The Problem with How Gartner Makes its Money

Executive Summary

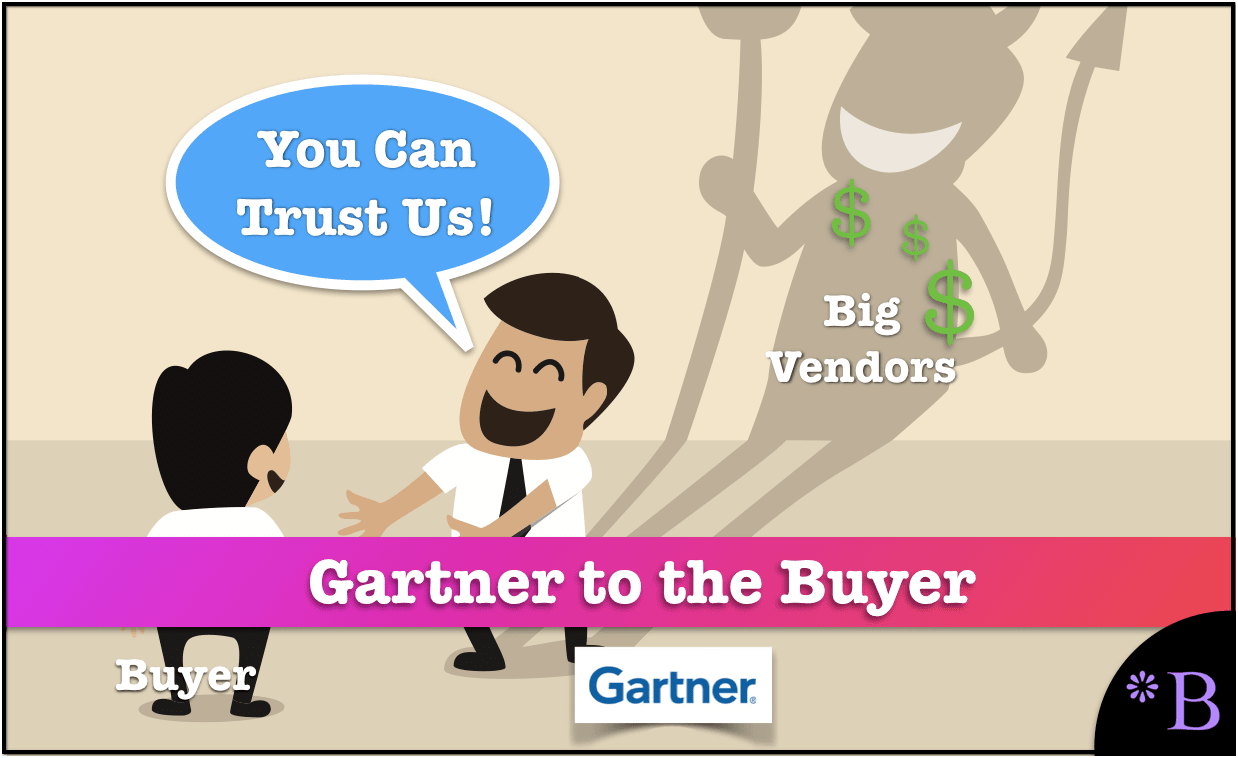

- Gartner has many problems with how it makes money, how it breaks out its revenues, and how Gartner dangles improvements in Magic Quadrant scores in return for vendor payments.

- The related corruption issues around Gartner.

Introduction

Understanding how Gartner makes its money is critical to understanding how it works and interpreting the information it provides. As they say in political thrillers and investigative journalism: “Follow the money.” Gartner’s approach to making money is a doozy, which is why we refer to Gartner as a “Rubix Cube” of corruption. When discussing one side of Gartner’s corruption, at least another five sides (maybe more) interact with that topic. This is important because it defines Gartner’s incentives and operations, and Gartner’s output can easily demonstrate this. This means that Gartner does not follow a research method with integrity, which is the problem with information-providing entities focusing on profit maximization. You will find out the reality of how Gartner makes its money.

