Is SAP Really a Cloud Provider or Just a Cloud Buyer?

Executive Summary

- SAP presents itself as a cloud provider.

- We evaluate whether this presentation matches how it operates its businesses.

This article focuses on SAP, but the lessons cloud just as well be applied to Oracle.

Introduction

This article began as a response to the following quotation from Vinnie Mirchandani.

Our References for This Article

If you want to see our references for this article and other related Brightwork articles, see this link.

Notice of Lack of Financial Bias: We have no financial ties to SAP or any other entity mentioned in this article.

- This is published by a research entity, not some lowbrow entity that is part of the SAP ecosystem.

- Second, no one paid for this article to be written, and it is not pretending to inform you while being rigged to sell you software or consulting services. Unlike nearly every other article you will find from Google on this topic, it has had no input from any company's marketing or sales department. As you are reading this article, consider how rare this is. The vast majority of information on the Internet on SAP is provided by SAP, which is filled with false claims and sleazy consulting companies and SAP consultants who will tell any lie for personal benefit. Furthermore, SAP pays off all IT analysts -- who have the same concern for accuracy as SAP. Not one of these entities will disclose their pro-SAP financial bias to their readers.

The Quotation

Let us begin with the quotation from Vinnie Mirchandani.

“After two decades of cloud applications (NetSuite and Salesforce were born in late 1990s) if you look at a grid of applications by industry, by geography there is only 20% or soin the cloud. Most cloud apps are concentrated in HCM, CRM, accounting areas, not operational areas or industry functionality. Even there, if you look for support for Brazil or China or the Czech Republic your choices drop off very quickly. These industry and regional white spaces won’t last forever. We are seeing startups target them, in industries like financial services, big banks are developing solutions to sell to others. The opportunities are limitless, but SaaS vendor investments have been grudging.” – Vinnie Mirchandani

This is not valid in SAP’s case.

But this gets to a fundamental question and a question that people tend to gloss over before jumping into discussions on SAP’s cloud offerings and strategy. And that is…

Is SAP a Cloud Vendor?

We conclude that SAP is not a SaaS vendor. SAP is a SaaS buyer. Let us take a look at the evidence.

