How to Understand the 40% Rule in Software

Executive Summary

- The 40% rule is what investors use to evaluate software companies.

- How to use the 40% rule and evaluating its accuracy.

Introduction

The 40% rule is a simple rule of thumb investors often apply to judge software companies’ attractiveness. The rule is that growth rate + profit should add up to 40%. The idea is that growth plus profitability should be 40% or greater once at scale ($50M ARR). For example, if a SaaS company grew 100% year-over-year and had negative margins of 60% (burning lots of cash on marketing and data centers), those combined percentages equal 40%. You can Google “40% rule for software companies” to learn more about the data behind the rule, but here’s an example from Tomasz Tunguz, a venture capitalist at Redpoint.

Our References for This Article

If you want to see our references for this article and other related Brightwork articles, see this link.

Lack of Financial Bias Notice: The vast majority of content available on the Internet about Oracle is marketing fiddle-faddle published by Oracle, Oracle partners, or media entities paid by Oracle to run their marketing on the media website. Each one of these entities tries to hide its financial bias from readers. The article below is very different.

- This is published by a research entity, not some dishonest entity that is part of the Oracle ecosystem.

- Second, no one paid for this article to be written, and it is not pretending to inform you while being rigged to sell you software or consulting services. Unlike nearly every other article you will find from Google on this topic, it has had no input from any company's marketing or sales department. As you are reading this article, consider how rare this is. The vast majority of information on the Internet on Oracle is provided by Oracle, which is filled with false claims and sleazy consulting companies and SAP consultants who will tell any lie for personal benefit. Furthermore, Oracle pays off all IT analysts -- who have the same concern for accuracy as Oracle. Not one of these entities will disclose their pro-Oracle financial bias to their readers.

The Spirit of the 40% Rule

The 40% rule is also useful for analysts and customers to understand vendor strategy. The spirit of the rule says that once a vendor reaches scale, they have to make tradeoffs between growth and profits. Some vendors will choose growth to capture more market share. In this case, they invest revenues in customer acquisition and infrastructure thereby making less or no profits for years. It took AWS 9 years to turn the first profit in 2015. By 2017, however, AWS generated 25% profit margins and contributed 40% of Amazon.com’s valuation.

Growth Companies

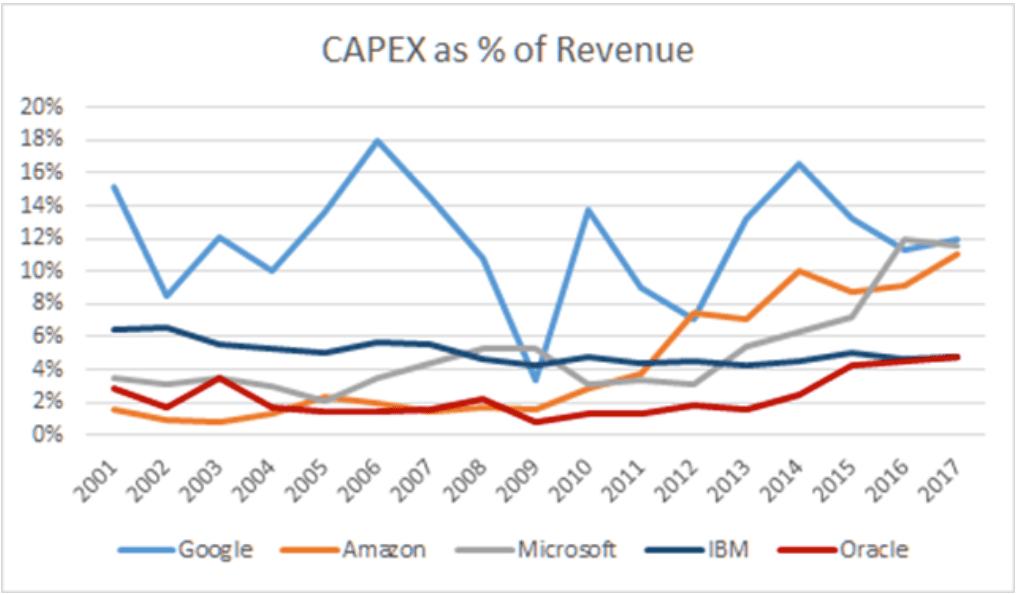

Growth companies, therefore, tend to invest more in R&D and innovation, release more products more frequently, invest heavily in data center infrastructure, and use their lower margin as an advantage to offer products at a lower price point than their competitors. AWS, for example, has lowered prices for their cloud computing services over 60 times in the past 12 years. Google and Microsoft often follow suit to remain competitive. The three companies are obviously operating in the growth zone.

