How Will GE’s Decline Impact the Cult of Six Sigma?

Executive Summary

- GE is such a decline that it calls into question why GE and Jack Welch scammed Wall Street.

- GE was a major proponent of Six Sigma, should it decline also.

Introduction

Currently, something is essential and exciting is happening, the company GE is in a severe nosedive.  Curiously, GE was a major proponent of Six Sigma. So much that they were ridiculed on the TV show 30 Rock (which was produced by NBC and owned by GE at the time) for their slavish infatuation with Six Sigma. For years GE was held up as a model company because of its use of Six Sigma. (another one being Motorola, another company currently in the dustbin)

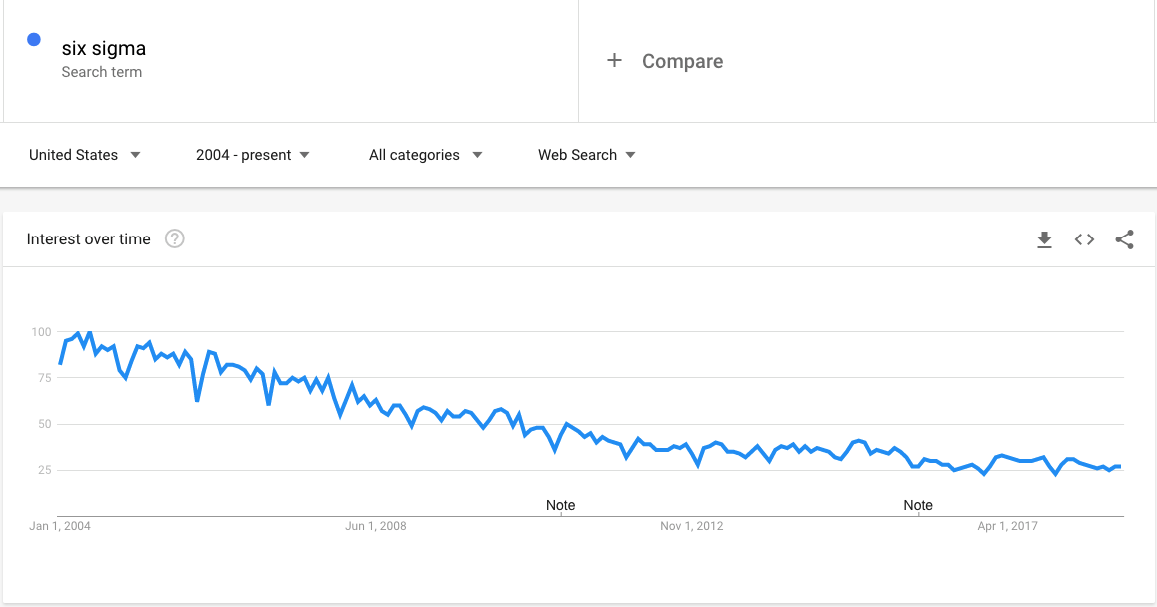

Curiously, GE was a major proponent of Six Sigma. So much that they were ridiculed on the TV show 30 Rock (which was produced by NBC and owned by GE at the time) for their slavish infatuation with Six Sigma. For years GE was held up as a model company because of its use of Six Sigma. (another one being Motorola, another company currently in the dustbin)  Six Sigma has seen a steady decline in interest over the past decade and a half. This was a significant drop from the late 1990s when 2/3rds of the Fortune 500 had Six Sigma initiatives, and Six Sigma consultants were scamming companies left and right. For a philosophy that was, according to its followers so integral to corporate success, why would this be the case?

Six Sigma has seen a steady decline in interest over the past decade and a half. This was a significant drop from the late 1990s when 2/3rds of the Fortune 500 had Six Sigma initiatives, and Six Sigma consultants were scamming companies left and right. For a philosophy that was, according to its followers so integral to corporate success, why would this be the case?

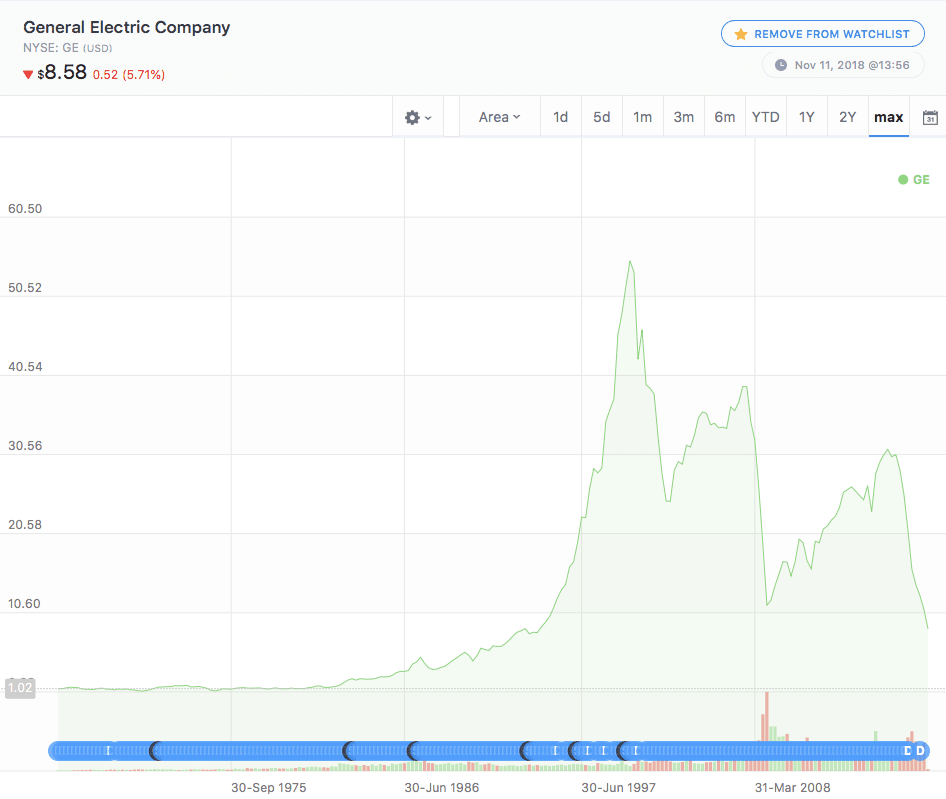

GE’s Continual Acquisitions

Now GE turns out to have been primarily a scheme to continually gain enhanced market capitalization by making acquisitions for which Wall Street would pay a higher multiple. That is, they marketed their “brand” and then used that brand to attract capital and make purchases that they did not have any justification for owning. That is, GE’s “model” was not based upon manufacturing excellence or anything to do with “Six Sigma” but with marketing to Wall Street, cost-cutting, and with shenanigans at GE Capital. The degree to which superstar CEO Jack Welch had built a house of cards was explained in the following quotation.

“In reality, these profits came by shortchanging capital investments, a move that would hurt the company later, and by tweaking the numbers in the financial unit known as GE Capital. When the financial crisis hit, GE Capital was so undercapitalized that the company needed what was billed as an investment, but was more of a bailout, from Warren Buffett.” – USA Today

Six Sigma as a Ridiculous Proposal on its Face

Six Sigma is a type of innumeracy, as actual Six Sigma quality levels are unattainable in nearly all manufacturing realms. Six Sigma is the “clean coal” of management trends. It describes a state of affairs that never happened and never will happen. It is a philosophy for those who cannot see the forest for the trees and is most appealing to those with obsessive-compulsive disorder. If you think one defect out of 3.4 million observations is a reasonable and cost-effective defect rate for any process, then congratulations, Six Sigma is for you.