Notice of Lack of Financial Bias: You are reading one of the only independent sources on Gartner. If you look at the information software vendors or consulting firms provide about Gartner, it is exclusively about using Gartner to help them sell software or consulting services. None of these sources care that Gartner is a faux research entity that makes up its findings and has massive financial conflicts. The IT industry is generally petrified of Gartner and only publishes complementary information about them. The article below is very different.

- First, it is published by a research entity, not an unreliable software vendor or consulting firm that has no idea what research is.

- Second, no one paid for this article to be written, and it is not pretending to inform you while being rigged to sell you software or consulting services as a vendor or consulting firm that shares their ranking in some Gartner report. Unlike nearly every other article you will find from Google on this topic, it has had no input from any company's marketing or sales department.

Gartner’s Annual Report

According to their annual report, their 2012 revenue broke down in the following way.

Gartner Sources of Revenue

| Category of Revenue | Percentage of Total Revenues |

|---|---|

| Research Sold to Software Buyers | 70% |

| Consulting (Most Advisory Services Sold to Vendors) | 19% |

| Events (Which Derives Income from Both Vendors and Buyers | 11% |

These figures are for 2012, and Gartner’s revenues grow virtually yearly. This pie chart in 2019 would be much more significant as Gartner now has revenues of $5.1 billion.

How Gartner Breaks Out its Revenue

Gartner does not break out its revenue per business line regarding its customer category (i.e., buyer, vendor, investor, etc.) or its events revenue. However, Gartner receives income from each business line’s buyers, vendors, and investors (research, consulting, and events). Roughly seventy percent of their income comes from research-related activities and thirty percent from consulting and events. Gartner receives revenues from other types of customers as well. For instance, they receive subscription revenue from consulting companies and several customer categories.

However, I focus on buyers, vendors, and investors because they are Gartner’s major customer categories. Furthermore, the explanation from Gartner’s annual report as to what constitutes research is not entirely clear; when a company pays to talk to a Gartner analyst, this goes into the research revenue bucket rather than the consulting revenue bucket.

Therefore, the description of the research should include both the subscription business and the analyst consulting business. However, services such as vendor contract negotiations would fall under the consulting revenue bucket.

How Gartner Dangles Improvements in Magic Quadrant Scores to Software Vendors for Payments

The vendor community openly discusses the proposal that vendors must spend money to improve their position with Gartner. This system is commonly called “pay to play,” The term is highly well-known in the industry. I named this heading “public and informed” because it is unclear how many people who read Gartner’s research know that vendors pay Gartner. However, the more people know Gartner, the more they are aware of this activity. I was unaware that Gartner received payments from vendors until the head of marketing for a software vendor explained how the system worked. Gartner has conflicts of interest all over the place and hides these conflicts. Their primary way of doing this is not to mention them or to deny they exist if they are brought up.

Gartner often sells what it refers to as technology advisory services, a few of which appear in a Gartner document on the topic and which are listed below:

- “Will this database platform deliver the performance our application requires?”

- “Will my key OEM partner be acquired?”

- “What are the biggest issues people in this market are dealing with?”

For instance, Gartner is interested in keeping up with all the players in a software category that they cover through what is referred to as an analyst briefing. Vendors give Gartner presentations on their product, company, and strategy, usually through some web meetings, and Gartner listens. This is explained in the following quote from Gartner.

“During a vendor briefing, the flow of information predominates from the vendor to the analyst and is not interactive. Analysts may ask questions of clarification during a briefing session, however, analyst feedback is not the focus and should not play a part or role during any given vendor briefing session.” – Gartner Vendor Briefings

Keeping the Vendor Briefing Separate from Advice

Gartner does this because feedback from Gartner is charged to the vendor as a consulting service. If Gartner did not do this, vendors would ask for Gartner’s feedback and thus get a free service. I know something about this because I have often been asked for input from vendors about how their application compares to others in the market. Gartner analysts are well-versed in the game; if a vendor asks for information during the briefing, the analyst will respond that this is just an analyst briefing. Providing feedback is not what Gartner is there for.

