Is High Public Debt Negatively Related to Economic Performance?

Executive Summary

- There are many statements made about the appropriate debt level of countries.

- What is often lacking is comparative evidence of how private debt and public debt contribute to or undermine economic performance.

Introduction

There is great debate as to what is the correct level of the public or national debt. This article will look at different sources on this topic.

Our References for This Article

If you want to see our references for this article and other related Non Status Quo articles, see this link.

Question on Debt

It is widespread to say that, for instance, US public debt is too high. However, this statement is normally made in a vacuum, without any explanation of the tested correct range of debt. The assertion implies a known level of debt that is appropriate and that one should be concerned when one falls out of that band. This article will look for evidence that supports statements around public debt.

These types of videos are extremely common. They are always promoted by Republicans. The assertions is that the US public debt is too high and will negatively impact economic growth.

The Case of Japan’s Debt

Japan is the case study for too much public debt. Japan grew very quickly after reconstruction and hit its zenith in the 1980s. At this time, Japanese investors came into the US and bought substantial companies, and there was a fear of Japanese manufacturing taking over the world. However, since the early 1990s, Japan has been in a long-term decline and has had the highest national or public debt in the world.

*data from World Population Review

Japan leads all countries for their public debt versus GDP.

This often leads to the conclusion that Japan’s debt level is related to its poor performance since the 1990s. However, I could propose the opposite. It was Japan’s decline that led to their increased debt. Conditions for the Japanese economy after the early 1990s were much different than the conditions before the 1990s.

- For one, Japan’s capabilities outside of manufacturing never translated to other businesses. It was assumed that the Japanese economy would be able to diversify into other areas with similar success. There was something special to Japanese culture that made everything they did superior.

- Secondly, manufacturing switched to low-cost countries in Asia in the 1990s. Now, only higher-level manufacturing is still done in Japan. Japan also had South Korea essentially copy Japan’s model of a manufacturing-based export-led economy. Televisions like LG and Samsung gradually have replaced Japanese models. In the 1980s, Sony was the dominant brand in many areas of consumer electronics. Now it has been replaced.

In effect, Japan faced much more competition in the 1990s and forward in manufacturing than they did before this time. Secondly, Japan has held a very high debt level for many years. And while people have bet against Japan’s public debt, it seems to have managed it.

This is the problem with analyzing debt levels. Many factors impact the debt level. Furthermore, some countries are “allowed” to run more debt than other countries. A certain debt level that might be a problem for a small country like Lebanon is not necessarily a problem for a country like the US, even though the debt percentage might be very similar. This table above is not updated, and if it were, the US would be higher as it increased its public debt in the past year to around 130% of GDP.

The book The New Great Depression makes the case that US private debt levers have become too high. And it relies on research that proposes that above 90% is a type of danger zone for public debt and any economy.