“A six sigma process is one in which 99.9999998027% of all opportunities to produce some feature of a part are statistically expected to be free of defects. ” – Wikipedia

Six Sigma is, in a way, a test for critical thinking skills; if you accept the precepts of Six Sigma or they seem reasonable or explain a logical set of goals, the listener does not have them (critical thinking skills, that is). Six Sigma was never implemented. Four Point Five Sigma was due to the “Sigma Shift,” Six Sigma was just the packaging as we covered in the article Six Sigma is for Losers, Seven Sigma Sweeping the Nation. As with the rest of GE, Six Sigma was based on deceptive mathematics. And like GE management. GE was serious about Six Sigma, so severe that Jack Welch was told to terminate people who questioned Six Sigma (question: Is terminating people who question Six Sigma part of Six Sigma?). Jack Welsh explained Six Sigma as follows:

Welch explained that Six Sigma was a term used to characterize the number of defects occurring in products. Motorola pioneered the concept—building on earlier models of quality improvement efforts established in Japan—in the late 1980s and early 1990s to improve the quality of its products.

However, the Japanese manufacturers did not use anything like Six Sigma. They used statistical process control but never bought into Six Sigma’s ridiculous and arbitrary quality specifications. And neither Six Sigma proponents nor Jack Welsh can explain why these quality levels are the “right” level. When one asks, the only thing one gets back is that Six Sigma was successful at GE or with the Japanese, both untrue. A second response is that “quality is important,” which no one would deny, but Six Sigma declares specific quality standards that have no foundation in any supporting evidence. This is very similar to discussing service levels with sales. Sales will confidently propose a very high and very arbitrary service level. However, once they are asked to explain why a particular service level is selected, a lecture commences on the importance of customer service, which has nothing to do with why one high service level versus another top service level is selected. Jack Welsh provided the following case studies of the benefits of Six Sigma.

One example Welch pointed to was GE Capital. It was fielding about 300,000 calls a year from mortgage customers, but nearly 25 percent of the callers had to leave voice mail messages or call back because GE employees were busy or unavailable to answer calls. After Six Sigma was implemented, customers’ chances of getting through to a representative on the first try improved to 99.9 percent. He also held up GE Plastics as a good example. GE Plastics produced ‘Lexan’ polycarbonate, which had very high purity standards, but it didn’t meet Sony’s requirements for new high-density CD-ROMs and music CDs. As a result, two Asian suppliers were getting Sony’s business. A Black Belt Six Sigma team solved the problems and designed a change in the production process to give ‘Lexan’ the color and static qualities Sony demanded. By going from a 3.8 Sigma level to a 5.7 Sigma level, GE took all of Sony’s business away from the Asian competitors. – Remembering and Imagined DDI CIA

99.9% is not Six Sigma levels of quality. Six Sigma is 99.9999998027%. Why was GE pushing the logic of 99.9999998027% if it only applied 99.9%? 99.9% is only 1/1000 errors. Was GE saying one thing and doing another? Secondly, is it vital to “implement a Six Sigma” program to determine if you need to hire more people to answer phones? Is this an intellectual endeavor or something considered more or less common sense? For instance, if one’s car runs out of gas, is it implementing Six Sigma to drive to Chevron and fill one’s tank with gas so there is a lower probability of running out of gas? The Lexan polycarbonate is another example — the product was not high-quality enough for Sony. Therefore, the quality level was increased. However, the sigma level proposed seems exaggerated. Sony required a purity level of one 5.7 sigma; GE did not match six Sigma. So what is the actual sigma level — Six Sigma states that the quality level should be 99.9999998027%, but sometimes it appears to be 1/1000, and other times it appears to be slightly below this. In reviewing quotes from Jack Welsh, he seemed to work primarily off of simplistic platitudes.

When Welch began downsizing and closing offices and accounts, some DI managers complained, “You’ll kill morale and you’ll never be able to mobilize on this issue if it ever gets really hot.” Other DI managers complained, “You’ve already cut all the fat out. Now you’re into bone and you’ll ruin the organization if we cut more.” Welch said that both arguments were weak. He responded to his critics, “I’ve never seen a business ruined because it reduced costs too much, too fast. When good times come again, I’ve always seen business teams mobilize quickly and take advantage of the situation.” – Remembering and Imagined DDI CIA

This is curious because GE ruined numerous businesses by cutting costs too fast. Secondly, why is the standard of expectation “ruined.” The question is not what won’t “ruin” a business. It is what is appropriate. If the bar is set so low, many damaging activities can be justified if one states that it won’t necessarily “ruin” the business. Jack Welsh was continually referring back to GE’s success; however, the information now increasingly available is that GE was not a successful business; Jack Welsh was running a con job. Jack Welsh displays the characteristics of a con man. And he received uncritical coverage by Wall Street and media entities that failed to perform a basic fact-checking of Jack Welsh’s statements.

One day, in one of his most controversial moves, Welch also proposed cutting out an entire layer of management in the DI. He justified this by saying, “De-layering speeds communication.” He added, “As we became leaner at GE, we found ourselves communicating better, with fewer interruptions and fewer filters. We found that with fewer layers we had wider spans of management. We weren’t managing better. We were managing less, and that was better.” He even caused much heartburn when he suggested DI managers should also consider drafting analytic papers instead of just editing them. He said, “Many believe we need more analysts in the DI. Perhaps this is true. Or perhaps, what we really need is less management.” – Remembering and Imagined DDI CIA