However, if the vendor is interested, they can purchase a technology advisor service. At this point, the Gartner analyst has a well-rehearsed pitch that explains how the service works, how large Gartner is, how much information they have to provide, and how other vendors have previously benefited from Gartner’s technology advisory services. However, without purchasing this service, the vendor can expect nothing back from Gartner.

Charging Both Sides to Serve as a Technology Middle Man

Gartner has managed an impressive feat when they ask for information from a vendor; they don’t pay for the privilege; however, when a vendor asks them for information, they must pay Gartner. Gartner receives this free information from vendors, analyzes it, packages it, and then sells it to buyers. When Gartner wants information, it pays nothing, but others wish to report Gartner. Gartner is running an excellent and very disciplined system for making money.

You can read all about Gartner’s analyst briefings in their website article:

Much in the same way that buying a preparation guide for the SAT will improve one’s SAT results, the amount of consulting services that a software vendor buys from Gartner allows the vendor to understand better the grading applied to them. The difference is that SAT preparation books are universally available and cost roughly twenty dollars. At the same time, Gartner’s consulting services are expensive and incomparable to other types of consulting costs in the industry.

“When with a previous employer, in one MQ interview I did it was suggested by the Gartner analyst that we were ‘not visionary enough’ for that part of the quadrant. When I asked what was visionary I was told that to get that information we needed to be clients. So I concluded that you had to pay to know what was visionary and then rework that into your vision in a nice circular process. So I do not know what the cost is but it seems to me you need to be paying to play.” – Nick Turner

All of this leads to the topic of the Gartner ombudsman.

Where Does Gartner’s Consulting Revenue Come From?

Gartner is sensitive about their consulting revenue from vendors because, at one point, Gartner offered software selection services to buyers. This upset the vendors because they were sharing information with the buyers that they had shared with Gartner in the first place. Gartner lost its vendor consulting business and consciously decided to reduce the depth of software selection services it offered.

Gartner receives money from vendors through subscriptions, consulting, and events. (Gartner charges vendors for booths and access to buyers. For instance, in addition to putting on the conference, Gartner will arrange special meetings on specific topics attended by several customers and one vendor.) The vendor payments reside in roughly thirty percent of the business, represented by consulting and events.

Gartner says that their ratings have nothing to do with what services various vendors purchase from them, and Gartner does not disclose which vendors pay Gartner or how much they pay. In fact, on Gartner’s website, there is no mention that vendors are also customers, and it is impossible to find out.

Gartner is paid by the entities that it rates and is brought up by people who know this fact, but Gartner makes every effort to keep this secret.

The Case Study of SAM Software

To illustrate a conflict that Gartner has, we will take the case of SAM software.

Understanding Software Asset Management or SAM

SAM is a software category that reduces the license fees paid to other software vendors.

- SAM determines actual software usage and allows the customer to reduce the amount that it is over-licensed, that it pays for licenses that it is not using.

- When a software vendor comes to audit a company and then brings a claim against the customer, which is typically exaggerated, the customer can use the SAM software output to push back on exaggerated claims on software vendors.

- Overall, SAM software can be used continually to plan license use and put the customer in a better position versus software vendors to optimize its usage.

- SAM software is a category that some software vendors wished did not exist.

In this way, SAM software is defensive software that reduces the license revenue for some software vendors. The word “some” is quite important because most of the audits and claims for extra payments for software licenses are carried out by the most prominent software vendors. So this list includes Oracle, SAP, IBM, and Microsoft.

Who Benefits and Who Loses from SAM Software?

SAM software as opposed to the interests of software vendors seeking excessive customer licenses. The vendors that habitually seek to obtain excessive license revenue from customers are the most prominent software vendors. This is the same group of software vendors where SAP receives a disproportionate percentage of their overall software vendor revenue.