John Maynard Keynes and Deficit Spending

The idea that deficit spending can stimulate on otherwise stalled economy dates to John Maynard Keynes and his classic work. The General Theory of Employment, Interest and Money from 1936 Keynes’s idea was straightforward he considered output a function of what he called aggregate demand. This is usually driven by business and consumer demand at times. This demand was lacking because depression airy conditions or deflation drove consumers into a liquidity trap in this condition consumers prefer to save rather than spend, both because prices were falling and because the value of cash was going up in those conditions it’s smart to defer buying and increase savings gains the solution is to the liquidity trap was to have government step in with government spending to replace the individual spending deficits were a perfectly acceptable way to do this in order to break the back of deflation and revive what Keynes called animal spirits. Keynes went further and said that each dollar of government spending could produce more than $1 or growth. When the government spent money or gave it away, the recipient could spend it on goods and services, those providers of goods and services would in turn pay their wholesalers and suppliers which would increase the velocity of money depending on the exact economic conditions, it might be possible to generate 1.3 dollars of nominal GDP for each dollar of deficit spending. This was the famous Keynesian multiplier, to some extent the deficit would pay for itself in increased output and increased taxes. In practice, Keynes’s theory was not a general theory but a special theory, it would work only in limited conditions. It worked when the government started in a depression, or in the early stages of recovery. It worked when the initial level of government debt was low and sustainable. It worked in conditions of deflation and a true liquidity trap. Keynes was not an ideologue he was a consummate pragmatist, his prescription was the right one for the 1930s. Unfortunately his ideas were grossly distorted. After his death, by Paul Samuelson and his followers at MIT and other centers of economic thought Keynes’s limited solution was turned into an all purpose prescription that deficits, could be used to promote growth at all times and an all places, provided the spending is aimed at social goals, approved by the academic elites MMT is the read reductor ad absurdim of what came from MIT, the belief that deficit spending of any quantity at any time produces more growth than the amount spent, is what lies behind the claims of stimulus in the congressional frenzy of trillion dollar deficits now wonder why this is a false belief. In fact, America in the world are inching closer to what Carmen Reinhart and Ken Rogoff, described as an indeterminant yet real point, when an ever increasing debt burden triggers creditor revulsion forcing a debtor nation into austerity outright default or sky high interest rates, the creditor revulsion point where more debt does not produce commensurate growth due to lost confidence in the debtors currency is reached as follows the country begins with a manageable debt to GDP ratio commonly defined as less than 60% in search for economic growth, perhaps to emerge from a recession or simply buy votes. Policymakers start down a path of increased borrowing and deficit spending. Initially results can be positive, some Keynesian multiplier may apply. Especially if the economy has under utilized and just industrial and labor force capacity, and assuming the borrowed money is used wisely in ways that have positive payoffs. Over time, the debt to GDP ratio pushes into a range of 70 to 80%, the political constituencies developed around the increased spending the spending itself becomes less productive more spent on current consumption in the form of entitlements benefits and less fruitful public amenities, community organizations and public employee unions, the law of diminishing marginal return starts to bide yet the the public’s appetite for deficit spending, and public goods is insatiable the debt to GDP ratio eventually pushes past 90%. The Reinhart and Rogoff research reveals that a 90% debt to GDP ratio is not just more of the same, rather it’s what physicists call a critical threshold at which a phase transition occurs, the first effect is that the Keynesian multiplier falls below one, the dollar of debt and spending produces less than $1 of growth, no net growth is created by added debt while interest on the debt increases the debt to GDP ratio on its own. Today pandemic related debt creation is not an incremental it’s exponential relative to prior deficits and it comes at a time when the GDX the debt to GDP ratio is already well past the Reinhart Rogoff 90% line. Creditors grow anxious when continuing to buy more debt in a vain hope the policymakers will reverse course or growth will spontaneously emerge to lower the ratio.

The United States is the best credit market in the world and borrows in a currency and prints. For that reason alone, it can pursue an unsustainable debt dynamic longer than other nations, yet history shows there is always a limit, the salience of the Reinhart-Rogoff research is not the eminence, or default, but the weight of the structural headwinds to growth. Of particular importance to the United States is the Reinhart Rogoff paper debt and growth revisited from 2010, the author’s maintain conclusion is that debt to GDP ratio is above 90%. The median growth rates fall by 1% and the average growth rate falls considerably more importantly Reinhart and Rogoff emphasize that the importance of nonlinearities in debt growth for debt to GDP ratios below 90% There’s no systematic relationship between debt and growth. Put differently, the relationship between debt and growth is not strong at lower ratios. Other factors including tax monetary and trade policies all guide growth. Once the 90% threshold is crossed debt is the dominant factor above 90% debt to GDP an economy goes through the looking glass into a new world of negative marginal returns on debt, slow growth and eventual default through nonpayment inflation or renegotiation. The point of default is sure to arrive yet it will be preceded by a long period of weak growth stagnant wages rising income inequality and social discord a phase where dissatisfaction is widespread, yet no dental ma occurs. Other research, respected research reaches the same conclusion. Reinhart and Rogoff may have led the way in the field but they are not out on a limb evidence is accumulating that developed economies, in particularly the United States are on dangerous ground, and possibly past a point of no return. The end point is a rapid collapse of confidence in the US debt and the US dollar. This means higher interest rates to attract investors to continue financing the debts. – The New Great Depression