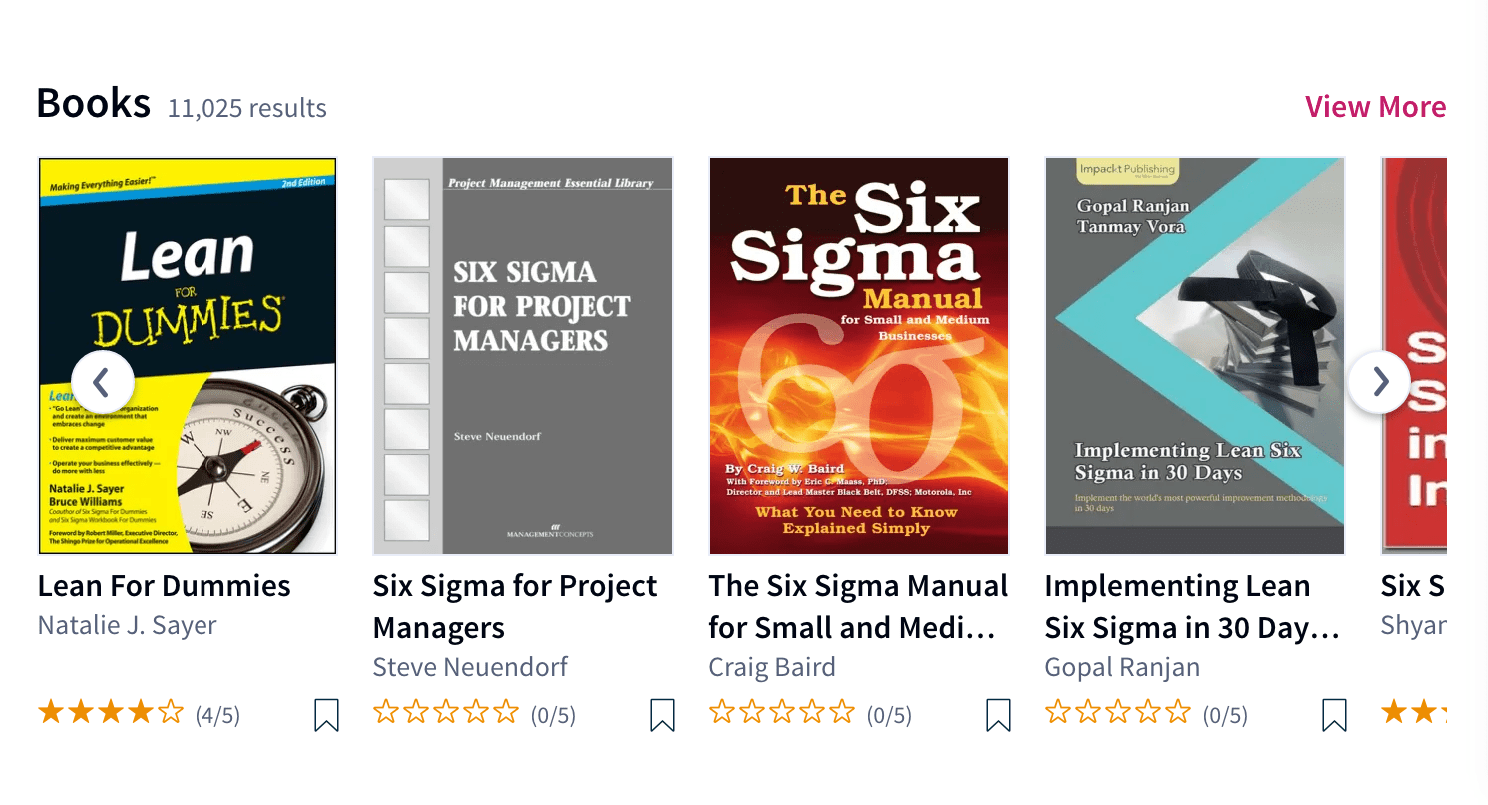

Fewer layers can be a good thing. However, again, Jack Welsh refers back to success at GE. However, while Jack Welsh romanced Wall Street and the media, there is no evidence that any companies GE acquired ran better because they were subjected to Jack Welsh’s management philosophies. The evidence is that these businesses were degraded following a financially engineered short-term strategy where the companies were debased through disinvestment. In essence, part of GE’s business was to run a Private Equity acquisition mill that undermined long-term prospects by extracting the maximum short-term benefit from these companies.  Six Sigma has many books published on the topic without any evidence of benefits. Without the supposed “success story” of GE, it’s unlikely most of these books would exist.

Six Sigma has many books published on the topic without any evidence of benefits. Without the supposed “success story” of GE, it’s unlikely most of these books would exist.

Six Sigma as an Industry

As the following quotation explains, six Sigma became a cottage industry with certifying entities designed to shrink heads, a conglomeration of consulting firms dedicated to promoting Six Sigma.

“After twenty-five years of Six Sigma, there is no evidence of any success, only an endless parade of hollow promises, followed by failure after failure. Proponents claim that Six Sigma has saved corporations and companies like Motorola and General Electric, billions and billions of dollars, year after year, and that Champions, Experts and Black Belts can train and lead your people into performing continuous improvements on your companies processes and products, that will lead to endless prosperity.” – SixSigmaFails

Yes, and most importantly, no evidence was ever demanded that Six Sigma was worthwhile, and of course, no evidence was presented. Six Sigma did not exist to be questioned. Six Sigma “was.” Six Sigma was never a hypothesis, and it never required any evidence. It was an axiom or an assertion. Those who questioned Six Sigma’s claim within companies that caught “Six Sigma fever” would have their careers put in jeopardy. How can one deny the incomplete anecdotal, and falsified evidence of Motorola and GE? Well, the following quotation explains why someone should have done precisely that.

“In 2018, the truth behind GE’s FAKE Six Sigma Successes has finally come to light- Welch was falsely claiming non-existent Six Sigma earnings by severely underfunding GE’s reinsurance reserves! Surprise Six Sigma proponents, your GE Six Sigma success story was a HOAX! Your Hero, Jack F. Welch lied to you, there never were any Six Sigma successes at GE! ” – SixSigmaFails

Why Six Sigma Projects Fail

Something quite interesting occurred while researching this topic, and it has to do with what excuses are given when Six Sigma projects fail.

“A search on why Six Sigma projects fail produces a long list of pathetic excuses. Primary blame is placed on lack of management support and buy-in; then- not enough attention paid to people, innovation, and customer relationships; process changes can be unsettling to workforce comfort; management fails to communicate the reasons behind the change and fails to demonstrate strong, visible support for it; the workforce may not be prepared to accept change as part of their daily routine;”

What is curious about this is these are the same excuses for why ERP systems fail!

Is Lean Six Sigma a Real Thing?

Six Sigma is sometimes introduced as “Lean Six Sigma,” which sounds like some variant of the Lean/Toyota Production System. However, The Toyota Production System (TPS) is based upon Deming, who was unassociated with Six Sigma and never proposed anything like the irrational defect levels recommended by Six Sigma. A collaborator with Deming named Charles Holland created a competing method for quality improvement and, in a study, found that…

“of 58 large companies that have announced Six Sigma programs, 91 percent have trailed the S&P 500 since.”

The link between Six Sigma and TPS appears more tenuous as the topic is researched.

“Many Six Sigma proponents erroneously claim that Toyota Production System (TPS) is Six Sigma or Six Sigma Lean. Harvard Business School professors, Steven Spear and H. Kent Bowen, studied Toyota for four years finding little similarity between the rigid tools and practices of Six Sigma and Six Sigma Lean, and the continuous, creative, flexible, and adaptive flow of TPS, which has never actually been written down and grew out of 50 years of the workings of the company. ” – SixSigmaFails

“Lean Six Sigma” can be viewed as merely a cynical way to borrow from the credibility of Deming and the TPS. Usually, those who laud Deming misrepresent Deming. Edward Deming was an academic with a solid statistics background who taught statistics and sampling for decades in universities and companies. He was far too advanced to accept any of the fake statistics of Six Sigma. That was the first indicator that the benefits of Six Sigma had to be false. When we first analyzed Six Sigma, the math made no sense.

The Corruption of Jack Welch

Jack Welch was a great salesman. He mainly sold himself and GE to the world. He, in essence, created a cult that was a reality distortion field, one that was supported with long-term financial reporting inaccuracies.  Six Sigma is one chapter in Jack Welch’s popular book Winning. There is an enormous number of books on Jack Welch. Now that his philosophy is little more than financial gerrymandering, can we now dispense with the obsession with Jack Welch? Jack Welch’s new book will be called “Jack Welch on How to Sell Jack Welch!” Jack Welch built up a financial services arm in GE Capital and lobbied to reduce financial standards.

Six Sigma is one chapter in Jack Welch’s popular book Winning. There is an enormous number of books on Jack Welch. Now that his philosophy is little more than financial gerrymandering, can we now dispense with the obsession with Jack Welch? Jack Welch’s new book will be called “Jack Welch on How to Sell Jack Welch!” Jack Welch built up a financial services arm in GE Capital and lobbied to reduce financial standards.

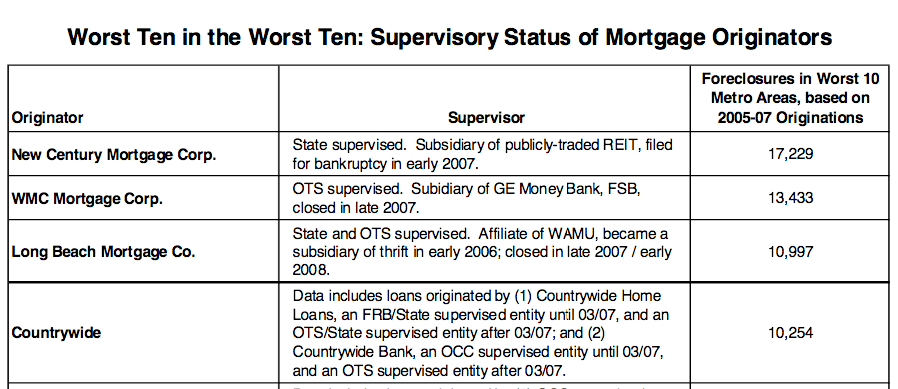

GE became two businesses, one a stodgy manufacturing conglomerate and the second a Wall Street financial sleaze operation, bombing in the mortgage-backed security failures of the 2000s. GE Capital received $139 billion from the US government. This is added to the fact that GE never paid any taxes in many years but instead received refunds. This means that GE’s executive compensation can easily be interpreted as being paid for by US taxpayers. It also means that GE did not pay to cover any federal, state, or local government services that its operations imposed in the areas they operated. This went on for over a decade and was barely mentioned. Jack Welch could appear on any business program and be assured that no one would ask him why GE did not pay taxes. This raises the question of how many mortgage-backed securities that GE got involved with were “Six Sigma.” Not many of them, as they needed a massive bailout. It seems GE’s financial standards were far below one defect in 500 million, much less one defect in 3.4 million. Were any of those mortgage-backed securities less than one defect in 3.4 million? Let’s find out. The following is from the Office of the Controller of the US Treasury’s Currency report. GE’s WMC mortgage subsidiary is listed as having the second-worst default level of all mortgage providers.  GE has significantly more foreclosures than Countrywide, which was involved in mortgage fraud. The mortgage company ahead of WMC (New Century Mortgage Corp.) was the subject of two criminal probes. KPMG was accused of collaborating with New Century to conceal problems in 2005 and 2006. New Century ended up filing for bankruptcy, as did the one just below WMC (Long Beach Mortgage Co), which was also found to have engaged in mortgage fraud.