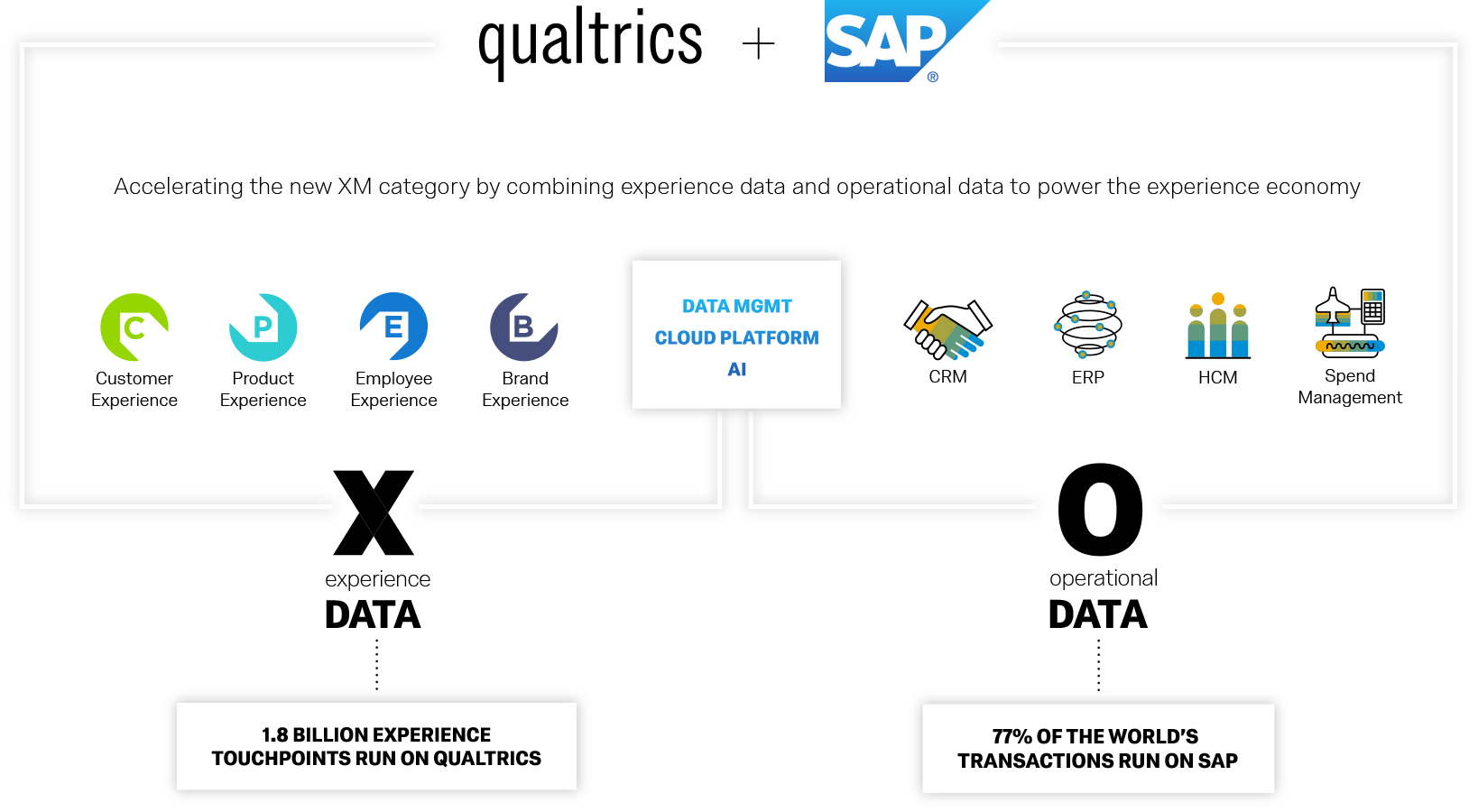

- Buying SaaS Applications: Every single SaaS application SAP sells is acquired. Therefore, their choices are limited to SaaS companies they can buy since they don’t internally develop any SaaS apps. In November 2018, SAP spent $8 Billion on Qualtrics, which we covered in the article Does SAP’s Acquisition of Qualtrics Make Any Sense? and another $2.2 Billion on Callidus in April 2018. And no one has an excellent handle on how these applications complement what SAP offers. We believe both acquisitions added more noise to SAP’s offering and increased their cost and management overhead. We analyzed C/4HANA (which Calladus has been rolled up into) and found the overall solution lost in space, as we covered in the article How Accurate Was Bluefin Solutions on C4HANA? Overall, none of these acquisitions look like they are actually for SAP. Instead, they are made to boost the stock price in the short term and increase executive compensation. That is the significant misinterpretation of many software acquisitions. Many of them are for the executives, not for the company.

- The CEO said they want to focus on CRM and the front office. So SAP invests in front-office technologies when CRM is already saturated and dominated by Salesforce. SAP must integrate all their front office and SaaS apps with their back-office ERP to deliver the promised complete customer experience combining X and O data.

Remember X and O data? This was all the rage back in November when SAP acquired Qualtrics and tried to tell investors, customers, and the media what a great acquisition Qualtrics would be. Still, it will probably be an expired concept when you finish reading this sentence. SAP’s marketing department may be on a new slide.

Where Are We Again?

SAP also invested in HANA and is now competing with Oracle and Microsoft as a databases company. They compete in IaaS and PaaS with AWS, Azure, and GCP as cloud companies. They are competing in AI, ML, and RPA. Don’t forget that SAP also acquired SuccessFactors for $3.4 Billion, Ariba for $4.3 Billion, and Concur for $8.3 Billion.

That’s a lot of investment. There is a lot of investment in applications that don’t have much to do with SAP’s primary offering. We found this quote of interest concerning SuccessFactors.

“In the SAP Universe, SuccessFactors is no longer really new, but integration in perfect ERP / ECC 6.0 (E2E) processes has not been successful to date.”We are working on it and know exactly about our deficits,” – E3

SAP acquired SuccessFactors in 2011 — how can we still discuss integration deficits in 2019?

They even invested in Ticket-Web, A ticket system for sports and entertainment. Is this because ticketing systems are naturally connected to ERP?

SAP has a strategy for all of these applications. Follow me on Twitter and be informed when we figure out what it is.

The Strategy is Everything

The one-stop shop for everything model, as proposed by SAP and so many SAP consulting firms?

How is IBM doing with this model?

SAP spent $10 Billion on Qualtrics and Callidus to go after the CRM market and integrate back-office ERP with front-office apps and upgrade hundreds of thousands of ECC customers to S/4 by 2025 and become the best database in the world and the best cloud platform and the best AI and make the best vertical apps in specific industries to compete with HP in telecom and Bosch in IIOT.

And that is a lot of “ands.”

However, Volkswagen Group and Amazon Web Services announced they are developing the Volkswagen Industrial Cloud together.

- Where was SAP when this happened?

- What about the SAP Cloud that SAP has spent so much time promoting?

- How likely is it that SAP pitched SAP Cloud to VW for this initiative and lost this opportunity to AWS (hint..very)

VW is a German company, and SAP is right around the corner. They have a long-standing relationship. Why did VW reach out to far geographies when they couldn’t see auto manufacturing opportunities inside Germany?

Conclusion

SAP poses as a cloud provider, but they aren’t one. They are a cloud buyer.

SAP feels they need to maintain the illusion of being a cloud provider because their cloud strategy for cloud services is to coerce (often through broadscale application discounts) customers to buy cloud services through them. This is so SAP can upcharge the cloud services providers, as we covered in How to Understand SAP’s Cloud Upcharge on AWS Storage.

This is ultimately a short-term strategy. But to pull it off, SAP will continue to pose as a cloud services provider, so they will do this. As with Oracle, there will be a lot of discussion around the cloud, but not much cloud.

As for SAP’s SaaS acquisitions, none is essential to SAP’s strategy or long-term viability.