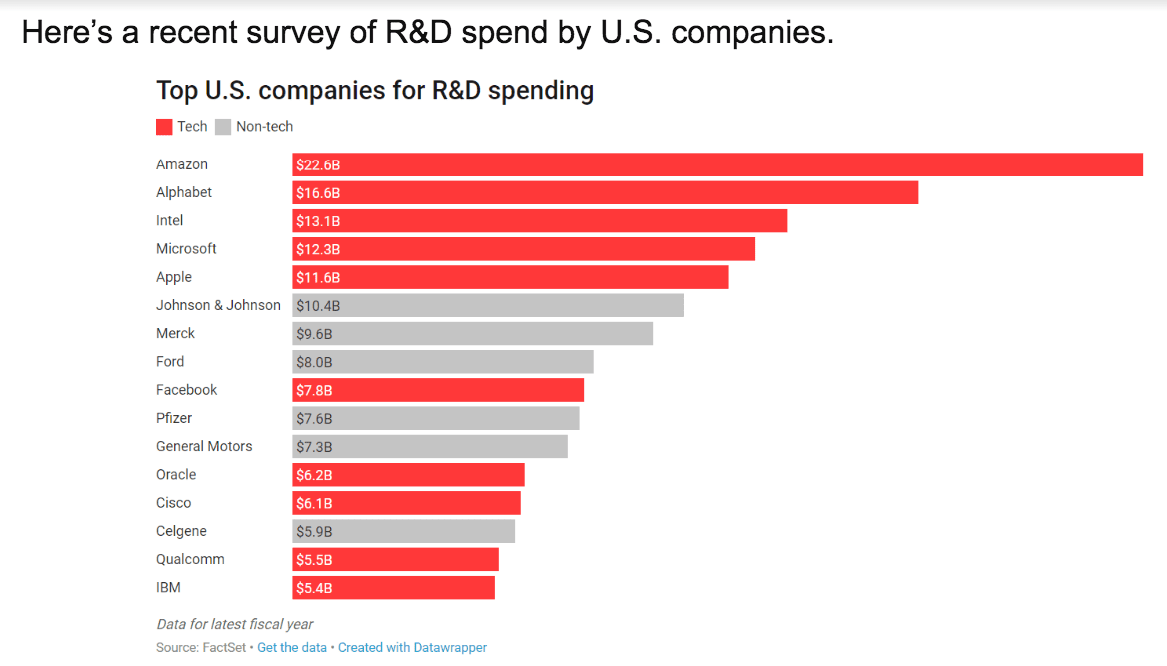

Here’s a recent survey of R&D spend by U.S. companies.

Here’s a recent comparison on CAPEX investment as a % of revenue for Amazon, Google, Microsoft, IBM, and Oracle.

On the Continuum

On the opposite end, some companies choose to maximize profit margins overgrowth. In this case, the vendor invests a much smaller percentage of revenues into growth to maintain high-profit margins. Vendors in the profit zone will spend less on R&D and infrastructure. Instead of acquiring new customers with innovative products and lower prices, they will try to generate more revenue from existing customers. In some extreme cases, mature companies operating in saturated markets often resort to severe cost-cutting to maintain their profit margins as their growth completely stalls.

IBM, Oracle, and SAP operate in the profit zone. The three companies have been aggressively cutting costs through waves of layoffs, divestiture, and job offshoring. Investment in R&D is among the lowest of their competitors. The common pattern among these vendors is that product development is practically non-existent. The vast majority of their products stagnate over time and become outdated legacy applications that get sold off or retired.

Working with profit zone vendors is risky because they often resort to abusive and draconian practices. Forced upgrades are examples where vendors like SAP push customers to spend more by ending support for existing products. Customers are forced to either upgrade or pay extra to get a lower level of support. SAP also uses indirect licensing to get customers to pay twice for the software they already purchased. Oracle uses audits to strong-arm customers into paying for software they do not use and penalizes customers for running their software on competitor clouds by doubling their licenses.

Another tactic used by vendors in the profit zone is selling projects instead of products. Examples of this are IBM Watson, SAP C4, S4, and Leonardo. These offerings are bundles of existing products sold only with a high margin onsite professional services contract. None of these offerings can be purchased as a standalone product.

Conclusion

How a software company makes its revenues are important to investors. Investors attempt to place a vendor they are evaluating within the historical context of other vendors they have evaluated. The 40% rule is one of the major rules used to do just this.