GE has significantly more foreclosures than Countrywide, which was involved in mortgage fraud. The mortgage company ahead of WMC (New Century Mortgage Corp.) was the subject of two criminal probes. KPMG was accused of collaborating with New Century to conceal problems in 2005 and 2006. New Century ended up filing for bankruptcy, as did the one just below WMC (Long Beach Mortgage Co), which was also found to have engaged in mortgage fraud.

On March 26, 2008, an unsealed report by bankruptcy court examiner Michael J. Missal[22] outlined a number of “significant improper and imprudent practices related to its loan originations, operations, accounting and financial reporting processes,” and accused auditor KPMG with helping the company conceal the problems during 2005 and 2006. – Wikipedia

The question is, how likely is it that WMC did not engage in mortgage fraud if it is number two on the list of having the most mortgage defaults? Beyond this, GE was sued by Freddi Mac, the US secondary mortgage entity, for misleading it on the sale of $549 million in mortgage-backed securities. GE settled that case with the US government. It seems, again and again, GE gets special consideration from the US government. They can be accused of lying to cheat the US government and are treated with kid gloves. All through GE, Six Sigma quality was never nearly attained, but many of the patterns within GE were of lower-than-average quality. This is explained in the following quotation.

“there was no more serious crime than to miss the quarterly numbers that had been handed down from on high. As a result, products with serious known problems got shoved out the door anyway. I will no longer buy a GE-designed or manufactured product of any kind. I cringe when I encounter one of their products in a hospital setting.”

Jack Welch also had a curious and exploitative view of how industrial policy should work, as explained by the following quotation.

“Several years ago Jack Welch, former CEO of General Electric, captured the new reality when he talked of ideally having “every plant you own on a barge.” The economic logic was that factories should float between countries to take advantage of lowest costs, be they due to under-valued exchange rates, low taxes, subsidies, or a surfeit of cheap labor. Globalization has made Welch’s barge a reality. However, in doing so it has made capital mobility rather than country comparative advantage the engine of trade. And with that change, “free trade” increasingly trades jobs and promotes downward wage equalization.” – Alternet

The Six Sigma Hell Barge

Such a barge could operate in countries without pollution regulations and labor restrictions (number of work hours per day, legal protections, child labor laws). The country could be bribed so taxes could be removed from GE. Those “taxes” or bribes that were paid would, as much as possible, not benefit the population but be directly deposited into Swiss bank accounts of the political leadership (see the Congo, a country with the resource wealth of Saudi Arabia but with an average income of 72 cents per day). One can imagine factory barges floating to countries currently in a civil war and war-torn regions where Welch can get the lowest possible labor costs. As soon as conditions improve, the barge floats away to another troubled spot. GE would then top this off by having GE Captial engage in a deceptive depreciation schedule on the barge, which the US government would approve due to GE’s political donations. This is the golden vision of Welch, which, hopefully, will publish a new book on this innovative and brilliant design and which the press will fawn over.

Where is the Media Coverage of GE’s Bailout?

This bailout occurred back in 2008. Why was there so little coverage about how a company with supposedly impossible quality standards ended up with so many loans that defaulted? Why was there so much coverage of bailouts to Wall Street but not on GE at the time? GE’s bailout is only somewhat smaller than the very well-publicized bailout of AIG, which cost taxpayers $182 billion. (was AIG also following Six Sigma?) How far do GE’s financial shenanigans go back? Quite away, it appears, as explained in the following quotation.

“GE’s 2000 Annual Report is seventy-seven (77) pages of Six Sigma glory blended with a litany of accounting mumbo-jumbo of swaps, options, offsets, risks, exposures, exchanges, rates, caps, floors, collars, hedges, assets, alternative valuations, comparables, time value, discounted value, intertwined with consumer credit, mortgages, probable future receipts, probable future obligations, determining fair market value, etc.; by its nature, no reasonable accountant could make sense of GE’s financial state. This allowed Welch to play fast and loose Enron-style, with his annual reports, which consistently beat Wall Street and analyst’s predictions. GE’s independent KPMG LLP, audit committee, simply rubber stamped GE’s financial positions, statements of earnings, equity and cash flows, with only a reasonable assurance of accuracy. ” – SixSigmaFails

Long-Term Rigging on the Part of GE

It brings up all manner of questions regarding how GE implemented Six Sigma.

“From 2008 to 2013, while GE made over $33.9 billion in United States profits, it received a total tax refund of more than $2.9 billion from the Internal Revenue Service. G.E.’s effective U.S. corporate income tax rate over this six-year period was -9 percent. In 2012, GE stashed $108 billion in offshore tax havens to avoid paying income taxes. If this practice were outlawed, GE would have paid $37.8 billion in federal income taxes that year.” – Sanders Senate.gov

How did GE pay so little taxes, cut so many costs, and still end up in the toilet? In addition to this overt cheating, they also face a criminal accounting probe, and the independence of GE’s auditor has been questioned.

“Shareholder watchdog groups worry that GE and KPMG have become too cozy during their 109-year-old relationship. Both Glass-Lewis and Institutional Shareholder Services are urging shareholders not to ratify KPMG as GE’s auditor at the company’s annual shareholder meeting on Wednesday. This extensive tenure has thrown KPMG’s effectiveness and relationship with the company into question,” Glass-Lewis wrote to GE shareholders. However, the maker of jet engines, light bulbs, and MRI machines still faces lingering questions about its accounting tactics. Questions about accounting are nothing new at GE. Under former CEO Jack Welch in the 1980s and 1990s, GE routinely beat Wall Street’s earnings expectations by just a penny. That is a huge red flag,” said Macey.” WMC, GE’s low brow subprime mortgage business has emerged in recent months as one of the biggest headaches in GE’s vast business empire. GE set aside another $1.5 billion in April to cover potential losses from the Justice Department investigation.” – CNN Business

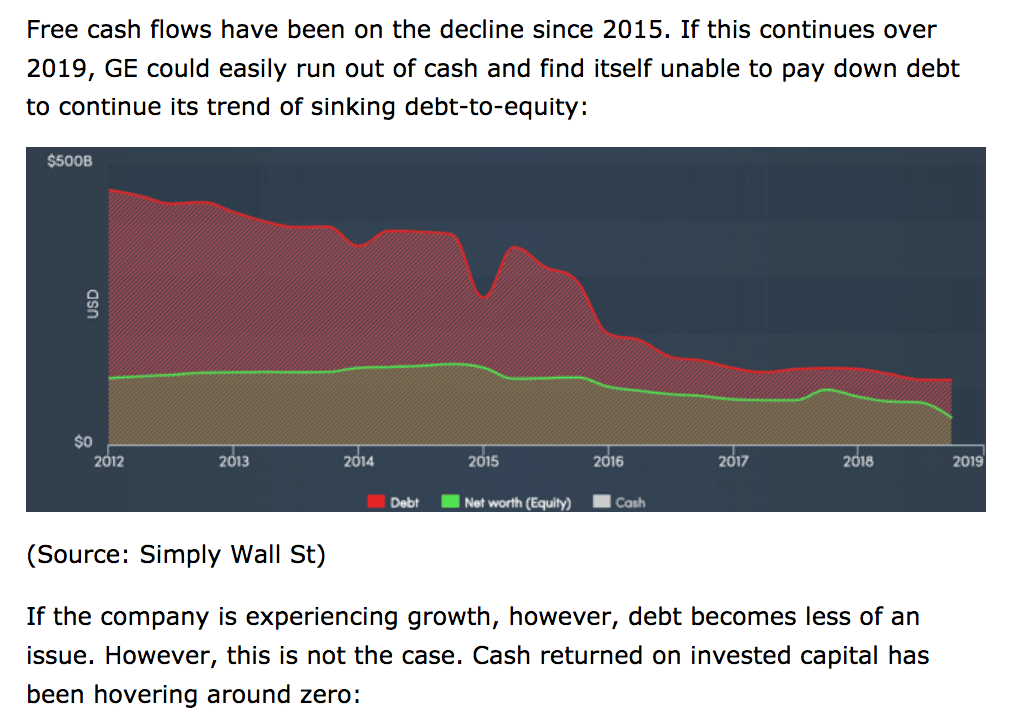

Furthermore, GE has $200 billion in liabilities but only $4 billion in cash flow. This places GE at bankruptcy risk. The inept management at GE is not being covered in sufficient detail.