In 2016, Gartner received somewhere around $800 million from software vendors. None of it is declared per vendor. I estimate that Gartner earns roughly between $100 and $150 million in total payments from SAP. Does SAP want its customers to know about the SAM software category? (Oracle and Microsoft are also major funders of Gartner.) Well, let us ponder that for a moment. SAM provides helpful information to help customers negotiate against what is often exaggerated under licensing claims brought by SAP. SAM can help customers know that they are over-licensed (a term not in SAP’s vocabulary) and can use this knowledge to keep from purchasing more licenses when they already possess SAP shelfware.

I don’t want to lead my readers too much, so I will let the reader conclude how much SAP talks to their customers about acquiring SAM software.

* SAP eventually came out with a SAM MQ after writing this article. However, MQ was missing a vast number of SAM providers. The question remains why SAP did not have a SAM MQ for so long and why, when they did release it, so many vendors were left out, and the overall MQ was so underwhelming.

The Lack of Gartner Coverage on SAP Applications

This brings us to the topic of Gartner’s coverage of a category of software that the largest funders of Gartner would prefer that their customers know nothing about.

The following experts explain the lack of coverage in the SAP software space.

Here is what Snow Software has to say on the topic.

“As business professionals and buyers, we want to know that the products and services we are looking at are going to be right for our organization and its needs. The cost of getting it wrong is at best wasted money and at worst career-limiting.

The classic example is perhaps the Gartner Magic Quadrant. From Enterprise Mobility Management to Enterprise Backup Software and Integrated Appliances, the Magic Quadrant has become the go-to reference point for an increasing number of organizations in the buying cycle for a given solution to validate their purchasing decision.

The appeal is obvious. A single document that reviews the acknowledged leaders in a given solution area, nicely broken down into Leaders, Visionaries, Niche Players and Challengers. One place to quickly assess the strengths and weaknesses of each solution your organization is considering (and maybe a few it wasn’t before).

Gartner isn’t alone in offering this kind of review. Forrester has its Wave, and Ovum its Decision Matrix for example. Given the popularity of Magic Quadrants,Waves and Decision Matrices, it’s no surprise that they are one of the most-requested documents from prospects, partners and our own sales people. In the buying cycle, stage one has become: check the Magic Quadrant!

And therein lies the problem. Not only for Snow, but all other players in the Software Asset Management world. And what is that problem? There is no Magic Quadrant for Software Asset Management solutions! Nor a Wave. Nor any other kind of credible group review by an internationally-recognized analyst firm that you’d care to mention.

By our own estimation (we have to use our own, since there are no analyst figures to rely on!), the Software Asset Management industry will be worth billions of dollars globally by 2019. Okay, that might seem small compared to Gartner’s claim that the enterprise software market is worth around US $326 billion in 2016.

But consider this. In 2013, Gartner announced that it was retiring the Marketscope for IT Asset Management (basically a Magic Quadrant by another name), citing a lack of innovation and market growth as the reason for there being no point in continuing the exercise. Another reason given was that the ITAM market was actually in decline, slipping from $452 million in 2010 to $445 million in 2011. The SAM market is looking far more buoyant.” – Snow Software

The Validity of Gartner’s Argument Against Having a SAM Magic Quadrant

Is this proposal by Gartner credible?

Let us take the innovation argument first.

- The Lack of Innovation Argument: Would the level of innovation in a category of enterprise software be a reason to stop coverage of a category? It would merely mean less work for Gartner. That is less work to cover the new “innovations” added to the software. It seems unlikely that this is the real reason. Secondly, is this a good reason to stop covering a software category even if it were true? Is the question of the software’s value how much the SAM software vendors add to the software every year (i.e., the degree of “innovation”), or is the question instead of how much the customer can save money optimizing their licenses? Is innovation the reason software should be purchased, software categories covered, or it’s value-added? Gartner seems to imply that it is the former.