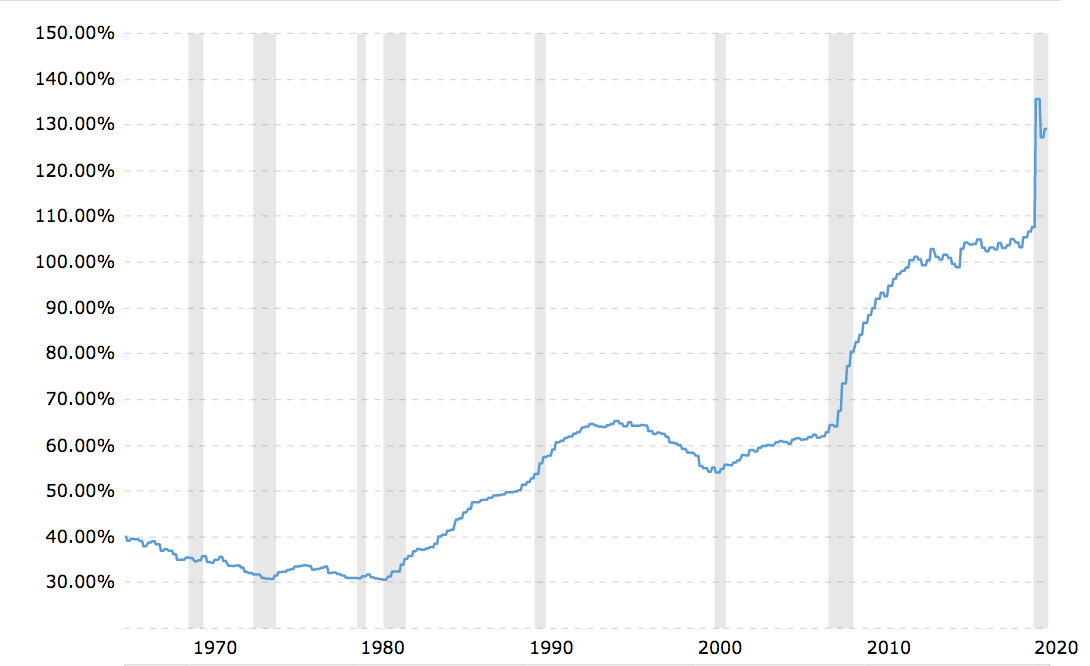

The coronavirus stimulus has caused the debt to GDP ratio to reach unprecedented levels and sits at roughly 130%.

Debt to GDP Ratio Historical Chart

The all-time high for the previous debt to GDP ratio was in 1946, right after WW2. This was a complete wartime economy and mobilization. It does not make any sense that the US debt to GDP ratio would be anywhere close to this during a pandemic. Furthermore, this 118% level of debt dropped to 92% two years later, even though the US was in a recession. The US economy did not take off in the post-war period until 1950. The debt to GDP ratio was in the low 30s all through the 1970s. It hit 40% or above in the 1980s and has never declined since that time. The next major inflection point was 2009 in response to the Great Recession of 2007-2008.

What should be noted was that the US debt to GDP ratio was already at 106% before the coronavirus hit, and the US engaged in the stimulus. All of this means that the US is far beyond the Reinhart-Rogoff 90% level.

Time Phased Public Debt to GDP Ratio for European Countries

This is another view on debt to GDP for European countries, but this shows the ratio as time passes. Here are some observations.

Overall, the debt to GDP ratio is increasing. And there is a specific reason for this which is explained by Steven Keen and which is covered in the article How the EU Was Designed to Indebt the Smaller Countries to the Larger.

Richard Vague on Private Debt and the Economy

Economist Richard Vague states that the real issue that foretells problems in an economy of a country is private debt, not public debt.

This is curious because if you look at the statements of Republican politicians, they are normally perfectly fine with high levels of debt and predatory loans and very high-interest rates on loans, even when the cost of capital is meager. This is, of course, what their campaign contributors want. However, what they don’t like, and the only type of debt they talk about is public debt — but only when Democrats control spending. When Republicans are in control of spending, the debt is barely mentioned. The way Republicans talk about debt can be synthesized down to this table.

The relationship between private debt and the economy is explained in the following quotation from Richard Vague.

What’s astonishing is how little attention the global debt problem—the extremely high ratio of private debt to GDP—has gotten. Not only does it leave the U.S. and other countries vulnerable to crisis should brisk growth in that ratio resume, but, quite apart from any crisis, the accumulation of higher levels of private debt over decades impedes economic growth. Money that would otherwise be spent on things such as business investment, cars, homes, and vacations is increasingly diverted to making payments on the growing debt— especially among middle- and lower-income groups that compose most of our population and whose spending is necessary to drive economic growth. Debt, once accumulated, constrains demand.