GE: Distilled Management Greed and Incompetence

GE developed a management strategy of disdaining domain expertise through its conglomerate approach. GE was the poster child of MBA generalists giving orders to those who knew more than they did, as explained in the following quotation.

“Still, under Immelt GE Capital only grew. Its profits quadrupled as it gobbled up credit card companies, subprime lenders, and commercial real estate. These weren’t businesses GE had much experience in, but the company had long taught its young executives that they could manage anything.” – Bloomberg

Jack Welch’s successor continued Jack Welch’s buying companies strategy that GE knew nothing about, planning on receiving a higher valuation from Wall Street for every dollar brought under the magical GE corporate umbrella.

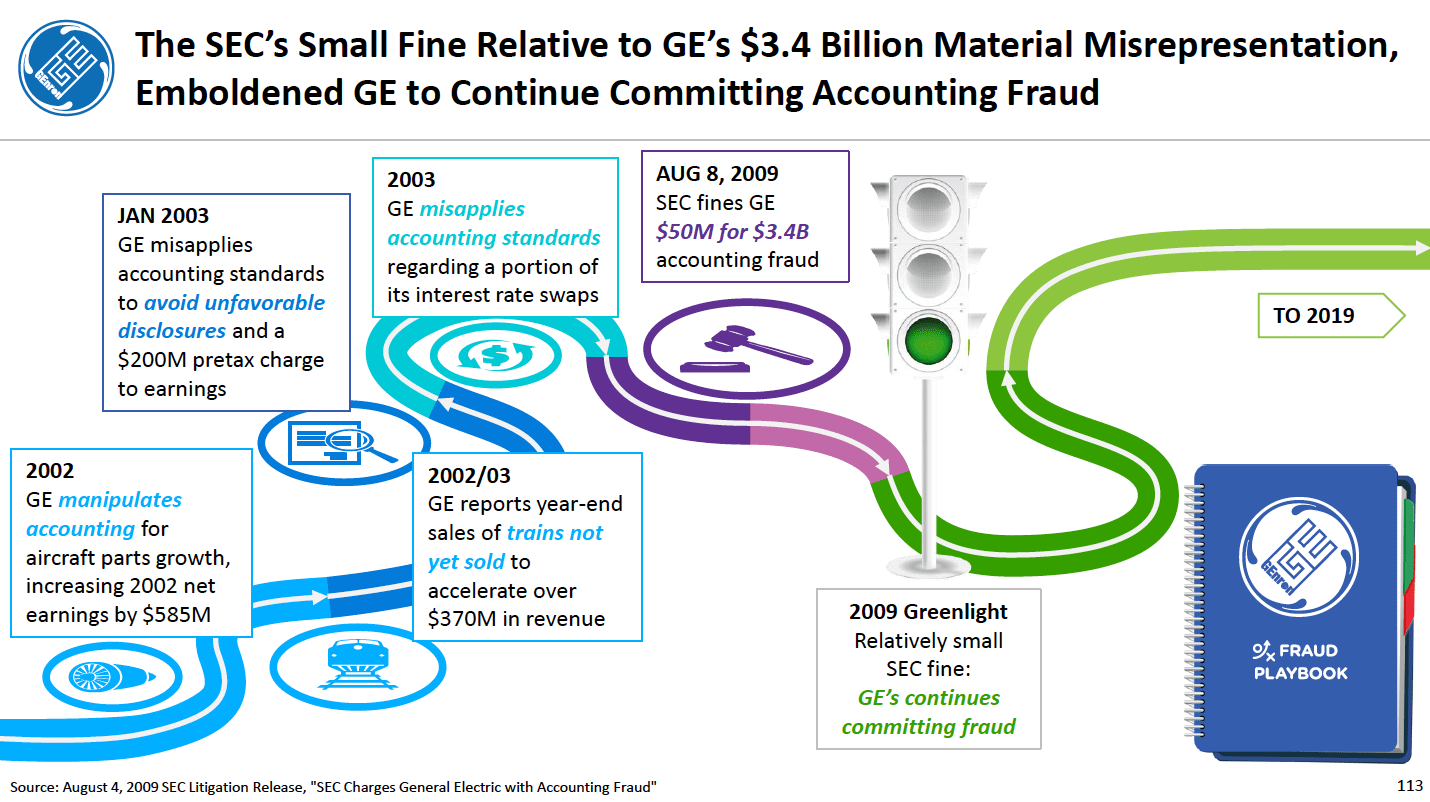

Analysis of GE by the Bernie Madoff Whistleblower

This article you are reading was written in November of 2018. However, in August of 2019, a bombshell report was released by the same person. Harry Markopolos was the first to inform regulators of the Bernie Madoff Ponzi Scheme.

He has the following to say about GE after exhaustively analyzing its financials.

This is an excellent interview with Harry Markopolos, explaining the background and findings of his investigation. The following slides are all from Markopolos’ GE Whistleblower Report.

Amazing quotes from the report include but are not limited to the following.

Amazing quotes from the report include but are not limited to the following.