- Is Innovation Gartner’s Primary Focus in First Place?: Gartner’s statement implies a slavish obsession with innovation. Gartner may be overly focused on innovation even at the expense of the value-added value of the applications they review. So is that true? Does Gartner’s obsession with innovation appear in Gartner’s Magic Quadrant rankings? Of all the applications reviewed by Brightwork, four have received perfect scores in innovation. This is covered at the MUFI Ratings and Risk link on this site. These vendors are Arena Solution, Planet Together, FinancialForce, and Intacct. However, these are not the vendors that Gartner tends to emphasize. Why not? Several, if not all, of those vendors don’t pay Gartner very much. And several of them don’t pay them at all. Gartner consistently shows a desire to maximize profits. Maximizing profits is impossible by providing the top ratings for software vendors unwilling to pay.

How Consistent is This Explanation?

This is also inconsistent with Gartner’s statements about SAM in their article titled Cut Software Spending Safely with SAM, where they point out the following:

- “Gartner clients that mature their SAM processes and use tools to focus on license optimizations typically report up to 30% spending reductions in one year.

- With worldwide total vendor software sales of $326 billion in 2016, the savings possible from software license optimizations are too significant to ignore.

- Plus, savings fall to the bottom line as profit.

- SAP optimizations require considering users, groups, licenses, and transactions. Choosing the proper named user category or pricing type can dramatically increase — or optimize — your SAP landscape costs. For example, SAP employee self-serve software is licensed for everybody to manage expense reporting in the business but is only deployed in the US, with thousands of unused seats in Europe.

Is the SAM Market in Decline?

The second reason Gartner gives is that the SAM market size is declining.

- The Size of the SAM Market: Gartner’s evidence is that the market declined by $20 million from one year to the next. This is a 4.4% decline. Is that such a significant decline to justify dropping coverage of the overall software category? Secondly, Adobe has stopped enforcing audits as it has moved mostly online. However, Adobe’s online monitoring and licensing are more straightforward than other vendors, so SAM will not decline. Even if the significant vendors eventually figure out the Cloud, Oracle audits are still very effective. Microsoft has not softened its stance, and SAP has stepped up its efforts to introduce Type 2 indirect access. SAM software is critical in providing customers with information to push back on each of these software vendors (and more).

Manufacturing a Story to Not Cover SAM with an MQ or MarketScope

Overall, this sounds like a constructed story on Gartner’s part. And Gartner has a history of misleading readers about its motivations. As I pointed out, it pretends that its vendor contributions do not impact its ratings while telling vendors that it is trying to sell services a very different story.

- Their sales team consistently promises better outcomes in their Magic Quadrants during sales pitches while stopping short of saying they can buy improvements directly.

- When vendors declare that they do not see Gartner’s funding value, Gartner will upsell the vendor to a higher level to have excellent access to analysts. The ability to influence vendors promised that at the lower level.

- This is the exact sales strategy the Church of Scientology uses to keep their devotees investing in Scientology courses, even when they fail to see their courses’ benefits.

The Striking Similarity to The Chruch of Scientology

Gartner’s sales tactics are strikingly similar to those employed by Scientology; they are covered in Gartner and Scientology: Similarities in Sales Strategy.

Gartner presents itself as a research entity. However, after many years of researching other research entities, I can’t find another example of a real research entity that behaves like Gartner.

Gartner uses high-pressure sales tactics out of its Fort Meyers facility. The tactics are so extreme that it causes one to wonder how much legitimate research Gartner performs. Gartner is far more focused on maximizing its revenues than emphasizing research quality.

That should be a concern to those who read Gartner’s output.

This is just one example; Gartner’s connection to the truth tends to be quite tenuous, and Gartner has established no history that would make its statements reliable guides to its real motivations. What we do know about Gartner is that they are profit-maximizing. So the question is, is creating a Magic Quadrant or Marketscope for SAM applications profit-maximizing?

- Would it be worth it for Gartner to alienate some of the most prominent software vendors to provide coverage to a software category that generally reduces their ability to extract excessive licenses from their customers?

- Gartner’s little pay-to-play playground, can the SAM vendors like Voquz, Flexera, and Snow compensate Gartner sufficiently to make it worth Gartner’s while and blowback from their largest vendor customers?