The ideal condition for growth is to have less capacity (that is, the supply of housing, factories, etc.) than demand, coupled with low private debt. This was the case during the decades immediately after World War II. But now we have nearly the opposite situation. In the first decade of the 2000s, the United States and Europe built far too much capacity, especially in housing, and incurred too much private debt. In the 1980s, Japan built far too much capacity, saddling its banks with too much private debt and too many bad loans. While all these countries have been catching up to this capacity, none yet has less capacity than demand, and all still have high private debt. And now China, whose industrialization and urbanization long fueled global growth, has created its own overcapacity and private debt problem, building far too much capacity in the form of industrial and real estate projects while providing easy credit that fueled a rapid buildup of private debt. So no major global economic player now has that pivotal combination of undercapacity and low private debt that can fuel productive investment and help boost global growth.

What’s more, excessive private debt may contribute to one of the great problems of our time: growing income inequality and the hollowing out of the middle class. The middle class tends to grow when there is too little capacity and low private debt (as after World War II). In contrast, the middle class plateaus or shrinks when there is too much capacity and too much debt (as at the present). Stated differently, inequality increases when there is high capacity and high debt; it decreases when capacity and debt are low. – Richard Vague

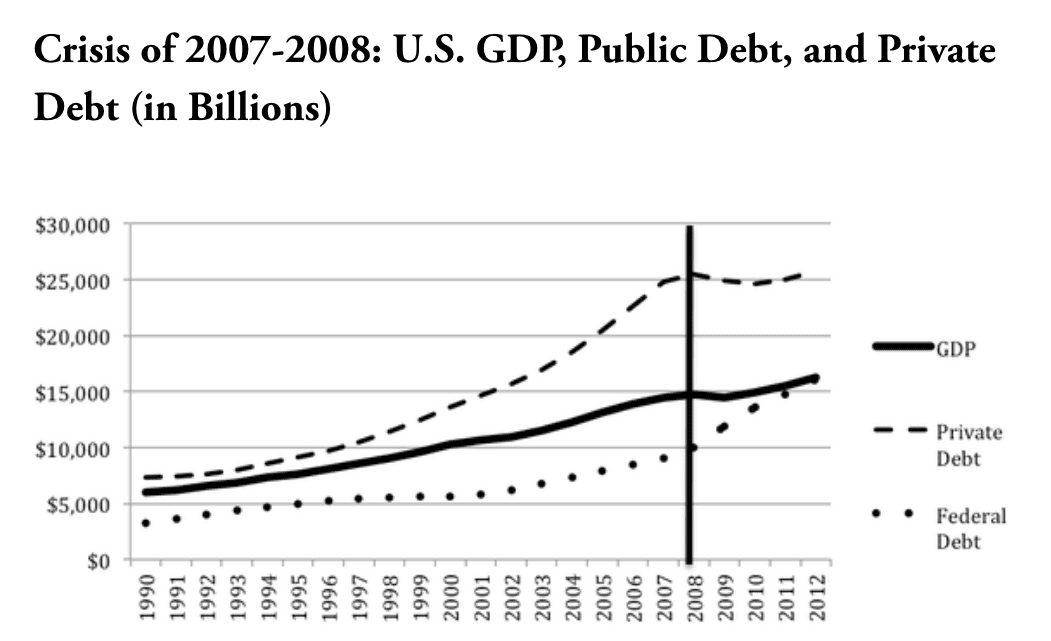

Vague points to this graph to illustrate that private debt’s growth preceded the 2007 and 2008 Great Recession.

This is Vague’s commentary on this graphic.

What was the big problem? Look at the line representing private debt. It clearly is not parallel to the GDP line and, indeed, reflects a rapid growth of private debt relative to GDP. By itself this isn’t shocking. We all know that a growth in home mortgages preceded the crash, and home mortgages are one kind of private debt—along with other consumer borrowing and borrowing by businesses. What’s more surprising is what we found when we looked at lots of other financial crises around the world, dating back to the 19th century: Though most of these crises aren’t thought of as being fundamentally caused by excessive private debt, the fact is that they were preceded by the same kind of runup in private debt that the U.S. saw prior to 2008.