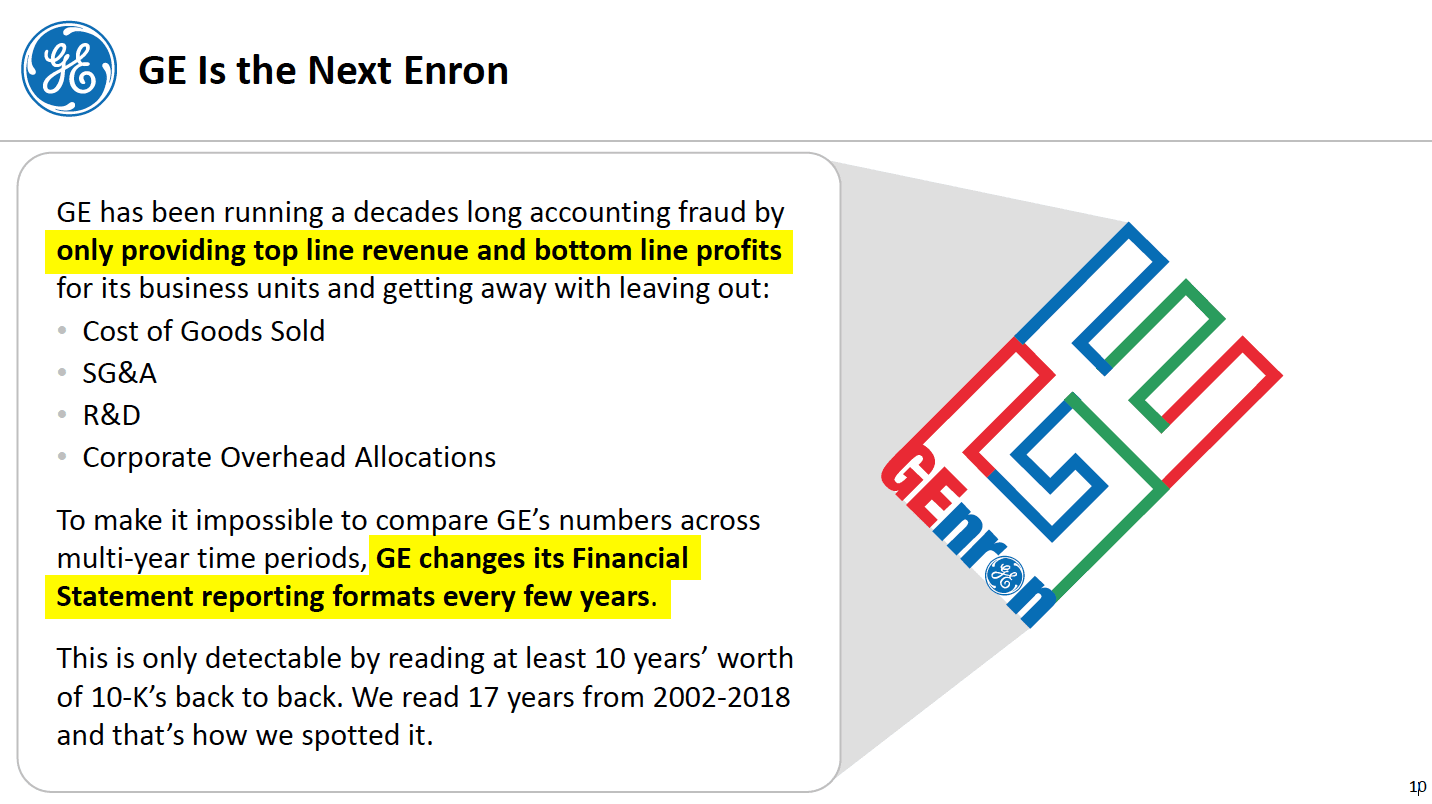

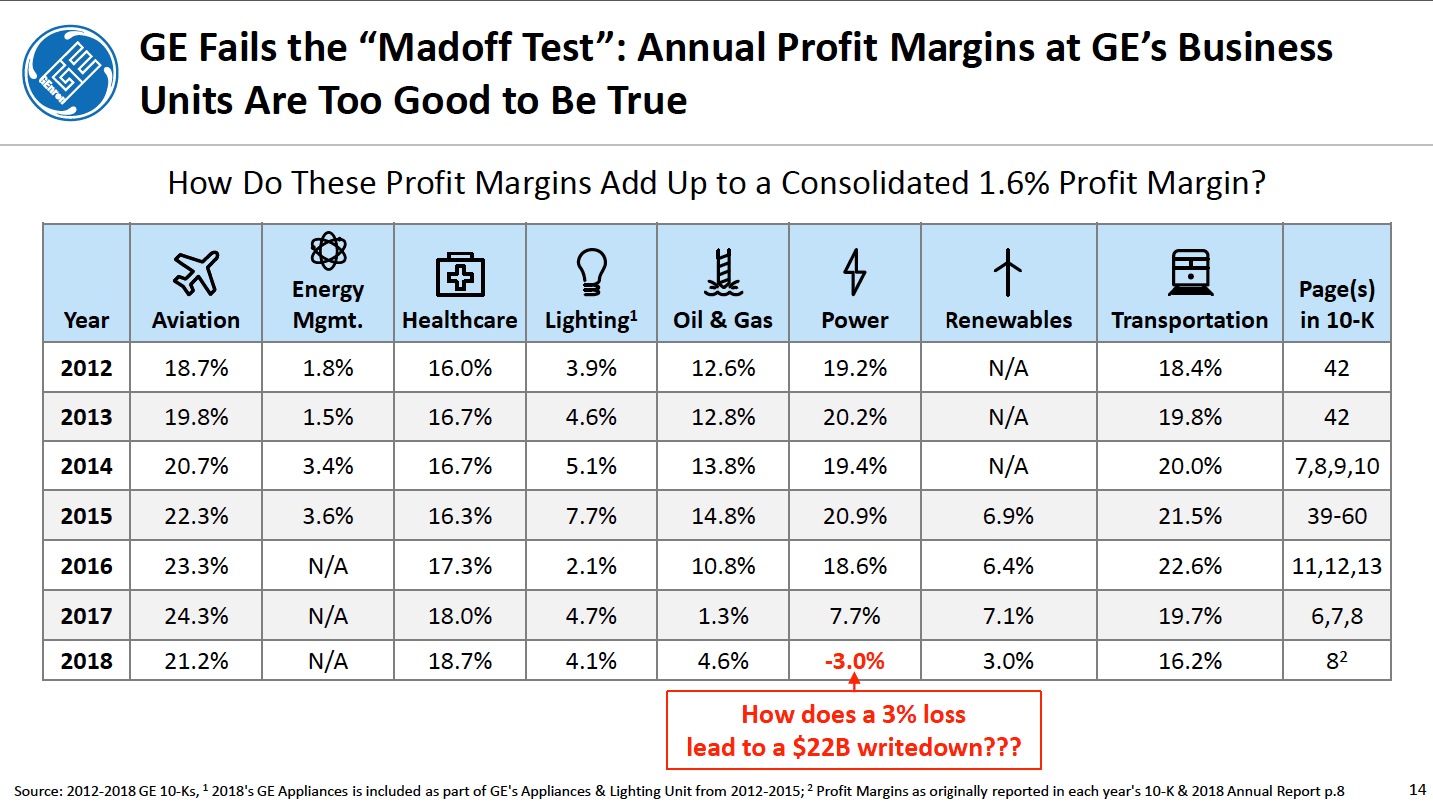

To prove GE’s fraud we went out and located the 8 largest Long-Term Care (LTC) insurance deals that GE is a counter-party to, accounting for approximately 95% or more of GE’s exposure. Either these 8 insurance companies filed false statutory financial statements with their regulators or GE’s financial statements are false. We’ll show you the losses from each reinsurance arrangement in both dollar losses and percentage losses and let you determine who is telling the truth. GE has been running a decades long accounting fraud by only providing top line revenue and bottom line profits for its business units and getting away with leaving out cost of goods sold, SG&A, R&D and corporate overhead allocations. To make it impossible to compare GE’s numbers across multi-year time periods, GE changes its Financial Statement reporting formats every few years. This is only detectable by reading at least 10 years of 10-K’s back to back. We read 17 years from 2002-2018. We paid to use the National Association of Insurance Commissioners (NAIC) and AM Best Databases to access these 8 insurers’ statutory financial statements filed with the relevant state insurance commissions. What they revealed was GE was hiding massive loss ratios, the highest ever seen in the LTC insurance industry, along with exponentially increasing dollar losses being absorbed by GE. The GE Capital insurance unit with the largest losses is ERAC and that unit’s average policy-holders’ age is now 75. The losses in this unit led to GE’s unexpected late 2017/early 2018 $15 Billion reserve hit. Unfortunately, the fast approaching 5-year age group between 76-80 will see a 77% increase in LTC claims filed which will see GE’s losses increase several-fold. We expect to soon see loss ratios of 750% to 1,000% or more on some of GE’s reinsurance agreements. According to industry data, approximately 86% of GE’s LTC claims are ahead of them and the accompanying losses are growing at an exponential and un-survivable rate. Of the $29 Billion in new LTC reserves that GE needs, $18.5 Billion requires cash immediately while the remaining $10.5 Billion is a non-cash GAAP charge which accounting rules require to be taken no later than 1QTR 2021. These impending losses will destroy GE’s balance sheet, debt ratios and likely also violate debt covenants. Unfortunately, GE has almost no cash, so they had to request special forbearance from the Kansas Insurance Department (KID) to be able to fund their January 2018 $15 Billion reserve increase over a 7-year time horizon, so the odds of them being able to fund $18.5 Billion in new cash reserves is doubtful. What’s even more doubtful is GE becoming cash flow positive in 2021 as management would have you believe. team has spent the past 7 months analyzing GE’s accounting and we believe the $38 Billion in fraud we’ve come across is merely the tip of the iceberg. To put it into perspective, $38 Billion in accounting fraud is over 40% of GE’s market capitalization and we know we only found a portion of it. I first became aware of GE’s suspect accounting attending educational program luncheons at the CFA® Society of Boston in the late 90’s. Chief investment officers, portfolio managers, analysts, and directors of research would all comment on how they believed GE’s earnings numbers couldn’t be true because they always met or beat consensus earnings estimates every quarter, year after year, no matter what the economy was doing. – Harry Markopolos and the GE Whisleblower Report

And who was GE’s auditor for 110 years — that would be KPMG, however, according to Markopolos.

