more important topics to cover, like writing macroeconomic research for banks. A literature review on the subject of the efficiency of the enterprise software market returned no results.

This is a problem because the individuals with the training to effectively analyze this and make a case for enhancing efficiency don’t even seem to be aware of the problem. Again, the way to achieve success as an economist is to know as little as possible about the “real economy” and be unconcerned with things like market concentration instead of focusing on the financial portion of the economy. Amazingly, such an important industry does not have economists who actively follow it or analyze it. Secondly, economists seem to not even inherently “get” technology and seem to be as technologically challenged as attorneys. About as close as an economist will get is repeating press releases by the major vendors related to how moving to SaaS will improve the software availability. Seemingly missing the point that significant monopoly vendors have zero interest in opening their systems to greater competition. (These types of articles appear in the Economist magazine from time to time under a technology review edition. Economists practice misusing technology terms and have no idea what they are talking about. The Economist loves quoting monopoly vendors like IBM and thinks that innovation in software springs from large firms rather than from the best breed vendors.)

Extremely few technology workers have any familiarity with either economics or antitrust law and have very little interest.

The Outcome of an Efficient and Inefficient Market

Let us go over whose interests are served inefficient versus an inefficient market.

- Consumers: An efficient market serves consumers.

- Prices: An efficient market produces lower prices.

- Producers: An inefficient market serves some privileged producers, but not all. An inefficient market works particularly against the high-quality producers/software vendors that do not have monopoly power and funfunctionr producers with monopoly power and prefer to provide poor value to their customers.

- Workers: Workers do receive a benefit for working for employers that have monopoly power. In the enterprise software area, employees who work for Microsoft, SAP, and Oracle are paid well versus their counterparts in employers with monopoly power. Unions tend to attempt to unionize companies with monopoly power and tend to stay away from companies that lack this power. Companies with monopoly power make excess profits because of this power, and some of this excess profit is shared with workers. Interestingly, workers are swift to assume that their extra compensation is because they and their company are “good” and rarely acknowledge that at least some of their compensation is because they work for a company with monopoly power. Workers for monopoly companies are quick to assume that the company they work for is the “best” rather than controlling the market through unfair competition.

- Innovation: This is mostly reduced in conditions of monopoly power. The major monopolistic software vendors – Microsoft, SAP, IBM, and Oracle, are all more known for buyer or copying innovation than creating innovation internally. The innovation that SAP developed was primarily its ERP system developed decades ago – when they did not have the monopoly power they do today.[6] Oracle was innovative in databases, at least initially, but again that was earlier in their history. Most of their recent activity has been merely buying other software vendors to increase their monopoly power.[7] This change in innovation level over time is why at Brightwork Research & Analysis when we rate a vendor’s innovation, we rate what we refer to as their Current Innovation Level. This is because the current innovation level is a far better predictor of future innovation than past innovation.

With an efficient market, more often than not, customers receive good value for their purchases and don’t have much of a problem finding the best product for their needs. In the absence of regulation, markets tend towards monopoly over the long term, not towards perfect competition – as is often proposed by those that promote the concepts of free markets.[8] Those entities that propose the markets can tend towards perfect competition or efficiency without regulation very strongly tend to be monopolists or media outlets that monopolists fund.

Making Better Future Decisions

It is essential to understand that much of the information necessary to make good software selection decisions in the enterprise software market is hidden from view and made difficult to obtain. In most cases, to collect this information, you must contact each vendor directly, interact with them, and go through their process (which they control). I have painted a rather bleak picture; however, the future looks better than the past in many ways. Several substantial changes are currently underway that buyers can leverage to improve their chances of obtaining better outcomes. The first of these is using SaaS applications. The CRM software category supports the theory that online and hosted applications would naturally lead to a more efficient market for enterprise software. Not only are SaaS solutions more transparent in areas ranging from pricing to the ability of buyers to experience enterprise software first hand, but SaaS solutions have a much lower TCO, go live more quickly, and have much less lock-in than on-premises solutions. SaaS software vendors must be much more concerned with their customer base’s satisfaction than on-premises vendors – and most of them know this. Arena Solutions sells most of its customers their SaaS solution, although they do offer an on-premises version. Arena Solutions knows that their success depends on the yearly percentage of their subscribers who continue to subscribe – and they openly state their belief that the SaaS model more tightly aligns the interests of the software vendor with their client’s interests.

Democratized Software Reviews

A second positive feature of the enterprise software market is the rise of crowdsourcing websites that democratize applications’ review and rating. In my book Gartner and the Magic Quadrant: A Guide for Buyers, Vendors, Investors, I was openly skeptical whether a crowdsourcing website could replace Gartner. For many executive decision-makers, I think this is true. However, I have much more faith in the objectivity and validity of the ratings of applications in a site like G2 Crowd than I do in Gartner. Secondly, Gartner covers applications at far too high of a level, and I believe that many other IT analysts make this same mistake – and it is bad for decision making. The most crucial feature of purchasing any application is not the high-level strategic considerations that tend to be highlighted by Gartner and many other IT analysts – as any application can be made to work with the current applications that are in the house.

Instead, the most critical feature of whether an application is a good fit for a company is whether it meets its business requirements. Gartner and many other IT analysts have gotten away from this truth, which has led to poor outcomes for those who have taken this advice.

The good news is that because of these developments. Buyers can make much better decisions than the typical company. One strategy to do this is to stop listening to entities with a financial bias. The other strategy is to leverage SaaS applications and more democratic forms of application review and rating.

How Can Brightwork Help Solve the Problem of Enterprise Software?

We discussed how to change the enterprise software system with Eduardo Muniz at the Advantage Group.