Vague’s assertions checks out with other historical financial bubbles. In 1929, the US debt to GDP ratio was 16%. However, in response to the Great Depression, within a few years, the ratio had increased to 40% by 1934. Was 16% the correct level, which was when the US economy had a large amount of fraud but looked good, or was the 40% level the right level of debt when the US was in the depth of the Great Depression? From 1962 to 1988, the US public debt was less than 50% of GDP. These are generally considered very good years for the US economy — although the wages began to flatline after 1972 as unions began to lose their power.

Vague continues.

What’s alarming is that, of the two ingredients for an economic crisis—high private debt and rapid private-debt growth—one is still with us even after the 2008 collapse. Private debt in the U.S., relative to GDP, stands at 156 percent. That’s lower than the 173 percent it reached in 2008, but it’s still nearly triple the level—55 percent—it was at in 1950. Indeed, across the globe there has been a steep climb in the ratio of private debt to GDP over that period.

*This article by Vague was written in 2014. It has gone up significantly since this time.

My math shows a private debt to GDP ratio of 2.5. However, I am not sure that my calculation is the exact same as that used by Vague. For some reason, the total public debt is not easily findable so I had to calculate it.

However, you can see the method. I took the total debt and subtracted all of the public sources or categories of debt. I also found another source that calculated roughly the same value as me (lower, but for previous years as their years stopped in 2018). This may mean that Vague is using a different calculation for determining the ratio.

However, Vague was concerned in 2014 about the private debt ratio to GDP and this ratio has only grown from that time.

Vague continues..

One form of deleveraging is to provide relief for borrowers. This spurs economic growth, because by and large borrowers—especially middle-income and lower-income consumers—are likely to use the extra money to make purchases that stimulate the economy.

So what we need to do is remove some of the debt burden weighing down middle-income and low-income people. You can call it debt “restructuring” or you can call it (partial) debt forgiveness. Either way, it’s needed.

This is exactly the assertion made by banking specialist Michael Hudson.

Hudson explains that debt forgiveness was common in ancient times. In Sumeria, the debts were wiped out upon the death of a king. This was referred to as jubilee year.

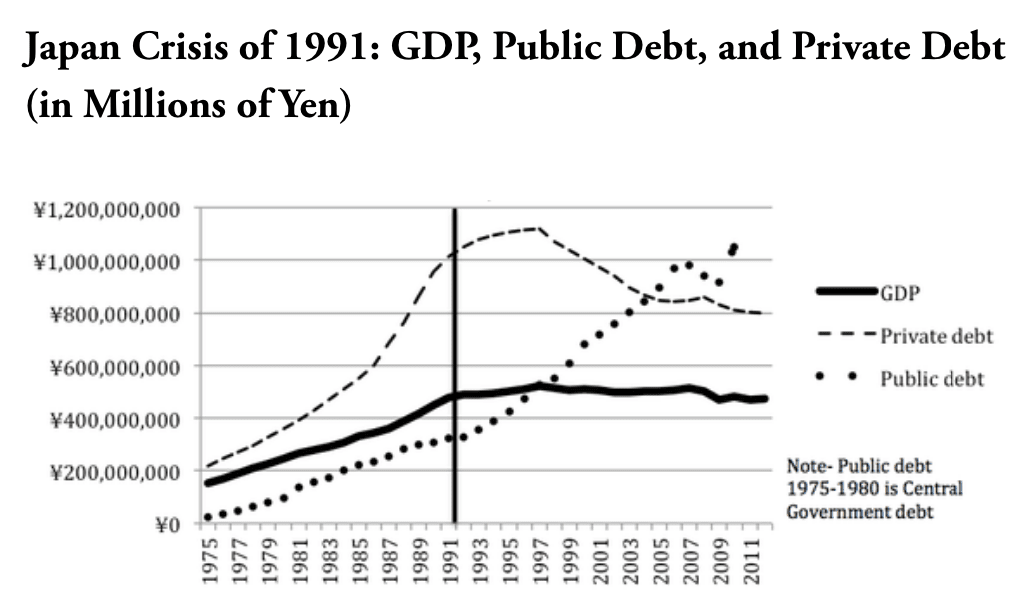

Vague points to the same pattern in Japan who’s bubble broke in the mid-1990s. The private debt in Japan begins to rise around 1985 steeply. It rises dramatically until roughly 1993. Since around 1997, private debt in Japan has gone down, while public debt has increased and even surpassed private debt around 2003. This illustrates that Japan was in a huge speculative bubble from 1985 to around 1997. Recall that expectations were sky high at this time for Japan’s future. Not only did most of the world not predict the rise of South Korea and Japan losing some manufacturing to competing countries, but very few people predicted that Japan would not be able to translate its success in precision manufacturing to other industries.