- If the answer is “No,” then Gartner can always explain why Gartner will not cover the software category. And virtually any excuse will do. (the type is too small, the sales went down one year, there is not enough innovation, the people that work in the SAM vendors aren’t sufficiently attractive, etc..)

ITAM, a credible source on SAM, has this to say.

“Disconnect in ITAM Tools Coverage: I felt there was a bit of a disconnect in Gartner tool coverage. 90% of the content from the summit and exhibitors were focussed on SAM, yet Patricia Adams provided a 90′s view of Asset Repositories. She referred to SAM tools as an ‘emerging’ category (emphasis added) which I felt was a bit of an insult to the tools and partners in the exhibitors hall and not an accurate reflection of the market. Gartner have no SAM tool analysis on the horizon and when asked, Patricia Adams stated some Gartner company spiel about category size. Big enough a category for two international conferences but not for tool analysis? An opportunity missed.”

If Gartner has decided not to cover the category, it begins to make sense to undermine the overall classification, perhaps emphasizing that it is immature.

Why Gartner Gives the Impression that SAM’s Software is Immature?

Who benefits the most from the impression being created that the SAP market is immature or emerging? That would be software vendors and the largest software vendors in the other software categories. Therefore, Gartner’s “professional opinion” always seems to align perfectly with how it makes money. The problem with entities that are still profit-maximizing is that they are only interested in relaying truthful information when it maximizes profits. When it doesn’t, they prefer to hide accurate information. In the study of information control, it is well known that the most effective way to engage in propaganda is not to lie but instead to emphasize things that one wants to be observed by one’s audience while obscuring or ignoring other things. This is generally a problem with private profit-maximizing companies and bias.

But it is mainly a problem when a company is posing as a research entity whose statements are taken as independent when they are yet another profit-maximizing entity. It is also why profit-oriented entities have such an unfortunate history of performing unbiased research.

ITAM continues…

“My fear is that Gartner will, based on these spiralling scores, withdrawal their ‘MarketScope’ citing insufficient interest which would be inaccurate and send the wrong signals to the market. You could argue they did they same by taking their eye off the ball with the withdrawal of ITSM tools and subsequent ‘lipstick on a pig’ ITSSMrehash.

I also believe it is a case of misguided marketing. This is flagship promotional marketing content for Gartner which is sending the message they focus on big ole Asset Repositories when the focus of their events, clients enquiries and research focus on audit defence, contract negotiation and licensing.” – ITAM

Retiring the MarketScope for ITAM

As stated in the Snow Software quotation, Gartner later retired the MarketScope for ITAM (which is the software category within which SAM resides)

Gartner is about profit-maximizing. Covering a controversial software category that reduces the ability of the most prominent software vendors to extract excessive licenses from its customers will not give Gartner a positive payoff (most likely).

Gartner does not exist to provide accurate information; it gives information to maximize profit. Gartner is the most prominent IT analyst because, throughout its history, it consistently focused on profit-maximizing over research integrity. And this is the problem when the analysts like Gartner and Forrester, who concentrate the most on profit maximization and the least on following research rules, grow to be the most significant IT analysts. When Gartner acquired other IT analyst firms, I found many analysts who left Gartner soon after. When I interviewed them, they told me they left because Gartner’s business model was too mercenary and anti-research in orientation.

Profit or Nonprofit and Why it Matters for Research

A final point and a criterion that I considered adding is whether the research entity is nonprofit. For-profit entities have a more challenging time maintaining research integrity than nonprofit entities, which is a significant reason why government-funded research outperforms private research.

The Disadvantages of Private Research

Private research has many disadvantages, including the fact that it does not share its research results with the research community. Suppose we take one of the most prolific private research entities—Bell Labs, responsible for a long laundry list of technologies ranging from the transistor to the laser and the winner of multiple Nobel Prizes. It is recognized that their success was precise because Bell Labs was funded by what amounted to a government-granted/regulated monopoly in the form of Bell Telephone. When the government broke Bell Telephone’s monopoly, Bell Labs’ ability to produce at the same level declined. Similar labs existed (although none as prominent as Bell Labs), such as RCA Labs and Xerox PARC. The relationship is clear: the more public the entity, the better it can support research and maintain its integrity. Of the research entities compared, only Gartner is for-profit, and the other three are nonprofit.