GE: 24 Years of Accounting Fraud Dating Back to 1995. With accounting fraud it’s impossible to keep numbers straight, because there are too many lies to keep track of. GE’s business units provide no transparency into expenses so its not possible to determine how much they really earn or how much free cash flow (if any) is generated.

Neither KPMG nor regulators have done their job with GE. This has allowed GE to limp along and now can only be rectified by GE completely cratering and leading to mass firings, bankruptcy, and re-organization. The question is whether the government will bail out GE.

Neither KPMG nor regulators have done their job with GE. This has allowed GE to limp along and now can only be rectified by GE completely cratering and leading to mass firings, bankruptcy, and re-organization. The question is whether the government will bail out GE.

Why Six Sigma Proponents Won’t Stop Promoting Six Sigma

Six Sigma was never about the evidence for Six Sigma. It was about propping up various careers and about money. Six Sigma creates an income stream for many consultants and a justification for multiple programs; therefore, the fact that Six Sigma is invalid and lacks evidence will not stop Six Sigma proponents from continuing to try to justify Six Sigma. This is expressed in the following quotation.

“Harry does not come cheap. The fee to licence his method and train a core group of Black Belts starts at $1 million (U.S.) and ramps up, based on the client company’s gross revenues. Training each additional class of 25 Black Belts costs $150,000. He feeds subcontracts to nearly a dozen other former colleagues from Motorola who have set up two other Six Sigma consultancies, including Harry’s neighbour, Mike Carnell, a former bull rider who is currently delivering Six Sigma training to Navistar International Corp. Canada employees at its truck plant in Chatham, Ont. Asked whether it is an accident of geography that so many Six Sigma consultants are cowboys, Carnell says, “No. It’s just because we aren’t smart enough to know when to quit. We want to reach Six Sigma in everything.” – Data Buster

Furthermore, Six Sigma consultants continue to make entirely unfounded claims.

Only people who like defects (corruption in Government terms) hate six Sigma. This process, if used correctly, makes CEO, Director, Prime Minister, President, or for that matter anyone defect free. Read my Quora profile for better details. – Annonymous Six Sigma Supporter

This is terrific news. All one has to do is use Six Sigma, and one is defect-free! It’s good to see that Six Sigma devotees are keeping the claims around Six Sigma rational. This is the problem: Six Sigma has been making enormous claims like this for decades, and now the Six Sigma devotees are irked when any of these claims are questioned and then go on to propose that they weren’t extreme claims made by Six Sigma.

Conclusion

GE is a company with a significant history and a history of innovation. This is explained in the following quotation.

“Trains are pulled by powerful, fuel-efficient diesel-electric locomotives. The basic design of this technology was developed in the 1920s, when General Electric combined diesel technology with electric traction motors (Stover, 1997, p. 213). As newer locomotives replace old ones, average motive power should be steadily increasing; AAR (2006, p. 49) has claimed that average locomotive horsepower, nearly 3,500 hp in 2006, increased by 51 percent since 1980.” – RAND

However, if one reviews GE’s innovations, they occurred before the arrival of Jack Welch. Innovation declined at GE after Jack Welch took the helm. This fits into the narrative that Six Sigma is a micromanagement device that eventually undermines a company’s innovation ability. Before Jack Welch arrived at the top of GE, GE was known for appliances lasting 30 to 60 years. However, years ago, GE’s ailing appliances division was sold to a Chinese company Qingdao. No appliances last anywhere near what they used to….that is, before the arrival of Six Sigma to manufacturing. Jack Welch created a parasitic organization that tricked credulous analysts and the US government into bending over to accommodate his corporation. GE’s success was far more a result of marketing and financial and tax cheating than anything of substance. GE was also a primary reason for the rise of Six Sigma, an approach that is mindless in its foundations and may have been created in the first place by Motorola to keep from sharing the actual reasons it had won a prestigious manufacturing award. The cult of Jack Welsh and GE was popularized by media entities that did not research it correctly. It lacked the domain expertise to understand nothing innovative or beneficial in the management of GE. This was very damaging to other companies that attempted to emulate GE. The business press is still not putting together the full story on GE. GE has at least three different stories.

- GE’s control over Wall Street with its marketing and romancing led to its exaggerated valuation.

- GE’s financial shenanigans

- GE’s dependence on the US government allowed long-term tax-free status and bailouts.

The only way these three stories could be part of the same company while resulting in the potential for bankruptcy is if some illicit activities were occurring at GE. GE has been sick for decades and used financial shenanigans to cover up for that fact. GE being so politically connected gives them both immunity from the US government and the ability to parasitize the overall system, all while pretending they are excellent as an executing organization. The following quotation describes GE from Edward Deming.

“By 1968 as Professor Reich says, the accountants and the lawyers became the important people in the company. Paperwork, creative accounting, make things look better, reduce-taxes-but that does not make the pie bigger….the lawyers become important to try to find out how to take over something, how to stave off a takeover.”

As GE continues to decline, the overall legacy of Jack Welch is brought into question. And if it enters bankruptcy, and its past financial performance is based on fraud, it increasingly appears that it was — this means that GE never had any particular answers. For decades in the US, if you had something you wanted to do that was terrible for workers and short-term orientation, you would take a page from GE. In this way, GE can be considered a stupidity justifier. As with its financial lies, Six Sigma was just another lie it used to inaccurately present itself as an innovative firm. Like the financial lie, this Six Sigma lie was bought hook, line, and sinker by not only the mainstream IT media but also by Wall Street analysts, Six Sigma consultants, thousands of misguided companies, and many more individuals. Secondly, the entire Six Sigma story was relatively simple to disprove, as it never made any sense. Now is the appropriate time to re-evaluate the cult of Six Sigma. All of this makes GE’s proposals about Six Sigma laughable. GE was not a company based on quality or standards. A larger question is how a company for which the system was so rigged in favor, that received bailouts and never seemed to pay taxes but instead received tax refunds (paid for by taxpayers, obviously), still managed to fall as hard as GE.

References

https://www.sanders.senate.gov/top-10-corporate-tax-avoiders

https://www.cnbc.com/2019/08/15/ge-shares-drop-after-madoff-whistleblower-harry-markopolos-raises-red-flags-on-its-accounting.html

https://www.wsj.com/articles/ge-is-new-target-of-madoff-whistleblower-11565866617

GE is already under investigation by the SEC and Justice Department for potential accounting issues that have come to light in the past two years related to its insurance holdings and problems in its power division. The company has denied accounting fraud in response to lawsuits and said it is cooperating with investigators. GE has said it is considering switching auditors after using KPMG LLP for more than a century. The Markopolos group also alleges that GE’s ownership of oil-and-gas business Baker Hughes isn’t being properly accounted for and that the company should have booked about $9 billion of losses on the investment. Last year GE recorded a $2.2 billion loss on the sale of part of its Baker Hughes stake, reducing its ownership from 62.5% to 50.2%.

Article Comment

GE so represents where the Boomer generation has taken American capitalism. Think about it for a second: long-care insurance looked like a money-printing machine. This is why GE got into it to begin with. What does a company known for industrial might have to do with eldercare insurance? It seemed like a good idea at the time. However, little did they know when they issued these policies that an epidemic in dementia among the very Boomers they thought they were suckering into buying LTC insurance, now need to call on that insurance to pay for some of the most expensive care on the planet. Rather than hiring all of those Harvard MBA whizzes, they would have done better to hire a some cold-calculating actuaries along with good medical professionals. But when you are in a hurry to show your bosses you can make money, it is simply always too late.

https://www.gefraud.com/

https://seekingalpha.com/article/4202180-ge-power-continues-deteriorate-threatening-investment-grade-debt-rating

*https://www.nytimes.com/2017/06/15/business/ge-jack-welch-immelt.html

http://search.proquest.com.jproxy.lib.ecu.edu/docview/194521515?accountid=10639

https://www.bloomberg.com/news/features/2018-02-01/how-ge-went-from-american-icon-to-astonishing-mess

https://www.usatoday.com/story/opinion/2018/07/15/general-electric-ge-ceo-editorials-and-debates/726675002/

https://www.wsj.com/articles/general-electric-shares-still-havent-hit-bottom-jpmorgan-warns-1541785618

https://en.wikipedia.org/wiki/Six_Sigma

https://www.alternet.org/story/64055/the_new_economics_of_trade%3A_factories_on_barges_and_the_race_to_the_bottom

https://seekingalpha.com/article/4218343-ge-descend-mediocrity

https://dailygazette.com/article/2017/06/26/welch-s-bad-policies-nearly-destroyed-ge

This quote raises the question of when Wall Street began to figure out that GE has falsified its earnings.