Dean Baker, of the Center for Economic Policy Research’s View on Debt to GDP Ratio

Dean Baker is a skeptic of the high debt to GDP ratio being an issue. He has repeatedly called out people who make claims about public debt as either not knowing the real story or being disingenuous. And he pointed out that the Reinhart-Rogoff was found to be based upon a spreadsheet error. There is too much to discuss around the Reinhart-Rogoff error, so this topic is covered in detail in the article The Problem of Gartner and Real Research in Not Publishing Data Sets.

This article explains how the Reinhart-Rogoff study was based upon a mistaken calculation in Excel, and once corrected, the conclusion strongly reverses.

The following quote is taken from one of Dean Baker’s articles.

Perhaps the most pathetic argument against an ambitious rescue package is that the debt will be an enormous burden on our children. This argument usually begins and ends by pointing out that the debt is a really large number. (It is.) But throwing out a really big number doesn’t tell us anything about the burden of the debt.

This is measured by the interest we pay. Last year, we paid $338 billion in interest, this year we are projected to pay $290 billion. Measured as a share of GDP, last year our interest payments came to around 1.6 percent, this year’s payments are projected at 1.4 percent. By comparison, in the early and mid-1990s (a very prosperous decade) our interest burden was over 3.0 percent of GDP.

But even the 1.6 percent figure overstates the actual burden. The Federal Reserve Board currently holds trillions of dollars of government debt. The interest paid on the debt held by the Fed is refunded right back to the Treasury. Last year the Fed paid $88.5 billion to the Treasury, reducing the true interest burden by 0.4 percentage points, which leaves the interest burden at only slightly above 1.0 percentage point of GDP. – CEPR

This is difficult to debate. The interest paid on the debt is small. This is all good, but it is not as convincing to me as the cross-country debt to GDP ratio analysis that was performed earlier in the article.

And this quote is taken from another of Baker’s articles.

I keep asking this question because whining over the government debt looks to be a huge growth sector in the next year or two, or perhaps until Republicans retake the White House. I regularly ridicule debt whining, because, unlike its cousin, deficit whining, it has no basis in economic reality.

Before again showing why the debt is a meaningless number, let me contrast it with the budget deficit, which can be a real cause for concern. The way in which deficits can pose a problem is that a large deficit can push the economy beyond its ability to produce goods and services.

But let’s flip the story over in the hope of teaching something to the debt whiners. Suppose that we looked to replace much or all of the debt that troubles them with new patent monopolies. Imagine that we sold off trillions of dollars worth of patent monopolies to pay off a large chunk of the debt.

If this sounds strange it is important to step back for a second and think of the logic of a patent or a copyright monopoly. While we ostensibly link the award of these monopolies to innovation or creative work, there is no necessary link.

At the point where the rents are being collected, a patent or copyright monopoly is simply a monopoly on a particular item. It doesn’t matter one iota whether the monopoly was awarded due to some brilliant innovation or whether it was awarded due to a payoff to a Trump friend or family member. The monopoly means that the holder gets to charge a price far above the free market price.

I have no idea if the debt whiners understand this point and try to obfuscate reality, or are just confused. As the old saying goes, “economists are not very good at economics.” But anyhow, the rest of the country need not take their debt whining seriously. – CEPR

Michael Hudson Agrees with Dean Baker

This view from Dean Baker is nearly duplicated by Michael Hudson, as expressed in the following quotation.

Out of habit, American economists worry about federal debt. But federal debt can be redeemed by the Federal Reserve printing the money with which to retire the bonds. The debt problem rests with individuals, companies, and state and local governments. They have no printing press.

We have explained that the indebtedness of the population means there is little discretionary income with which to drive the economy. The offshoring of middle class jobs lowered incomes, and after paying debt service—mortgage interest, car payments, credit card interest, student loan debt—Americans’ pockets are empty.

This situation has been worsened by Covid lockdowns. In the US the federal government has sent out a few Covid payments to help keep people’s heads above water as they face expenses without income. The financial press refers to these Covid checks as “fiscal stimulus,” but there is no stimulus. The Covid checks do not come close to replacing the missing wages, salaries and business profits from lockdowns.