The Question

“Needless to say that what Brightwork’s research does exposing the wrongs of IT providers is highly respected by Business community. When you publish something Business people reads acknowledge and believe and start making questions. Nevertheless They would also want to read HOW to fix the problem? Tomorrow you fix the issue of corruption, Machiavellian games in the IT world and Appoint some one like Mother Theresa as SAP CEO. But what about the fact that vast majority of IT platforms (SAP included) are wrongly deployed and unsustainable because of lack of Organization Readiness and lack of Governance? It is known that SI have been unable to address that….

How to address that is what Brightwork doesn’t include. That’s what I talk about going to the next level, do the whole enchilada. You already got Business leader’s attention. What can you do what the SI don’t/can’t to help Business Community to deploy SAP rightly and sustainably?

I know it is easier said than done. But it is doable. It is no different from what you have already done….”

Our Response

“Eduardo,

We have a lot of confidence in that we can do research and get to the bottom of issues. However, I don’t have all the answers about how to fix the problems. Remember, many people are delighted with how the system works presently. Recall, there are companies that have their names on the side of major buildings with hundreds of thousands of employees who like the system as it is.

I have two primary observations.

1.) One has to research the statements by vendors and SIs. When you do this you find a lot of false information.

2.) We laid out in the book Rethinking Enterprise Software Risk, that companies are relying upon advisors that have sold them down the river and don’t care about them as anything more than a bag of money. To specifically answer your question, SI’s cannot be part of the solution because they are designed around maximizing billing hours and margin. SI’s produce no research because they are fundamentally opposed to research. SI’s want to implement as many projects as possible, which mean hiding the reality of what has happened before, hyping various trends (AI, Big Data, Autonomous Database, etc..), and pretending applications are more successful than they are. They don’t fundamentally care what is true. They care about how much money they can extract from an account. So when you ask what the difference between SIs and Brightwork, one of the most fundamental is that we don’t lie to customers. We are not in bed with software vendors. That is a pretty big difference. I work with customers that know their SIs are lying to them, by they say to me “look this is are approved SI by SAP, so there is nothing we can do.” Which I find super weird.

This means that any SAP partner or any entity who is financially connected to SAP (which can be indirect by the way) needs to be fact-checked. Our research shows that financial bias determines advice that is it is the predominant factor in what information is given. SI’s would be honest to say the following….

“We recommend A over B, because we looked at A and figured out we can make more money from A.”

There is a fantastic video on US political corruption that we have adopted for the IT market, which you can read at The Problem of Corruption in IT Matches That in US Politics.

If just those two areas of guidance were followed, companies would be far further along. That is fixing the problem. Getting unbiased research from outside or developing the capability internally is the pathway to solving the problem.”

References

[1] Please see the book Gartner and the Magic Quadrant:

[2] In fact, economists so rarely comment on technology that it was jarring to find an article on “The Decline of E-Empires” by Paul Krugman, one of the most prominent economists in the US. https://www.brightworkresearch.com/enterprisesoftwarepolicy/2012/03/11/why-the-largest-enterprise-software-companies-have-no-reason-to-innovate/

[3] Without the regulation of a natural monopoly, the monopolist could charge extremely high rates. A perfect example of this scenario was Enron. While the California utilities themselves, the energy market in California was deregulated under the Pete Wilson administration. Not surprisingly, Enron and other energy trading firms were instrumental in lobbying to have deregulation passed. Enron’s traders created shortages of power specifically so they could massively increase the price of electricity. They did this in a state that at the time had a 1/3 more energy generating capacity than they had energy demand. Enron did everything from move power out of the state to call utilities and tell them to make up an excuse to go down for maintenance during peak periods. Enron then charged many times the standard cost of the energy. While a kilowatt-hour may have generally traded for $35, with $40 being a high price, Enron would charge $1000 per kilowatt-hour. This is what happens when an unregulated monopoly is allowed to run wild. It results in price gouging.

[5] In fact, there are many cases where those responsible for corporate purchases place the seller’s interests ahead of the recipient, such as in cases where the decision-maker is being compensated in some shape or form by the seller – compensation can come in many forms – such as seller-provided dinners and gifts. Sellers provide these enticements precisely because they move the decision-making away from the purchased item’s actual attributes. This extends from the corporate procurement environment to the government procurement environment (where political donations overwhelmingly control contracts) and to doctors’ offices, where doctors will, in most cases, write prescriptions for patented drugs that often have either very similar or identical chemical properties to the patented drug. The pharmaceutical companies compensate the doctor for doing this – offer “free samples” of the patented drug to promote the continual purchase and use of the drug. Patients that off-patent alternatives, in the US at least, must ask the doctor if it exists, but most patients don’t do this.

[6] SAP actively reverse engineers software from other software vendors. They had a program that was nothing more than an enormous intelligence gather program cloaked as a partnership program. https://www.brightworkresearch.com/inventoryoptimizationmultiechelon/2010/01/its-time-for-the-sap-xapps-program-to-die/, https://www.brightworkresearch.com/enterprisesoftwarepolicy/2012/01/27/how-common-is-it-for-sap-to-take-intellectual-property-from-partners/. SAP lost a case to Oracle for downloading vast amounts of its intellectual property through SAP’s TomorrowNow subsidiary.

[7] The counterexample of the relationship between monopoly and innovation is that two of the most critical private research laboratories of the 20th century were Bell Labs (funded by the AT&T monopoly) and PARC (funded by the Xerox monopoly). But in general, innovation declines as monopoly power increases. Apple has been enormously innovative in its history, actually serving as the R&D entity for the computing industry. Many computer and software companies don’t seem to do much innovation themselves but reverse engineer whatever Apple comes up with. It will be interesting to see if Apple can break the cycle of ceasing to push and innovate as they have gained monopoly power.