Welch saw financial services as an easy money generator. When Welch started purchasing low PE ratio financial services companies, the stock price kept rising because the combined earnings from manufacturing and the acquired financial companies were given the much higher PE given to manufacturing. By the time Immelt took over, the stock price began dropping because Wall Street was questioning the quality of the earnings; GE became more of a financial company. The high PE given to GE stock was no longer justified. The financial crisis showed the failure of Welch’s strategy that nearly bankrupt GE. In summary, Welch’s strategy during his 20 years as CEO made it nearly impossible for Immelt to become a successful CEO. Welch refused to be interviewed for the June 16 story because he wants only praise. Welch will be remembered as the chief financial engineering officer of the century whose misguided strategy nearly destroyed GE.

https://qz.com/work/1106715/former-general-electric-ceo-jeff-immelt-traveled-with-an-extra-corporate-jet-in-case-his-broke-down-ge/

https://www.forbes.com/sites/kenkam/2018/11/16/ge-pensioners-and-stockholders-contemplate-the-unthinkable/#243a7e368e39

https://www.cia.gov/library/center-for-the-study-of-intelligence/csi-publications/csi-studies/studies/vol48no3/article04.html

https://wolfstreet.com/2018/11/02/what-general-electric-does-to-avoid-question-when-will-ge-file-for-bankruptcy/ (Comment)

https://money.cnn.com/2006/07/10/magazines/fortune/rule4.fortune/index.htm

https://money.cnn.com/2018/04/24/investing/ge-annual-meeting-kpmg-accounting/index.html?iid=EL

https://en.wikipedia.org/wiki/New_Century https://www.wsj.com/articles/in-ge-probe-ex-staffers-say-insurance-risks-were-ignored-1543580971

https://www.forbes.com/sites/ronashkenas/2013/07/24/why-continuous-improvement-may-need-to-be-discontinued/#d65be786b769

https://sixsigmafails.com/ https://sixsigmafails.com/ge-six-sigma-failure

https://www.ft.com/content/27d8b4ac-c043-11e9-89e2-41e555e96722

Mr Left also criticized Mr Markopolos’ research, saying that if there were fraud at GE, “then it has been a grand-scale conspiracy by thousands of accountants, auditors, and division CFOs who have all secretly collaborated over the past 20 years. This is not exactly Madoff’s secret 17th floor.”

Comment

It’s a bit rich for other short sellers to criticize the taking of a position before publishing critical research. Provided the research is bona fide, this is a legitimate market service. I don’t read any specific criticisms of the report here – I take it those complaining haven’t read it yet. It seems more likely that the other hedge funds moaning about this probably had long positions in GE.

Comment

If you examine the board of directors, there is a member named Francisco D’Souza who is also president of an Indian IT constancy named Cognizant. The predecessor of him in Cognizant, was accused for fraud, and he openly said that he did not nothing wrong because this is how business are done in India. Cognizant last year was accused for tax avoidance and the government of India had to freeze the cash accounts of the company.

Comment

Here is what I said on the last article discussing Mr Markopolos report I don’t think there is much else to be said. Although fact other short sellers are calling Mr Markopolos out instead of GE and are questioning his report. Alongside the fact he went begging to four hedge funds and got in bed with one I think shows where opinion ultimately lies. “if the stock goes up he and the hedge fund lose out” as if the stock was going to go anywhere but down with this calibre of report. It stinks to high hell of market manipulation. Everything in it we already knew all the big allegations for the most part are already being followed by the SEC/federal authorities. He’s just regurgitating what’s already out there while fear mongering over Enron/WorldCom and Madoff to try and get more traction using his big name as well to further scare the markets.

Comment

Markopolos deserves to make money for his work. Waiting to get money from the SEC could be like waiting for hell to freeze over. In this case (GE), obviously only time will tell whether Markopolos has grossly overstated his case, and it may take a while. If memory serves, in Enron’s case, it took more than a year from the time Chanos and presumably others started their positions until they covered. Enron did not declare Ch. 11 until several months later. It is hard to believe that GE is going belly up. If Markopolis is wrong, no one will ever believe him again. Meanwhile, GE will survive. if Markopolos is significantly right in his analysis, wouldn’t that be a service to investors, small and large.

https://www.seattletimes.com/business/policies-at-wamus-long-beach-mortgage-invited-fraud/ https://en.wikipedia.org/wiki/New_Century https://www.forbes.com/sites/rachelsandler/2019/08/15/ge-ceo-slams-whistleblower-report-as-market-manipulation/#3370babd5bad https://www.occ.treas.gov/news-issuances/news-releases/2010/nr-occ-2010-39d.pdf https://seekingalpha.com/article/4232277-general-electric-will-penny-stock-2019

GE’s capital allocation has not paid off. Its recent acquisitions have been some of its most expensive (e.g., Alstom, the French turbine company – and former GE competitor) yet they have been unable to bring GE back to its glory years.

GE has also been aggressively engaging in buybacks. Buybacks make sense when you have excess capital, wish to reduce outstanding shares, and want to bolster the stock price – and only when the stock is objectively cheap. However, we find GE spending most of its $90B buyback budget near the recent peak.

*https://investorplace.com/2018/04/ge-stock-terrible-risky-short/ https://www.forbes.com/sites/kenkam/2018/11/16/ge-pensioners-and-stockholders-contemplate-the-unthinkable/ https://bbs.boingboing.net/t/the-guy-who-figured-out-bernie-madoffs-scam-now-says-ge-is-about-to-go-bankrupt/149835/8

If Markopolos is lying, he should go to jail in the cell right next to Bernie’s. I do not think the description of this article sufficiently demonstrates the motive for Markopolos to make this report as it was handed over to a short hedge fund the the day BEFORE public dissemination. He was employed by this hedge fund and would be rewarded handsomely with a percentage of the short profits after market correction specifically targeted at GE. This, the second cousin to insider trading, is called market manipulation and it is illegal. Today, GE got most of the losses back because Wall Street thinks Markopolos is lying. Of course, it doesn’t hurt when Culp, GE’s CEO, put his money where his mouth is by doubling down on his GE investment by buying $2,000,000 worth of shares in GE, the company who Markopolos says will file for bankruptcy in a matter of months.

*https://davidkigerinfo.wordpress.com/2016/07/15/six-sigma-and-general-electric/ https://finance.yahoo.com/news/ge-accused-masking-financial-problems-115643284.html Comment

What everyone here should know is that GE is not what it was. It’s been gutted over the last decade as they’ve “transformed” themselves into a shell of what they were. I was short a few years ago after they did the big financial transaction and I think Peltz or another private equity guy was cheerleading the transaction pumping his huge position. Jack Welch and Jeff immelt made a fortune on bullshit numbers that almost no one on wall street understood because the accounting is so convoluted and billions of dollars of liabilities hinge on assumptions that don’t accurately reflect the economic reality.

Comment

GE has immense debt for an industrial company, having spun off and sold earnings and kept the debt. Everyone knows this. GE from the 1980s notoriously massaged earnings and made every quarter. Everyone knows this. GE got into the insurance business, which famously is prone to under-reserving to generate short-terms profits but long-term losses. The similarity to an alcoholic buying a bar is striking. With each new CEO “cleaning house” but finding under the dirt is more dirt, GE has been in the red, sitting at 31% negative return on equity currently. GE was in plane leasing before 9/11, network TV as it was technologically eclipsed, and bought Baker Hughes instead of paying down debt as real alternatives to oil in transportation belatedly emerged. Yes, GE is in trouble and has no clue in the insurance business. Endless writedowns don’t end. It’s not really news.