Corporations have indebted themselves and impaired their capitalization by borrowing money with which to repurchase their stock. This has built up their debt in the face of stagnant or declining consumer discretionary income.

We propose to deal with the debt crisis by forgiving debts as was done in ancient times. Our basic premise is that debts that cannot be paid won’t be. Widespread foreclosures and evictions would further worsen the distribution of income and wealth and further constrain the ability of the economy to grow. Writing debt down to levels that can be serviced would clear the decks tor a real recovery. Income that would be siphoned off in debt service would instead be available to purchase new goods and services.

A few economists muttered that we were overlooking the “moral hazzard” of absolving people of their debts. But leaving the economy stagnated in debt is also a moral hazzard.

Policymakers did not endorse our proposal, but, in effect, policymakers adopted our policy. However, instead of forgiving the debt itself, they forgave payment of the debt service. Individuals and businesses who cannot pay their landlords or lenders cannot be evicted or foreclosed until June. This doesn’t hurt the lenders or banks, because the loans are not in default, and their balance sheet is not impaired. The banks add the unpaid payments to their assets, and their balance sheets remain sound.

When June arrives, the prohibition against eviction and foreclosure will have to be extended as the accrued debt service cannot be paid. Extending the moratorium on foreclosures and evictions will just build up arrears. Is the implication a perpetual moratorium?

The question is: If policymakers are willing to forgive debt service, why not just forgive the debt. The latter is neater and clears the decks for an economic renewal.

The US economy has been financialized. Debt has been built up without a corresponding gain in productive capital investment in order to carry the mounting debt.

The main purpose of bank loans is to refinance existing investments, not to expand productive capacity with which to service the debt. It is not possible to grow out of debt in a financialized economy, because too much income is used for debt service. The way to deal with this problem is to write down debts.

What is the Public Spending On?

Another problem of analyzing public debt is what it is spent on. In the 1960s, US public debt used to be more effectively spent. However, in the present day, for example, the coronavirus response, more of that debt was just gifted to the wealthy, and not to things like infrastructure projects that benefit the overall society of making the country more efficient. Expenses that are incurred as deficit spending that ends up in the pockets of the rich and that does not benefit the rest of society cannot be counted the same way as funding infrastructure projects that have a high proven track record of not only having a strong multiple (that is the number of times the investment recirculates) and also creates an item with demonstrable usable capability. However, some of the most corrupt politicians that will approve of contracts being given to McKinsey or Accenture, or BlackRock, or to bail out AIG will turn around and complain about how $1400 stimulus checks increase the US debt.

The effectiveness of deficit spending tends to get left out of the analysis in what is the appropriate debt level.

Countries with a low public debt to GDP ratio can sort the list by the smallest debt to GDP ratios and are not desirable economies. Afghanistan has very low public debt as does Russia, but these are not desirable economies. Brunei has the lowest debt, however, Brunei is essentially an oil rig connected to a country with a tiny population. They have more money than they know what to do with. The Sultan of Brunei has 7000 cars. Kuwait and the United Arab Emirates are basically similar. You find either oil-based countries or not significant economies with the lowest public debt to GDP ratios.

Why Was The Error in the Reinhart-Rogoff Study Not Caught Far Earlier?

The observation I have is that the cross-country analysis of the public debt to GDP ratio contradicts the conclusion asserted by Reinhart-Rogoff’s study. And this should have been obvious before the spreadsheet error was found in 2013. I found this inconsistency when performing the research for this article. In fact, I first read of the Reinhart-Rogoff study in the book The New Great Depression. I did not learn the spreadsheet error in the original research until around 1/2 way through writing this article. I only found it when it was pointed out in an article by Dean Baker in an article on the CEPR website.

However, before I read Dean Baker’s article, I had already at that point reviewed the debt ratios per country. I could immediately observe that the higher public debt to GDP ratio was not correlated with lower economic performance. And I did not need to do any math to see this. It was obvious from just reviewing the list of countries.

The question that should be asked is why was the Reinhart-Rogoff study was not verified by either economists or authors who used the study in their writing?

It was easy to do. And I don’t have any superpowers in reading a table over specialists in the field who could have easily done this.

This false conclusion in this study is now embedded in a huge number of published documents and books, and government documents as evidence to not engage in deficit spending.

The question of the relationship between economic growth and private debt is covered in the article Is a High Public Debt Negative Related to Economic Performance.