Of course, none of the other three entities is a viable option for a decision-maker to use as an IT analyst, and IT analysts are all private for-profit entities. Thus, companies that seek to use the research output must be careful how they use the research output from these companies.

What Does Gartner Consider Sensitive?

We estimate that Gartner receives around 1/8th of its vendor revenues from SAP. What does receiving so much money from SAP do for Gartner’s appetite for covering SAP topics that may not please SAP? Let us review this quote on this exact topic from the book SAP Nation 2.0 by Vinnie Mirchandani.

“Firms like Forrester, Gartner and IDC often 10-40 analysts who cover different aspects of a large technology vendor like SAP, but they do not often employ integrative models. I had to reach out to several analysts to help validate small segments of my model of the SAP economy. Other market analysts were more defensive. One question why I was even modeling the SAP economy when I am “not a full time analyst.” Another declined saying it is a “sensitive topic.” Customers should expect analysts to take more of the customer perspective as they cover SAP and the ERP marketplace and to better weaver the research their silos.”

Curious. So when a topic may embarrass SAP, the issue is called “sensitive.” Here, Gartner, Forrester, and IDG show no interest in helping Vinnie figure this out. They declined.

Maintaining Research Integrity

The relationship is clear: the more public the entity, the better it can support research and maintain its integrity. Of the research entities compared, only Gartner is for-profit, and the other three are nonprofit. Of course, none of the other three entities is a viable option for a decision-maker to use as an IT analyst, and IT analysts are all private for-profit entities. Thus, companies that seek to use the research output must be careful how they use the research output from these companies.

Conclusion

Gartner is by no means alone in this approach. It is a rare IT analyst firm that does not sell services to buyers and sellers. By having so much contact with buyers, Gartner develops valuable information databases to vendors and vice versa. Gartner has created some consulting services that leverage the knowledge that they accumulate through their interactions and research.

This differs from financial analysts, often called “buy-side” or “sell-side.” Gartner provides both buy-side and sell-side analysts. This is the most common approach for IT analyst firms, but a few diverge from it. One example of an IT analyst firm that is only “buy-side” is The Real Story Group. However, finding an exclusively “buy-side” analyst for the software category you are interested in is not a simple matter. For instance, I could not find a well-known IT analyst firm that did not sell consulting services to software vendors in my software category.

Understanding The Core for Gartner

Gartner is not a legitimate research entity; it pretends to be a research entity that is more of a social network that receives funding from both buyers and software vendors. Gartner takes advantage of the fact that most people who read their reports don’t dig below the surface and don’t have any research background to know what to look for or see the research rules.

What is curious about this Magic Quadrant? No open-source options are listed in an area with many great open-source options. MongoDB — which is listed, is the MongoDB organization, not the open-source project. Open-source projects can’t pay Gartner — so for Gartner, open-source does not exist. Gartner argues against open source, even when the open-source product is much more valuable than the commercial alternative. If Gartner were a research entity, they would not do this.

- Gartner is entirely designed around maximizing how much it extracts from each side. It can wring out $2.5 billion in yearly revenues for activities that should be no more than $300 million to perform through marketing and negotiation. (if you recall, the Internet was supposed to lower the cost of distributing analytical information)

- As covered in the article, Gartner and the Devil Wears Prada, Gartner, in many ways, has much in common with a fashion magazine. It tells executives what is “in fashion” and what they should buy. Gartner’s projections have low accuracy as they declare that fashion has little to do with the software’s ROI or benefit to companies that implement the software categories they recommend.

- Anyone who tries to understand Garter as a research entity will never realize its behavior or media output.

Sharing This Article

Share this article with someone you know by copying this article link and pasting it into your email so they can read the same information.